A share represents a unit of ownership of the issuing company. There are various factors that may influence which way its price moves. When a company performs well and grows, its stock price tends to go up. In such cases, if you’re a shareholder, you can sell some of the company’s stock at a profit.

Key Takeaways

-

A share represents a unit of ownership in a company.

-

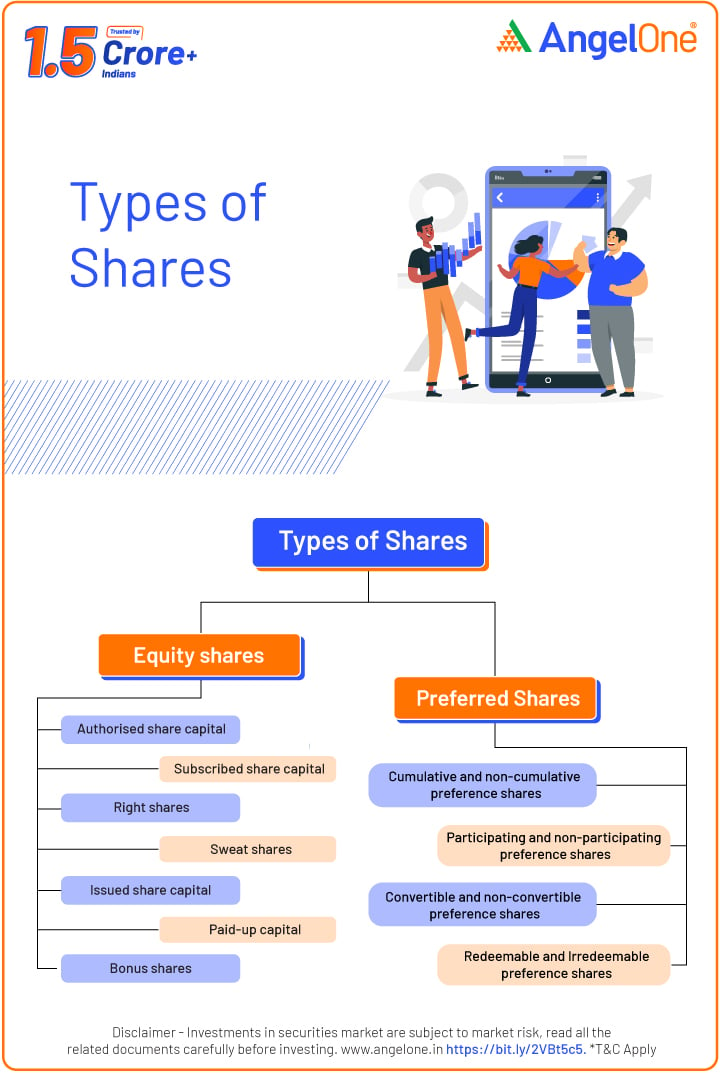

There are two main types of shares: Equity shares, that offer ownership and voting rights, and preference shares, which prioritise dividends, and repayment during liquidation.

-

Types of equity shares include authorised, issued, subscribed, paid-up capital, right, bonus, and sweat equity shares, each serving different ownership and reward purposes.

-

Preference shares can be cumulative, participating, convertible, or redeemable, offering fixed dividends and repayment priority, making them ideal for investors seeking stability.

What are the Different Types of Shares?

Broadly, there are two types of shares:

-

Equity shares

-

Preference shares.

Equity Shares

Equity shares are also referred to as ordinary shares. They are one of the most common kinds of shares. These stocks are documents that give investors ownership rights in the company. Equity shareholders bear the highest risk. Owners of these shares have the right to vote on various company matters. Equity shares are also transferable, and the dividend paid is a proportion of profit. One thing to note, equity shareholders are not entitled to a fixed dividend. The liability of an equity shareholder is limited to the amount of their investment. However, there are no preferential rights in holding.

Preference shares

Apart from equity shares, preference shares are among a popular type of shares. When a company is liquidated, the shareholders who hold preference shares are paid off first. They also have the right to receive profits of the company before the ordinary shareholders.

Types of Equity Shares

Before understanding the types of equity shares, it’s important to understand the different types of share capital:

Authorised share capital:

This is the maximum amount of capital a company can issue. It can be increased from time to time. For this, a company needs to conform to some formalities and also pay the required fees to legal entities.

Issued share capital:

This is the portion of authorised capital which a company offers to its investors.

Subscribed share capital:

This refers to the portion of issued capital that investors accept and agree to.

Paid-up capital:

This refers to the portion of the subscribed capital for which the investors pay. Since most companies accept the entire subscription amount at one go, issued, subscribed, and paid capital are the same thing.

Right share:

These are the kind of shares a company issues to its existing investors. Such stocks are issued to protect the ownership rights of existing shareholders.

Bonus share:

Sometimes, companies may issue shares to their shareholders as a dividend. Such stocks are called bonus shares.

Sweat equity share:

When employees or directors perform their role exceptionally well, sweat equity shares are issued to reward them.

Types of Preference Shares

Cumulative and non-cumulative:

In the case of cumulative preference shares, when the company does not declare dividends for a particular year, it is carried forward and accumulated. When the company makes profits in the future, these accumulated dividends are paid first. In the case of non-cumulative preference shares, dividends do not get accumulated, which means that when there are no future profits, no dividends are paid.

Participating and non-participating:

Participating shareholders have the right to participate in remaining profits after the dividend has been paid out to equity shareholders. So in years where the company has made more profits, these shareholders are entitled to get dividends over and above the fixed dividend. Holders of non-participating preference shares do not have a right to participate in the profits after the equity shareholders have been paid. So, in case a company makes any surplus profit, it will not get any additional dividends. They will only receive their fixed share of dividends every year.

Convertible and non-convertible:

Here, the shareholders have an option or right to convert these shares into ordinary equity shares. For this, specific terms and conditions need to be met. Non-convertible preference shares do not have a right to be converted into equity shares.

Redeemable and Irredeemable:

Redeemable preference shares can be claimed or repurchased by the issuing company. Irredeemable preference shares, as a truly perpetual security, are largely prohibited by modern corporate law in many jurisdictions (such as India). Instead, most preference shares must be redeemable within a specified period (e.g., 20 years). In some older contexts, "irredeemable" meant they did not have a fixed maturity date but would only be paid back upon the liquidation or winding up of the company.

Conclusion

Understanding share types will help an investor understand how the stock market works. By knowing about equity and preference shares, you can weigh ownership rights, dividend payouts, and risk profiles to align your investments with your financial goals. Start your investment journey with a confident grasp of share fundamentals!