- Use this link to access to access details of the activated segments

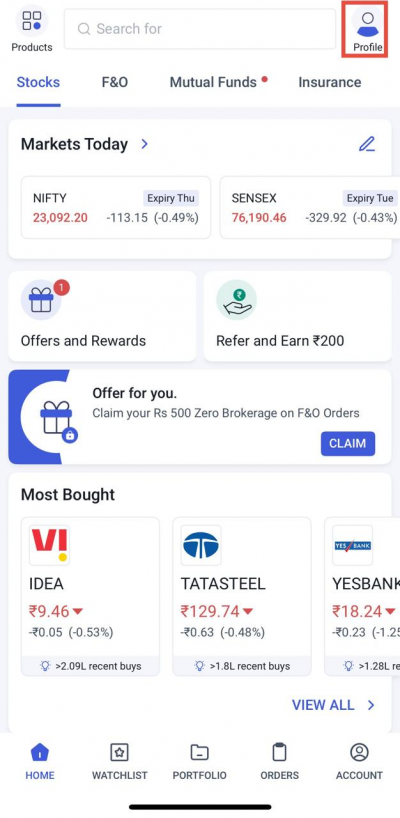

- Alternatively, log in to the Angel One app, go to the Accounts page, and click on the Profile Widget

- Use your mobile number/client ID and OTP to login

Process to Activate Segment Online

Step 1: Process to Activate Segment Online: Use this link to access segment activation

log in to the Angel One app, go to the Accounts page, and click on the Profile Widget. Use your mobile number/client ID and OTP to login

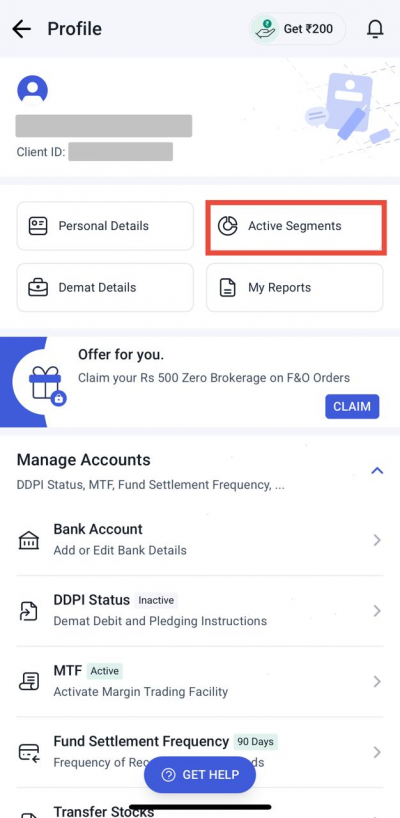

Step 2: Click on “Active Segments”.

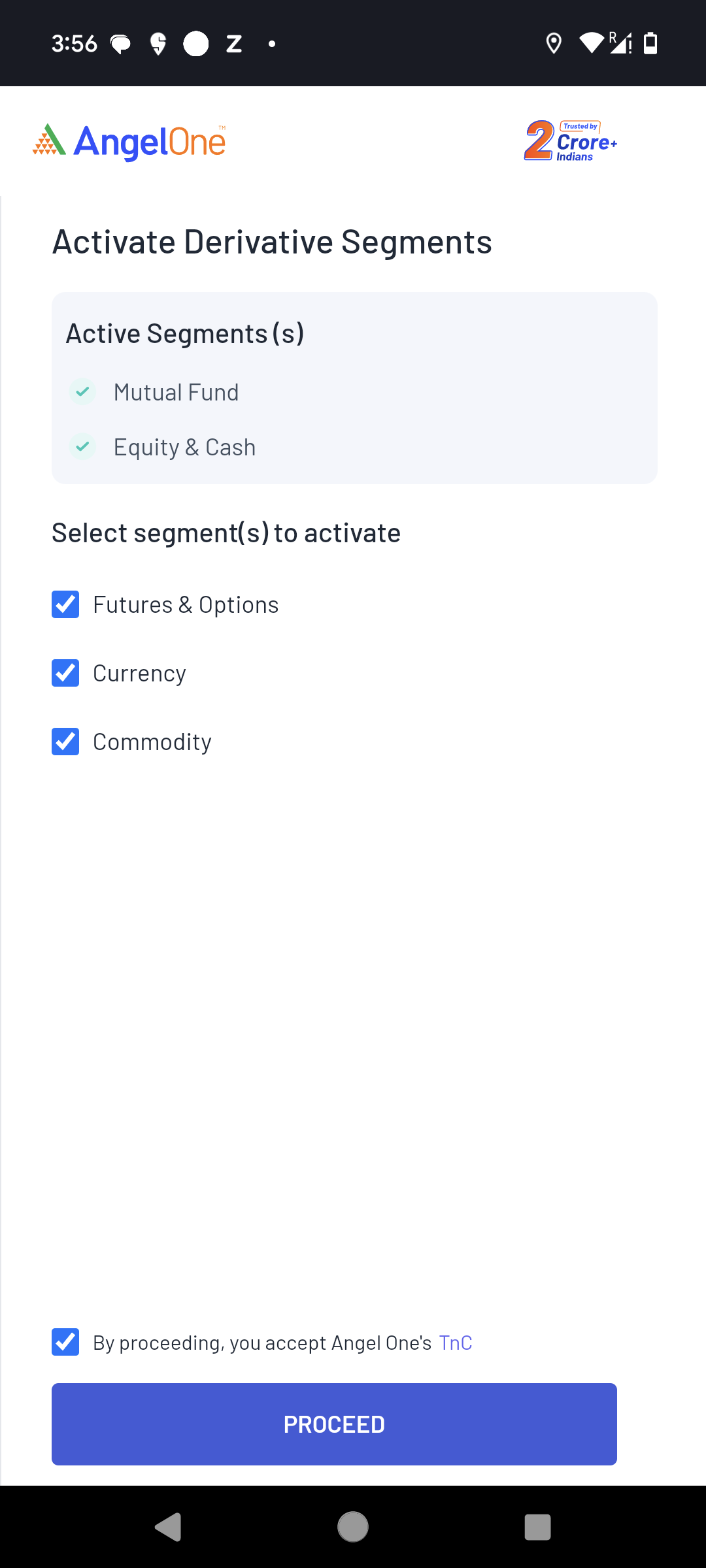

Step 3: Select the segment(s) to be activated.

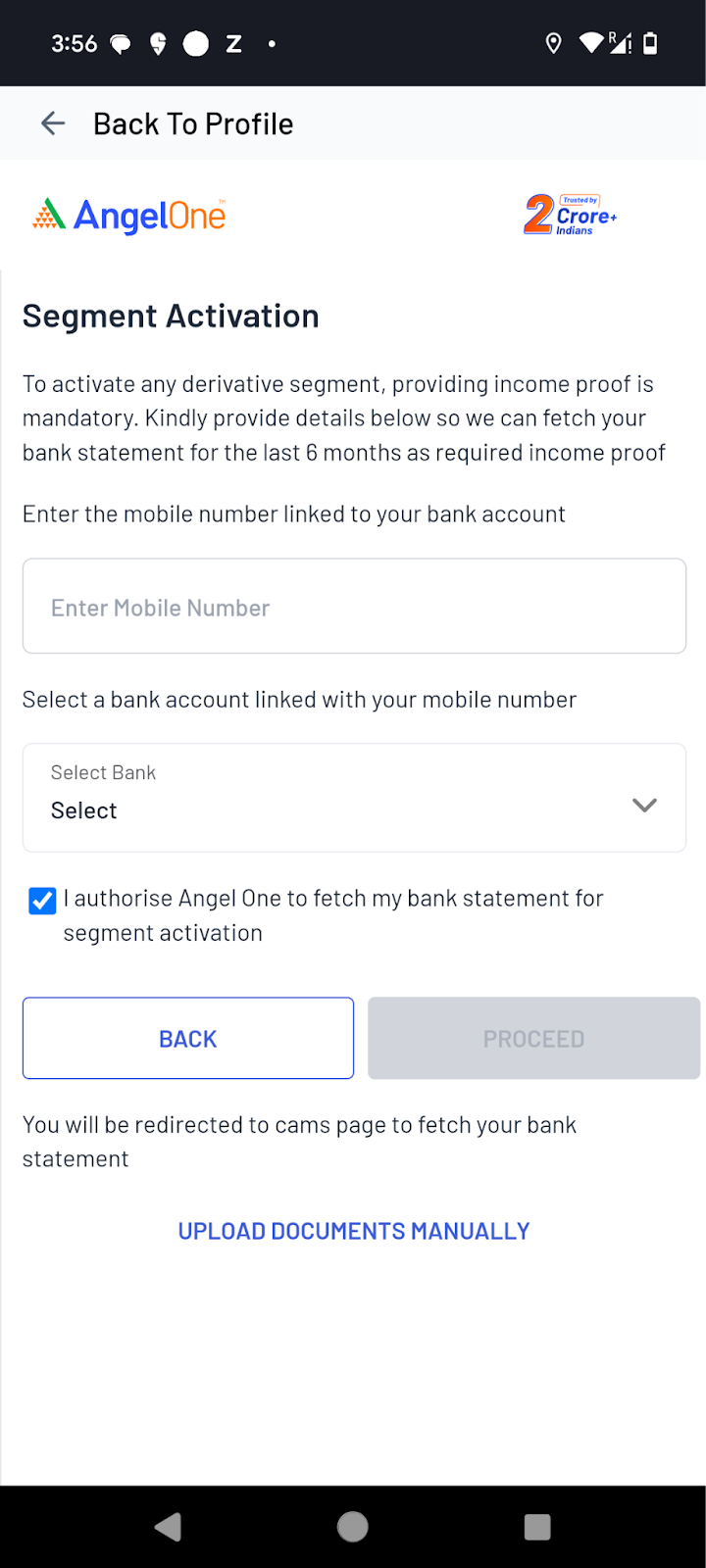

Step 4: Provide financial proof

- Allow system to automatically fetch last 6 month bank statement by entering the bank name and mobile number linked to your bank account

- Alternatively, select “Upload documents manually” option to upload the income proof yourself

Step 4a: Automatically fetch bank statement

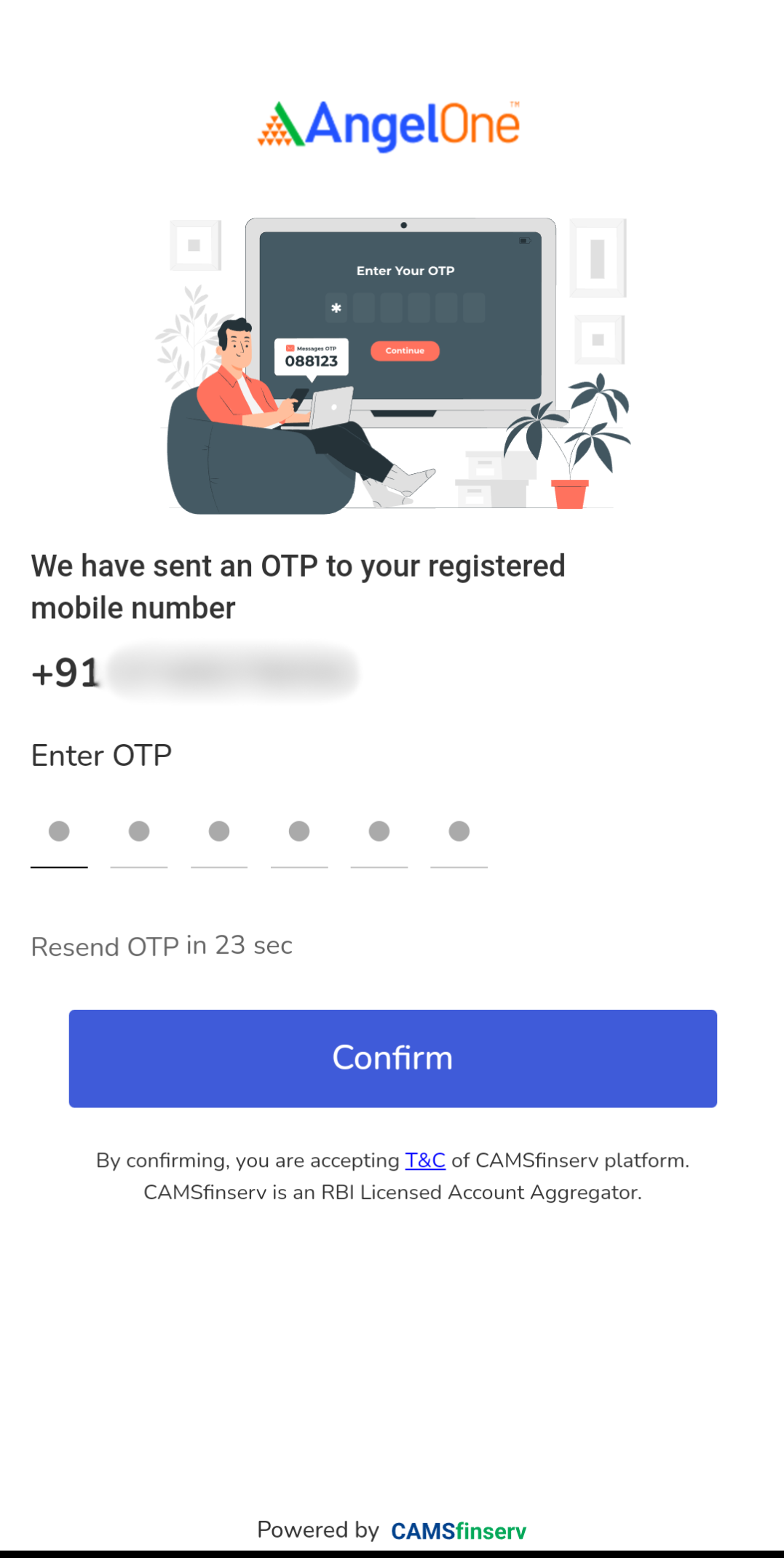

i) Enter the OTP sent by CAMSfinserv to your registered mobile number  ii) Bank accounts linked with the mobile number will be fetched

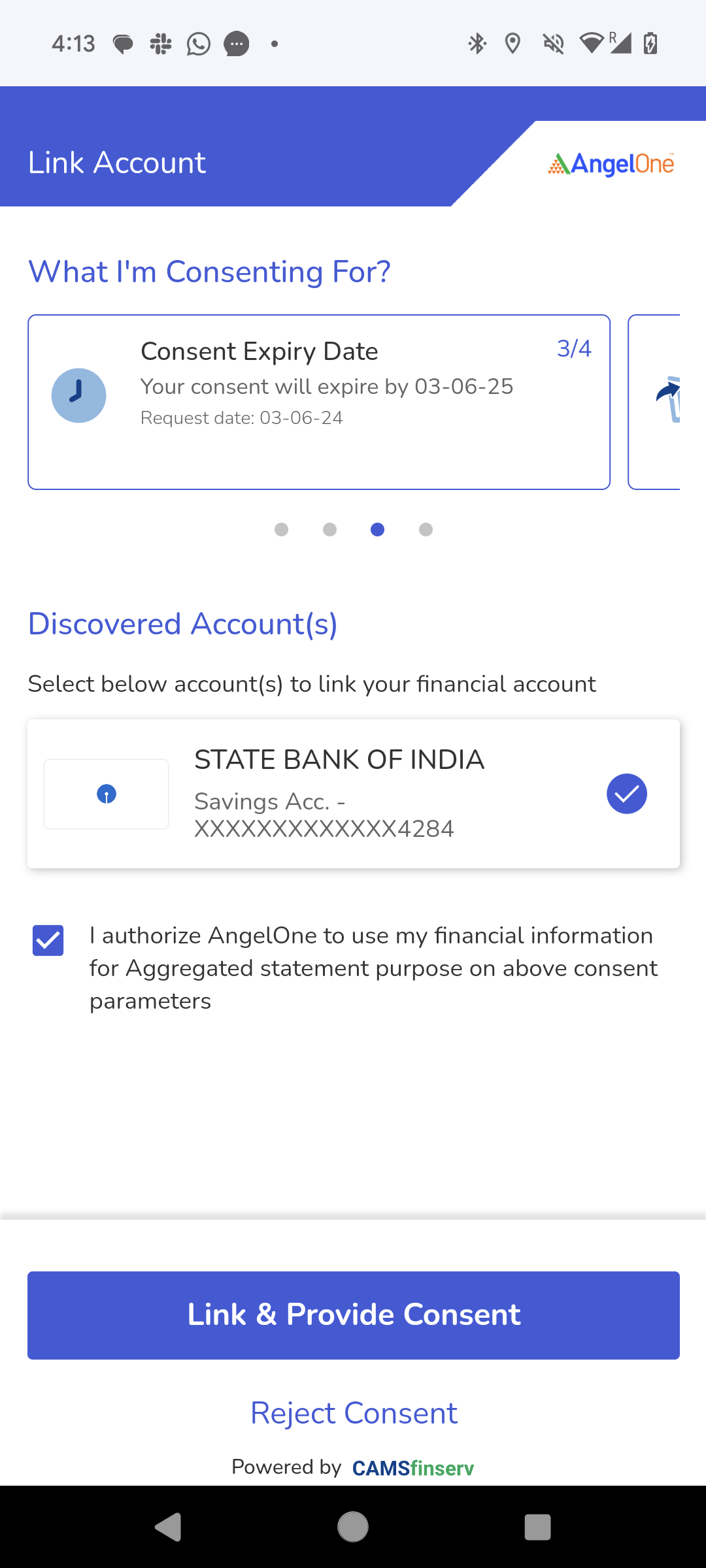

ii) Bank accounts linked with the mobile number will be fetched

- Select the bank account you want to use to provide last 6 months bank statement

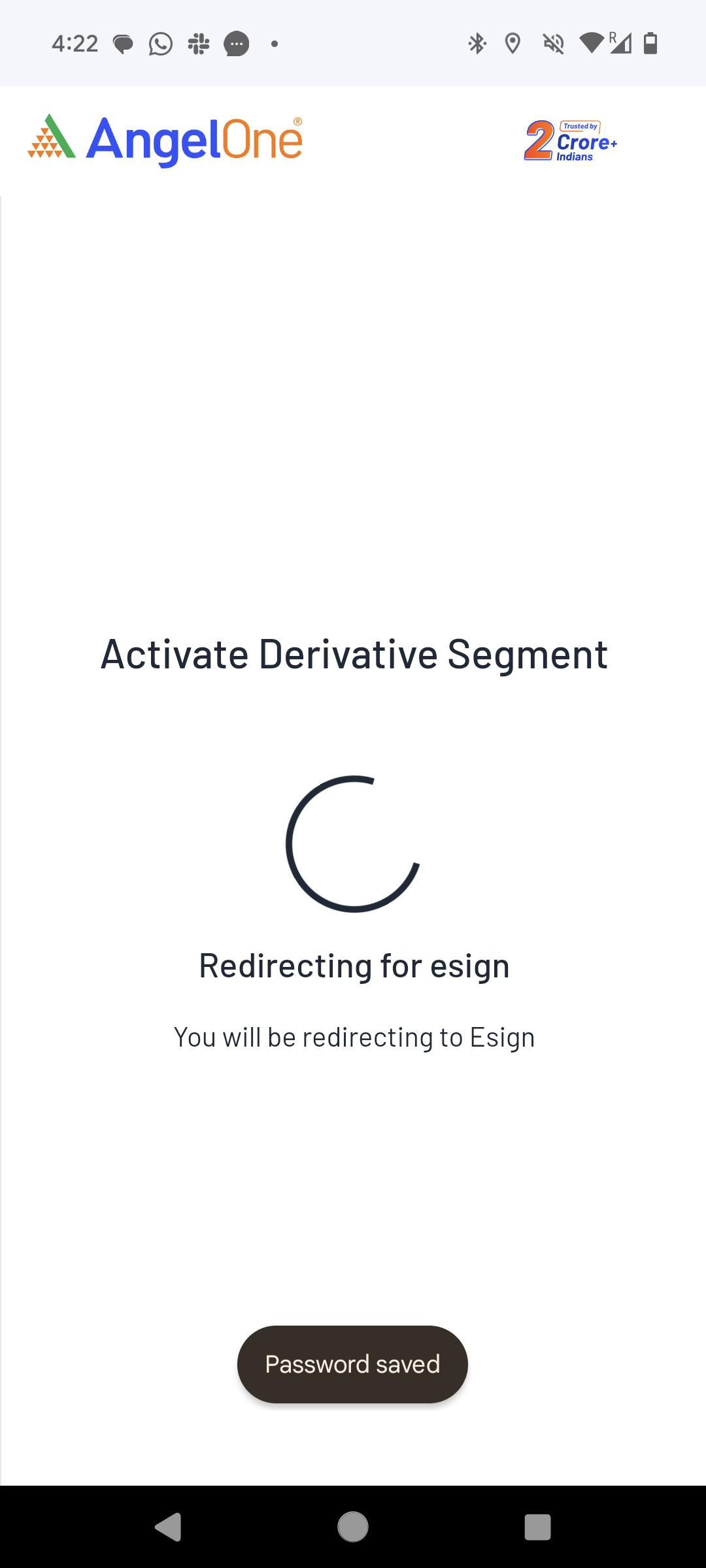

iii) User will be automatically redirected forthe e-signing

iii) User will be automatically redirected forthe e-signing

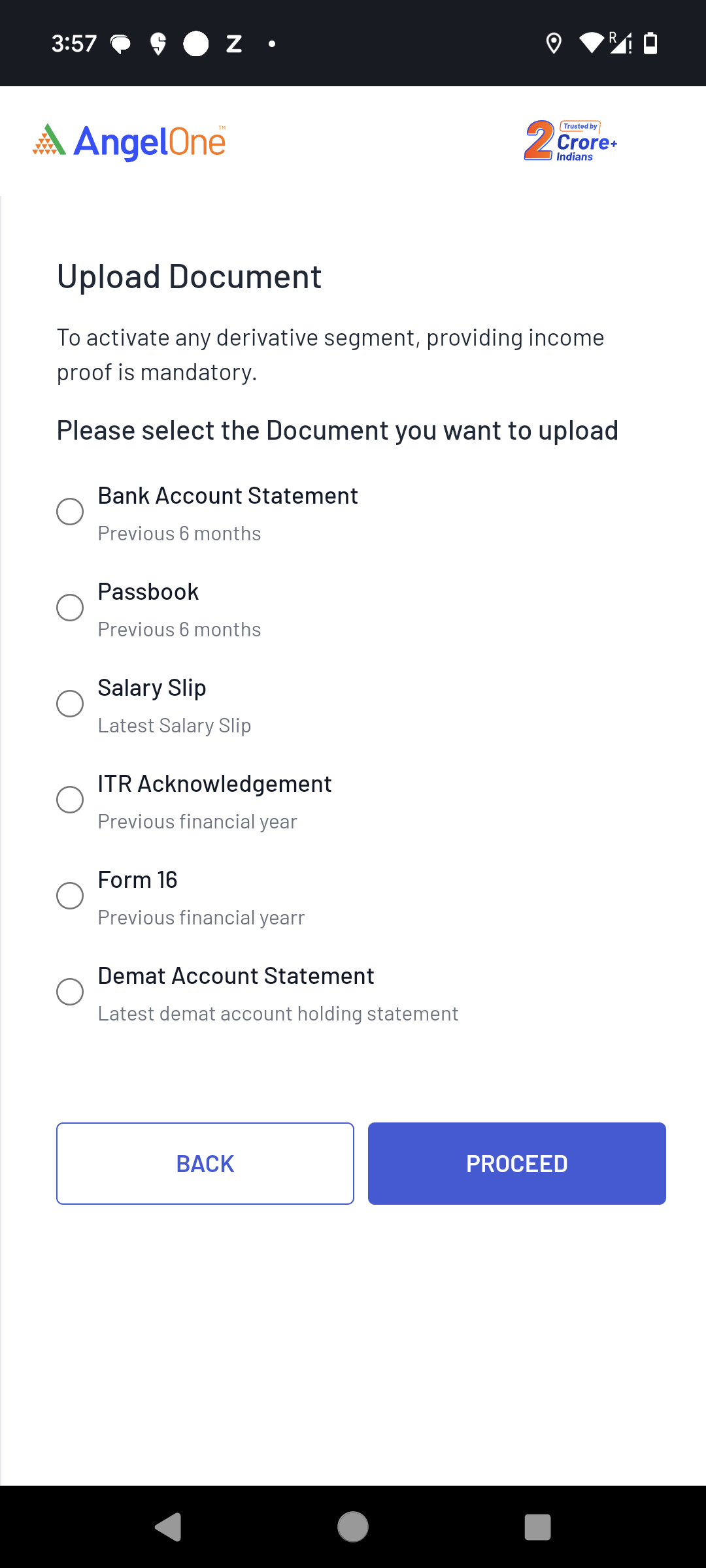

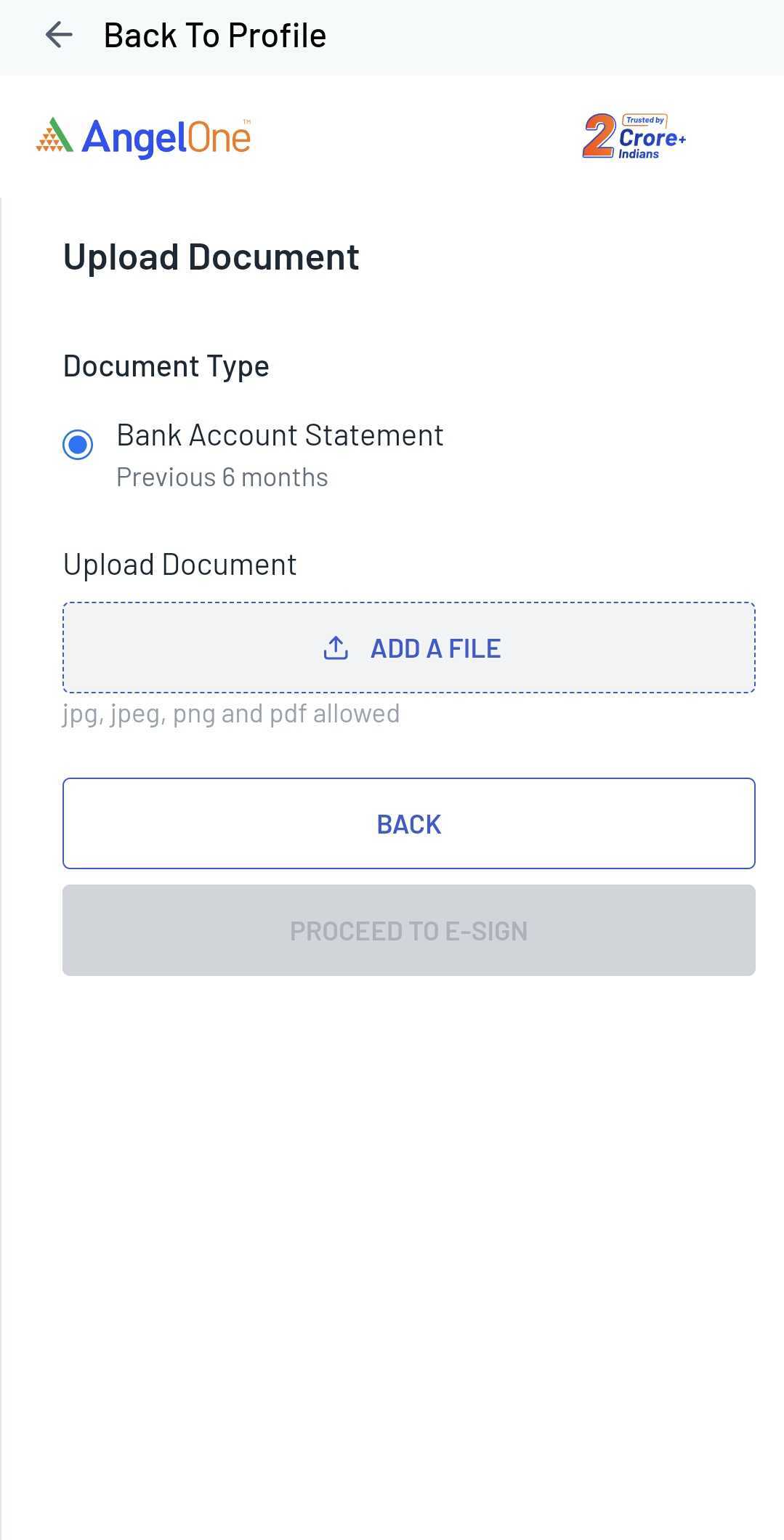

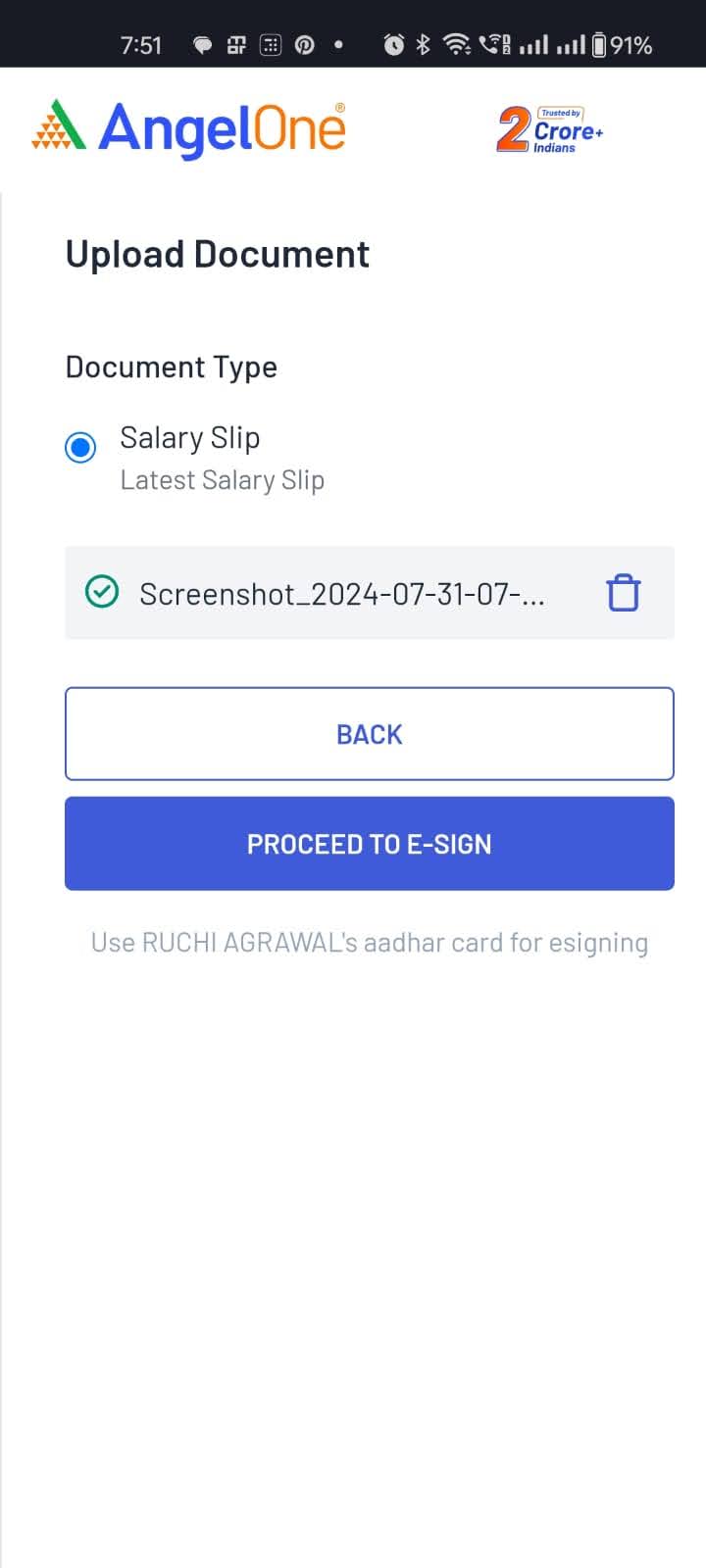

Step 4b: Manually upload documents

i) Select the document from the list you want to provide as the financial proof  ii) Click on “Add a file” box. Select the file you want to add from your device.

ii) Click on “Add a file” box. Select the file you want to add from your device.

- If your document is password protected, you will be asked to provide document password in order to verify the document

- Once the file is uploaded, click on “Proceed to E-Sign” button

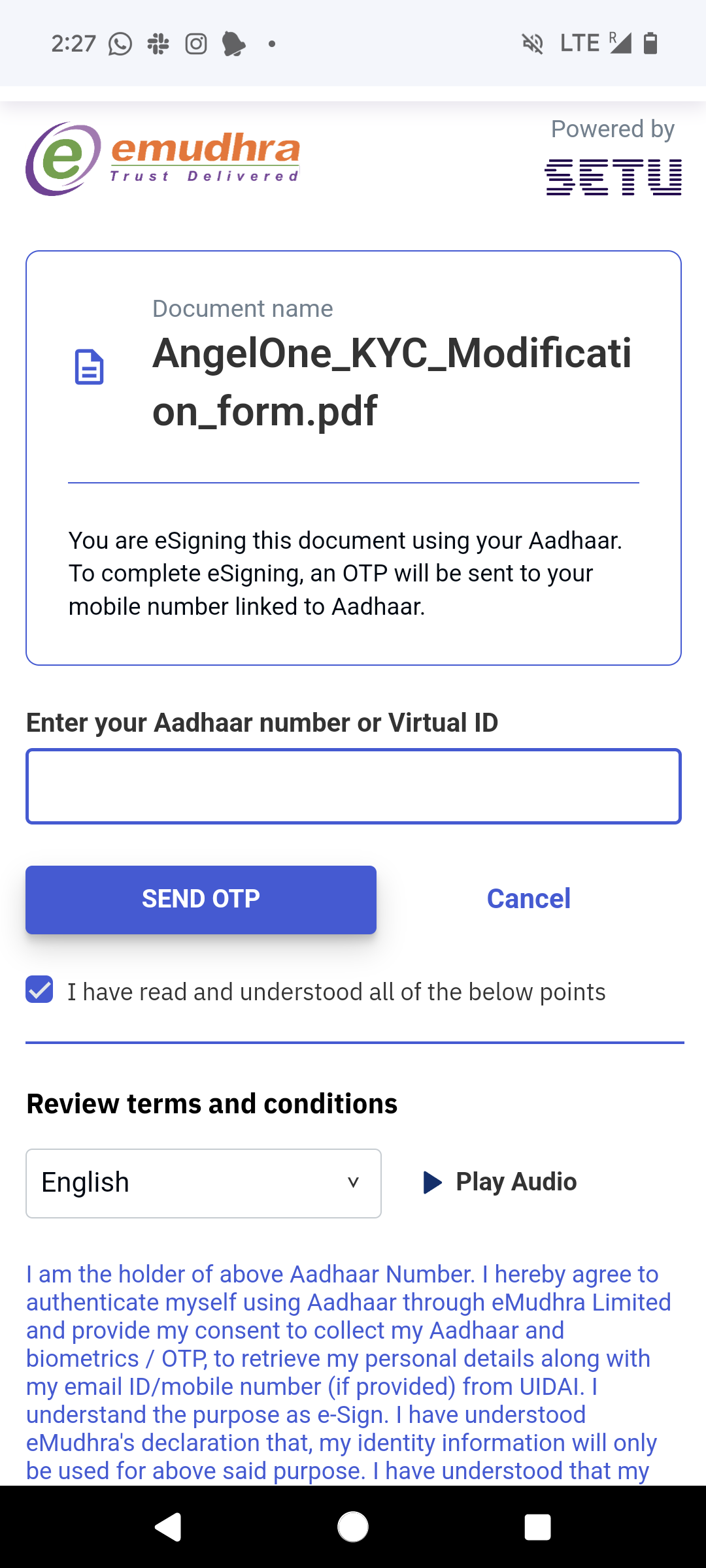

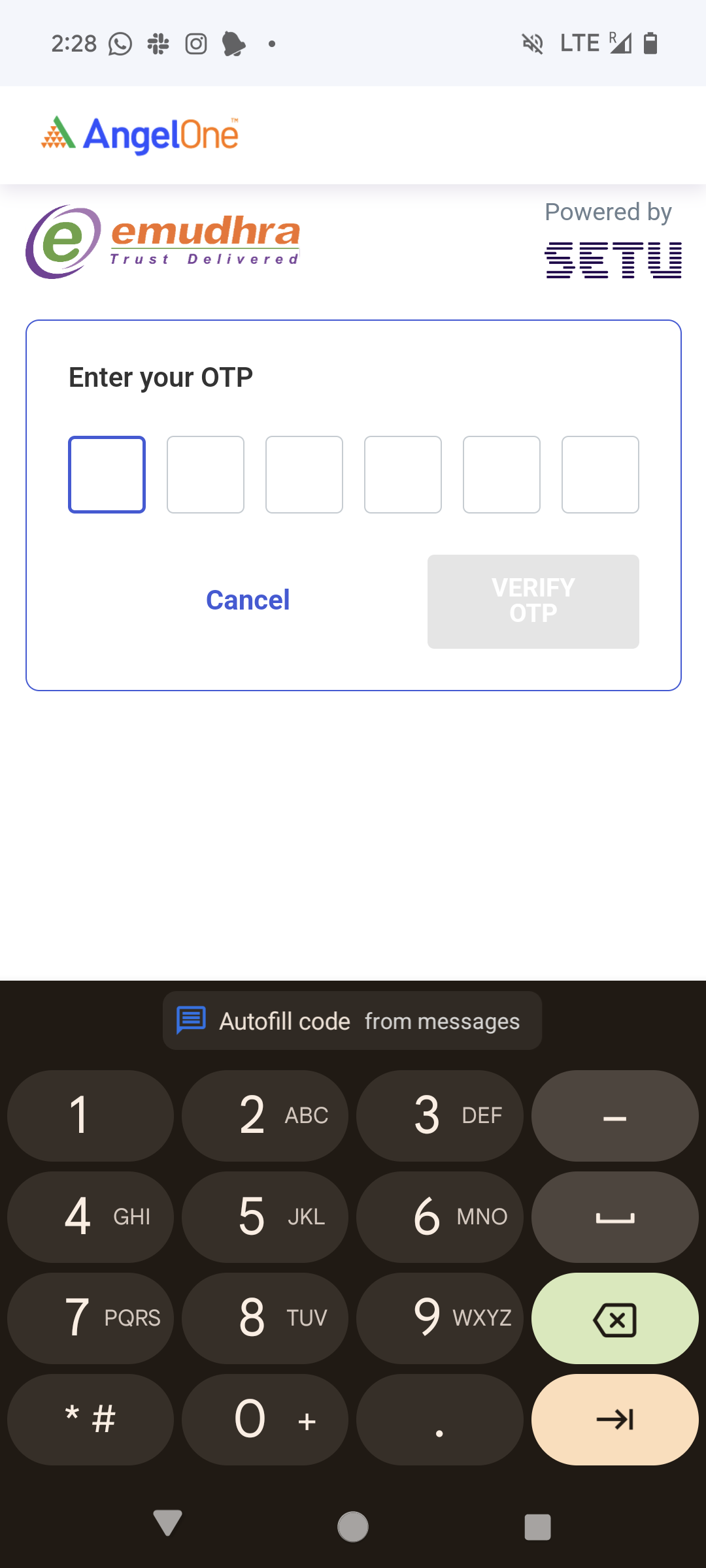

Step 5: You will be redirected for e-signing the request. Enter the Aadhar details & OTP sent from Adhaar on your mobile number

- Make sure to use your own aadhar card for e-signing

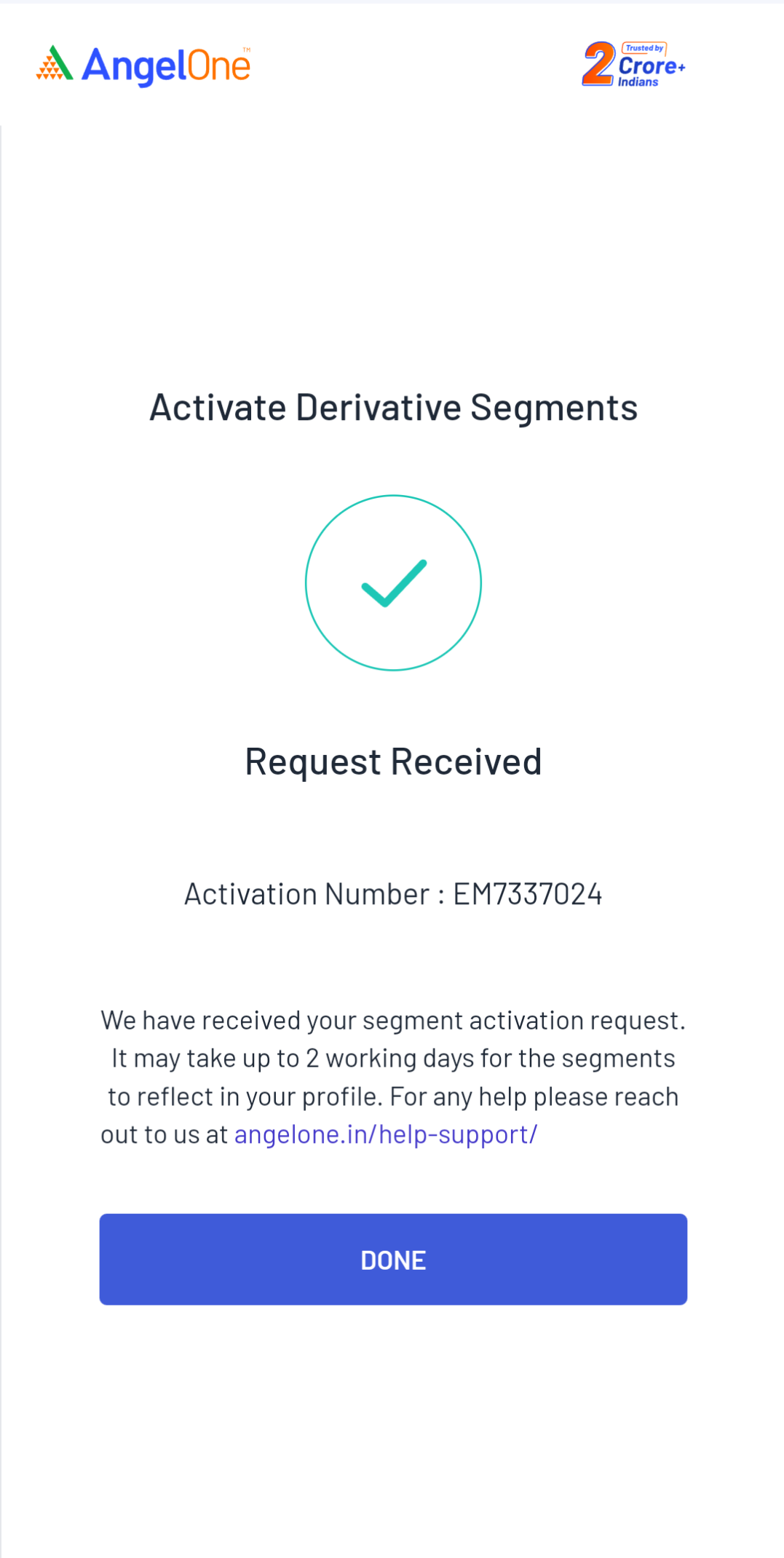

Step 6: The request will be processed in 2-3 working days.

Points to Note

- The following segments at the mentioned exchanges are available for trading -

-

- Futures & Options - NSE, BSE

- Currency - NSE, BSEThe following segments at the mentioned exchanges are available for trading -

- Commodity - NSE, MCX, NCDEX

- Equity and Mutual Funds are the default trading segments activated for all the users with a demat account

- Segment activation process will take 2-3 working days

- Online segment activation is available for the individual account holders. Individual can activate segment online by directly using this link

- Please have your Aadhaar card ready when placing an online segment activation request to e-sign the application.

- Ensure that your Aadhaar card is linked to your mobile number to complete the process.

Conditions for Segment Activation

1. Individual Accounts -

- Providing financial proof is mandatory for activating derivative segments

- Any proof provided should be in the name of the angel account holder

- The proof must contain the logo and seal of the concerned authority

- If there are any holdings in the angel one account, segments will be activated without any additional proof in online segment activation process

- If there are no holdings,financial proof needs to be provided. Any of the documents from the below mentioned list are accepted as valid income proof:

- Last 6 months bank account statement

- It should have at least one transaction from every month

- Passbook

- It should have first page and last 6 months of transaction details

- Salary Slip

- Last month’s salary slip needs to be provided

- ITR acknowledgement form

- It should be from latest/previous financial year

- Form 16

- It should be from latest/previous financial year

- Demat Account Statement

- Latest Holdings statement

- Last 6 months bank account statement

2. Non-individual accounts (Joint, HUF, Corporate) -

- Currently there is no online process of segment activation for non-individual accounts.

- For activating derivative segments, you can raise a ticket here (Create Ticket —> Select Account Details under Category —> Select Segment Activation under Sub-Category) and attach the filled in segment modification form along with any income proof.

- Any of the documents from the below mentioned lists are valid income proof:

- Last 6 months bank account statement

- It should have at least one transaction from every month

- ITR acknowledgement form

- It should be from latest/previous financial year

- Form 16

- It should be from latest/previous financial year

- Demat Account Statement

- Latest Holdings statement

- Mutual Funds Statement

- Latest Holdings statement

- Net worth certificate

- Last 6 months bank account statement

- If you are an HUF account holder, then Karta’s signature and HUF stamp is required on the form.

- If you are a corporate account holder then a corporate stamp is accepted in place of a signature.

- If you are a joint account holder then all holder’s signature will be required on the form.

- For Minor and NRI account holders, segment activation is not allowed.

How to deactivate a segment?

We currently do not have an online option to deactivate segments. However, you can deactivate a segment by writing to us at support@angelone.in.