On a circular dated 6th October, 2022, the Securities and Exchange Board of India (SEBI) declared that the pre-existing Power of Attorney (POA) document that defined an important part of broker-client relationships in the stock market will be replaced by the new “Demat Debit and Pledge Instructions” (DDPI) document.

What is DDPI?

DDPI (Demat Debit and Pledge Instructions) is a document that allows a stockbroker (like Angel One) to debit the securities from your demat account upon their sale and deliver them to the exchange. This means once the DDPI is submitted, you do not have to enter the CDSL T-PIN and OTP to sell any shares you hold. However, using the DDPI is voluntary, and you can continue selling shares by entering the T-PIN for every transaction. Earlier, a POA (i.e. Power of Attorney) could be used for debiting the shares from the client’s account. However, the facility of POA is no longer available for new users – DDPI is now offered instead.

1. Individual account holder

- If you are an individual account holder, You can activate DDPI online using this link through Angel One App.

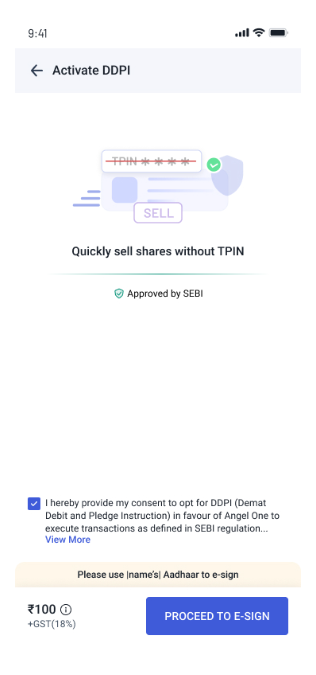

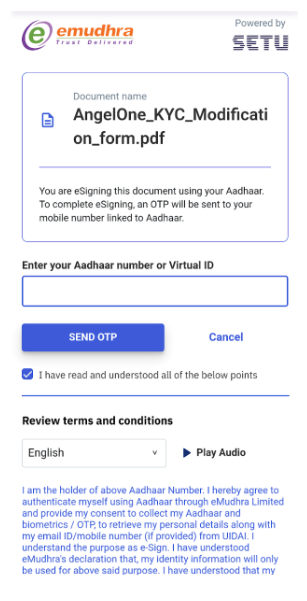

- Please have your Aadhaar card ready when placing an online DDPI activation request to e-sign the application.

- Ensure that your Aadhaar card is linked to your mobile number to complete the process.

2. Joint account holder/ HUF account holder/ minor account holder/ NRI/ corporate account holder

- To activate DDPI, you can raise a ticket here (Create Ticket —> Select Account Details under Category —> Select Profile Details under Sub-Category) and attach the filled-in and signed DDPI form.

- You can download the form from the links below –

HUF | Joint | Corporate | Minor | NRI(E) | NRI(O)

- If you are an HUF account holder, then all family members’ name and signature is required along with the HUF stamp.

- If you are a joint account holder then all holder’s name and signature is required on the form .

- If you are a corporate account holder, then an authorized signatory signature and stamp is required.

- If it’s a minor’s account, then the minor’s name and guardian’s signature is required.

Process to Activate DDPI Online

Step 1. Accessing the DDPI option:

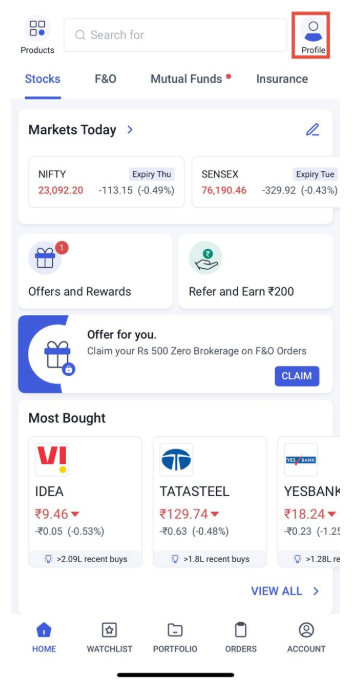

- Log in to the Angel One app, access the profile section from the home page. Use your mobile number/client ID and OTP to login.

Use this link to activate DDPI.

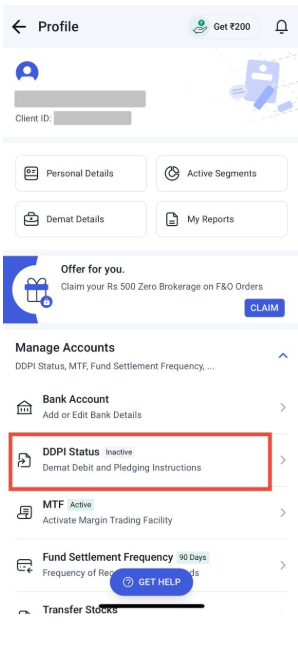

Step 2: Click on ‘DDPI Status’ under the “Manage Accounts” section.

Step 3. Read the DDPI consent and proceed to esign

- Click on “Proceed to E-Sign”.

Step 4: Pay the required charges to complete DDPI activation

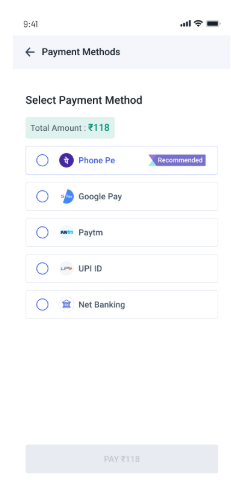

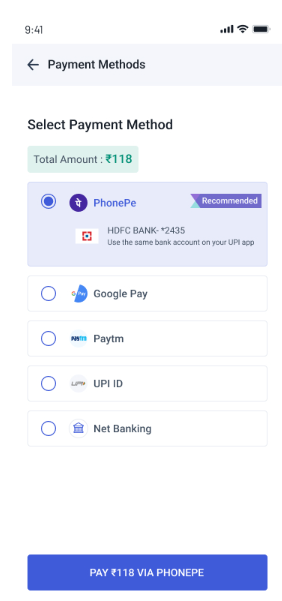

- Once e-sign is complete, proceed to make the payment

- A one-time fee of Rs 100 + GST is charged to cover the e-stamp and DDPI form, as well as the processing and maintenance of the DDPI request

- On confirmation, you will be redirected to the payments page where you can select your preferred payment option

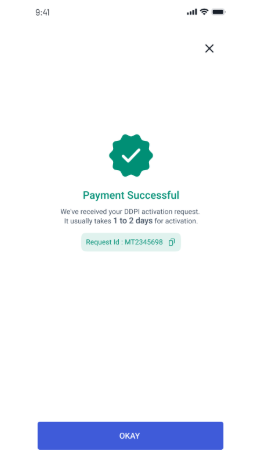

Step 5. The request will be processed in 1 – 2 working days.

Why Should You Use DDPI?

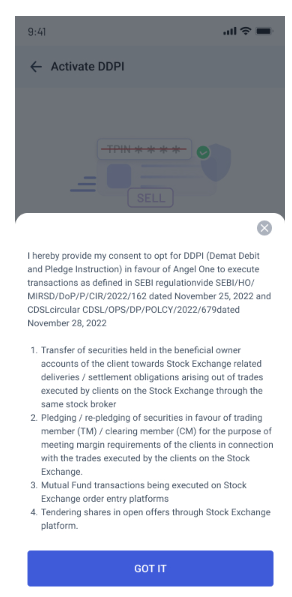

DDPI makes frequent trading of shares a hassle-free process. You should definitely consider using DDPI because it allows Angel One to perform the following functions on your behalf –

- Transferring shares from your demat account to the exchange upon their sale.

- Pledging/re-pledging of securities in favour of a Trading Member (TM) or Clearing Member (CM) for meeting margin requirements.

- Transferring mutual fund units from your demat account upon their sale.

- Transferring your shares in open offers ( ie. buybacks/delisting/acquisitions) on the stock exchange.

Therefore, the entire process of selling and pledging becomes much smoother across asset classes.

Future of the existing POAs and DDPIs

In case a client has not given the POA to his/her stockbroker already, the client can opt for DDPI. However, if the DDPI is also not submitted, then the electronic delivery instruction slip (E-DIS) must mandatorily be submitted each time the stock sell transaction is made. Submitting e-DIS multiple times might be a hassle to a client and hence it is advisable that clients sign the DDPI at the earliest. Moreover, a. If a POA request has been submitted already before 1st September 2022 then DDPI is not required to be submitted. b. But from 18th November 2022 onwards, only the DDPI request has to be submitted.

Reasons for introducing DDPI

- The POA had to be stamped and submitted physically which created a lot of trouble for both clients and brokers alike. But the DDPI can be electronically signed and submitted to brokers, saving time, space, effort and paper.

- A clear and transparent DDPI curtails possible misuse of the POA given by clients to the broker.

Conclusion

DDPI is an important document for seamlessly conducting your demat account operations. However, the process of signing your DDPI is extremely easy when done through an Angel One account. So do not worry, open demat account today with Angel One, India’s trusted broker!