What is a stop-limit order?

Stop-limit orders are condition trade. It combines stop-loss features with limit order with the primary objective of mitigating risk. A stop-limit order is generally related to other order types and enables traders to precisely control when an order should be filled but not guaranteed execution.

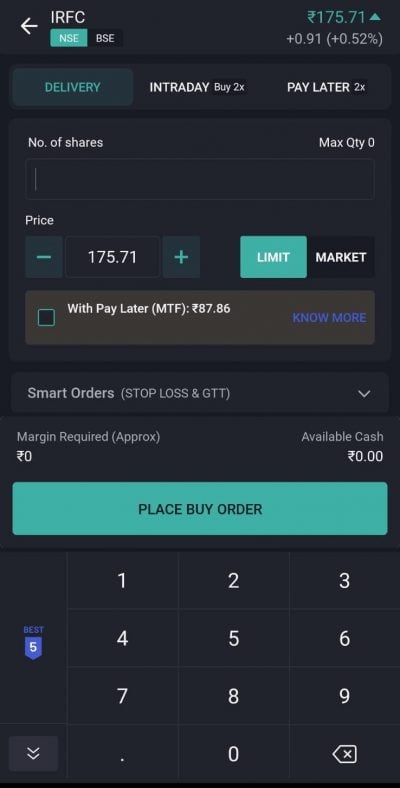

How Do Stop-Limit Orders Work?

When you place a stop-limit order, you must decide two prices

- Stop price

- Limit price

You should keep in mind that these prices cannot be the same.

The stop and limit prices for buying should be higher than the current market prices, and the stop and limit prices for selling should be lower than the current market price. You also decide how long the order will be active for the day or until you cancel it.

After you set the stop-limit order, it goes to the stock exchange and is listed in the order book. The order will be executed if the stock reaches your specified stop price and trades at or above your limit price. If the prices are not met, the order will expire at the end of the trading day or be cancelled automatically.

Two Types Of Stop Limit Order

- Stop Order: A stop order will limit further loss of a security position. It becomes active only when a specified price is hit. Once the stop price is hit, the stop order turns into a market order and is executed at the next available price.

- Limit Order: A limit order allows you to specify the maximum or minimum price at which you want to trade a security. This order type ensures that the trade will not be executed at a price less favourable than the specified limit.

Features of Stop and Limit Orders

A stop order is executed when the set price is reached and then filled at the current market price. A traditional stop order is filled in its entirety regardless of changes in the current market price as the trades are completed.

A limit order is set at a specific price and is only executable when the trade is performed at the limit price or a price more favourable than the limit price. If the price becomes unfavourable, then the activity related to the order will cease.

Thus, combining the two orders gives the investor more precision in executing the trade.

A stop order is executed at the market price after the stop price has been reached, even if the price changes to an unfavourable position. This will lead to trades being finalised at less than desirable prices if the market adjusts quickly. Combining the stop order with a limit order ensures that the order will not get filled once the pricing becomes unfavourable, based on an investor's limit. Thus, in such a order, after the stop price is hit, the limit order takes effect, ensuring that the order is not completed unless the price is at or better than the limit price that the investor has specified.

Example

For example, let us assume a stock of Reliance is trading at Rs 2355, and an investor wants to buy once it begins to show some upward momentum. The investor puts in a stop-limit order to buy with the stop price at Rs 2360 and the limit price at Rs 2365. If the stock price moves above the Rs 2360 stop price, the order is activated and turns into a limit order. The trade will be filled as long as the order can be filled under Rs 2366, which is the limit price. The order will not be executed if the stock is above Rs 2366.

Buy stop-limit orders are traded above the market price, while sell stop-limit orders are placed below the market price.

Do stop-limit orders work after hours?

Stop-loss orders are triggered during standard market hours. They will not be executed when the market is closed.

Example of a stop-limit order for a short position

A short position necessitates a buy-stop limit order to minimise losses. If any trader has a short position in stock Dixon Technologies at Rs 5000 and wants to cap losses at 10 to 15%, they can enter a stop-limit order to buy at a 5500 and a limit price of Rs 5750. The stop-limit order will be executed if the stock trades between Rs 5500 and Rs 5750, minimising the trader's loss on the short position in the desired range. However, if the stock gaps up—say, to Rs 5800—the stop-limit order will not get executed, and the position will remain open.

How long do stop-limit orders last?

They can be set as either day orders—in which case they would expire at the end of the current market session. It can also be a Good till Cancelled order which can be carried over to future trading sessions.

Conclusion

Stop limit order combines a stop order and a limit order. It provides more control to the trader and allows them to control the execution of the transaction in a favourable price range. These orders are placed for day trade or can be placed for a more extended period using the good till cancelled option. As mentioned previously, when a trader is looking to buy or short-sell security, the stop-limit order can seem very fruitful as the trader will be doubly sure of the execution and the trend leading to execution. As far as the stock order execution is concerned, it is generally possible when the stop price is reached and within the favourable limits provided.