Japanese candlestick patterns are as unique as their names. Used for describing a wide variety of market trends these patterns are consulted frequently by technical traders. But it requires skills and detail understanding to be able to interpret candlestick patterns. In this article, we will discuss the evening star candlestick pattern and how to interpret it in a chart.

What Is Evening Star Pattern?

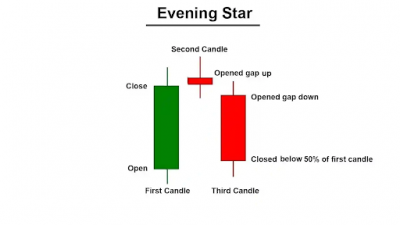

The Evening Star pattern is a bearish candlestick formation used by technical analysts to identify potential trend reversals. It typically appears at the peak of an upward price trend, signalling that the uptrend is likely nearing its end. The pattern consists of three candles: a large bullish candle, a smaller-bodied candle indicating indecision, and a bearish candle that confirms the reversal.

The Evening Star indicates waning bullish momentum and growing selling pressure, making it a valuable tool for traders looking to anticipate price declines. Its counterpart, the Morning Star, signifies a bullish reversal at the bottom of a downtrend. The Evening Star pattern is widely used in technical analysis to predict market shifts and guide trading strategies.

Forming trading strategy with evening star candlestick

Ideally, traders should look to enter at the open of the next candle, but if you are a conservative trader you may delay your entry and wait to see if the price action moves lower, however, by doing this you run the risk of getting into a much worse level in a volatile market.

Besides, you can place targets at previous support levels or for that matter at the earlier area of consolidation.

Example of an Evening Star Pattern

An example of an Evening Star pattern can be observed in the chart of a hypothetical stock, ABC Ltd., over three trading sessions. On the first day, a strong bullish candle forms as significant buying pressure drives the price up from ₹500 to ₹550, reflecting growing market optimism. On the second day, a smaller-bodied candle appears, indicating market indecision. The price opens at ₹552, reaches a high of ₹555, but closes near ₹553, showing a slowdown in upward momentum.

On the third day, a long bearish candle emerges as selling pressure takes over, pushing the price down to ₹525, which closes near the midpoint of the first day’s bullish candle. This sequence confirms the formation of an Evening Star pattern. Traders and technical analysts often interpret this as a signal of a bearish reversal, prompting them to sell or short the stock in anticipation of further price declines. This pattern acts as a useful tool for exiting long positions or initiating short trades.

What are the Pros and Cons of Evening Star Candlestick?

Advantages

- Clear visual bearish reversal: The Evening Star pattern provides a distinct and clear visual signal of a potential downturn in price momentum, making it easy to recognise on a chart.

- Identifies potential selling opportunities: This pattern is valuable for traders looking to spot potential selling opportunities or exit points from long positions, aiding in timely decision-making.

- Structured and easy to identify: With a well-defined structure of three candlesticks, the pattern is easy to spot, making it an ideal tool for traders of various skill levels.

- Versatility across different markets: The Evening Star pattern is applicable across different financial markets and timeframes, providing flexibility for traders engaging in various strategies.

Disadvantages

- Rare occurrence limits utility: The pattern appears infrequently, reducing its effectiveness as a primary tool for consistent trading decisions.

- Risk of false signals: Like many candlestick patterns, the Evening Star may generate false signals, particularly in volatile markets, leading to potential losses if used in isolation.

- Requires confirmation for accuracy: To ensure the pattern's reliability, it should be confirmed with additional technical indicators or complementary analysis, as standalone use may lead to misleading results.

- Effectiveness can be affected by market variability: The pattern's reliability can fluctuate with changing market conditions, necessitating careful risk management and consideration of broader market trends.

How to identify an evening star on a Forex chart?

This can be achieved by identifying four main candles:

- Large bullish candle: The large bullish candle is an outcome of large buying pressure. A trader should ideally be looking for long trades.

- Small bearish or bullish candle: The second one is a small candle which indicates the initial signs of a slowing uptrend. This may well be interpreted as a market without a direction or undecided market.

- Large bearish candle: This is the initial sign of new selling pressure

- Bearish Evening Star Candle formation: Traders will often look for signs of indecision in the market. Markets tend to be flat, and it is the ideal place for a Doji candle to emerge.

How to Trade Using the Evening Star Pattern?

1. Price analysis

Analyse the chart for the Evening Star pattern, characterised by two bullish candles followed by a larger bearish candle, signalling a potential trend reversal.

2. Integration of RSI indicator

Use the Relative Strength Index (RSI) to validate overbought conditions. When RSI hits 70 or higher alongside the Evening Star, it confirms a strong reversal signal.

3. Entering the market

Enter a short position by placing a sell order just below the third candle in the pattern, marking the start of a downward trend.

4. Setting stop loss

Set your stop loss above the highest point of the pattern, preferably above the second candle (Doji), to minimise risks from potential price rebounds.

5. Time frame change

Shift focus to a shorter timeframe after identifying the Evening Star to fine-tune entry and exit points with greater precision and speed.

Conclusion

The Evening Star candlestick pattern is a powerful indicator of bearish reversals, providing traders with clear signals to exit long positions or initiate short trades. By recognising the Evening Star candle and using it within a well-planned strategy, traders can make informed decisions and effectively navigate market shifts using the Evening Star chart pattern.

Explore the Share Market Prices Today

| Tata Steel share price | Adani Power share price |

| PNB share price | Zomato share price |

| BEL share price | BHEL share price |

| Infosys share price | ITC share price |

| Jio Finance share price | LIC share price |