(All you need to know, for trading in Options)

Now, you know all about how to trade using Call & Put Options, how to read the Option chain & How can we select Strike to trade, in my previous blog ‘Options Trading Basics - Part 1’.

Now let me tell you, Options trading can be done for many scrips like Nifty, Bank Nifty, and all FnO stock.

Which scrip should you choose to trade in Options?

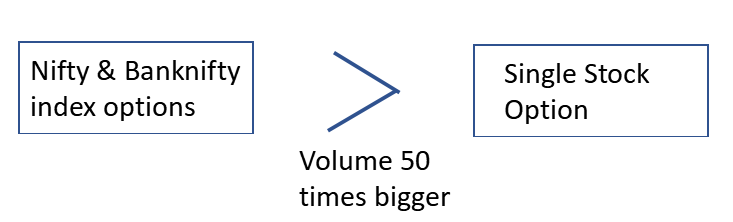

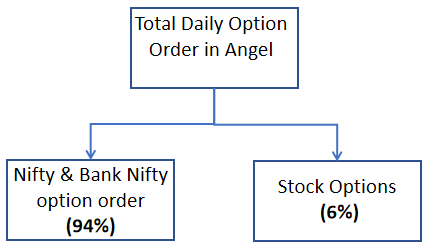

Nifty & Bank Nifty are the most popular scrips for Options trading.

In exchange volume terms, the Nifty & Bank Nifty option’s volume is 50 times bigger than any single Stock Option’s volume.

So these numbers indicate that Nifty & Bank Nifty Options are the most popular scrips to trade in Options.

Reasons why traders choose Nifty & Bank nifty (Index Options) over Stock Options:

- Traders don’t need to track individual stock-specific news or company fundamentals

- Identification of an overall trend is the only thing that is required in Index Options trading.

- Stocks are more volatile than Index.

- Volume in Index Options is more than in Stock Options, so there are fewer chances of slippages.

Due to these reasons, Index Options are more popular. And we recommend you to trade in Index Options only i.e. Nifty or Bank Nifty.

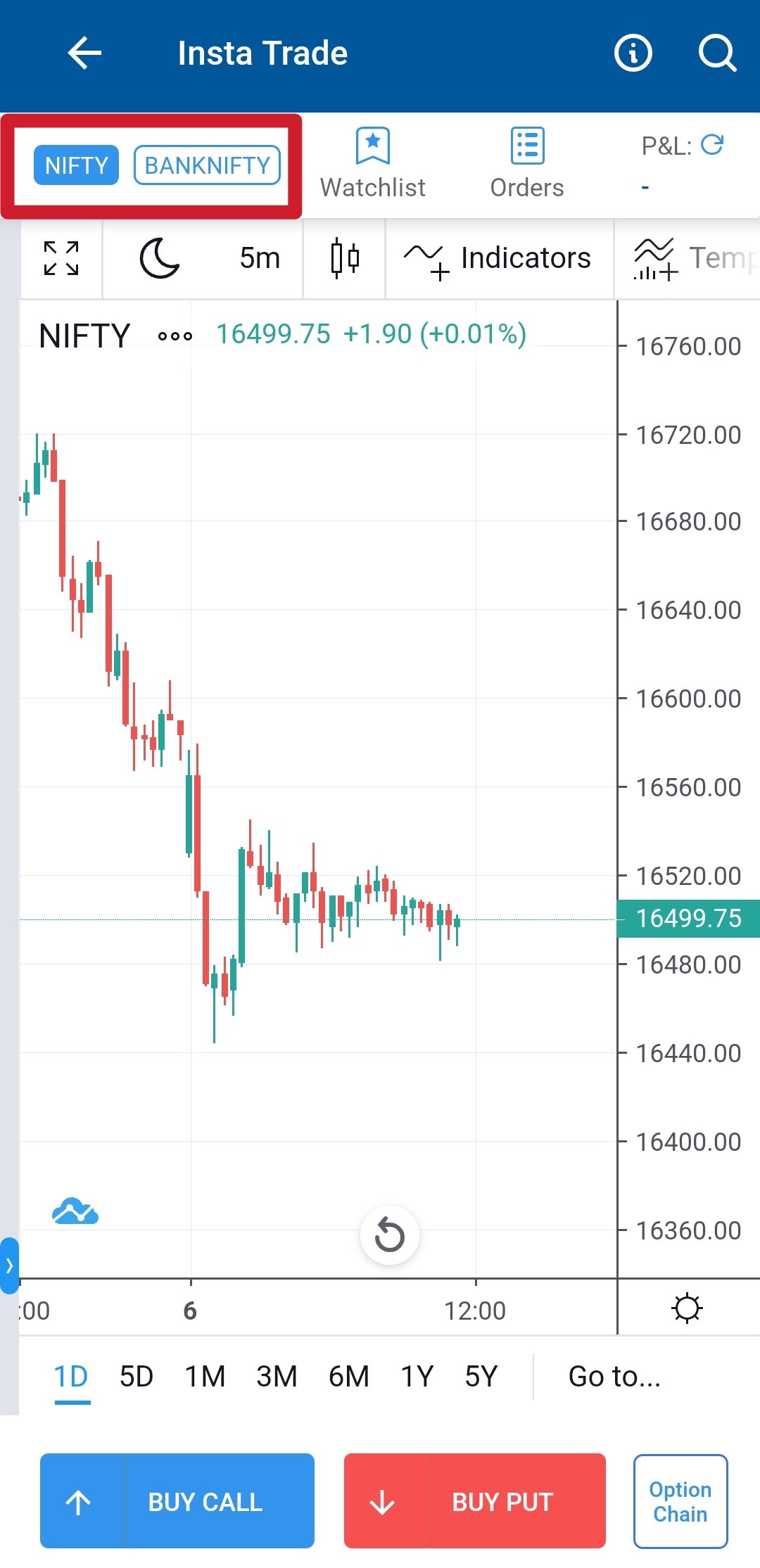

Understanding this, in Insta trade we have given the Nifty & Bank Nifty button on the screen.

You can toggle between them, can view charts and can trade their Call/Put options on the same screen.

Intraday Vs Carry Forward (in Options trading)

Should you trade Options Intraday or Carry forward?

Intraday means - Buy & Sell on the same day

Carry forward means - Buy today Sell another day.

The answer to this is somewhat technical, I will try to explain it in simple language.

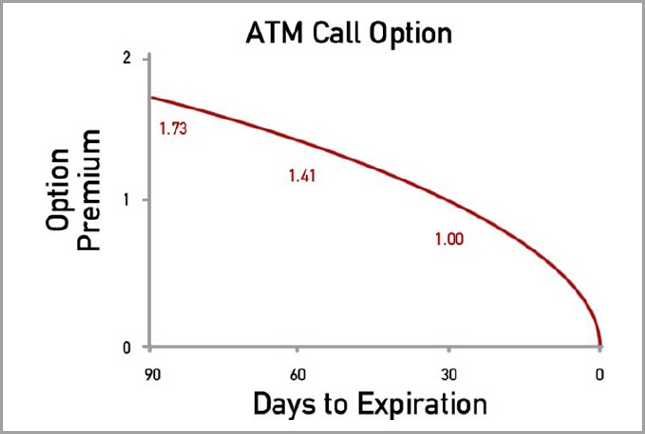

Index Options have weekly expiry, options get expire every Thursday at 3:30 PM.

So, as you can see in the above graph, as the expiry day comes closer, the option price keeps falling. This is because of Theta Decay or Time Decay. Let's understand this with an example.

| Day | Nifty Spot | 16500 Strike LTP (ATM) |

| Friday | 16500 | 150 |

| Monday | 16500 | 128 |

| Tuesday | 16500 | 110 |

| Wednesday | 16500 | 94 |

| Thursday | 16500 | 80 |

As in the table, you can see that on Friday suppose Nifty is trading at 16500.

At that price, the Nifty 16500 strike’s Option price will be Rs.150 (apx.)

Suppose, the Nifty didn’t move at all, it keeps trading at 16500,

You will notice that the Option’s price will fall as the time passes.

This is because Time decay works against option prices as the time passes.

Even on Thursday morning, as you can see if the Nifty price is the same at 16500, you will notice the Option price has become half.

So to save yourself from the loss due to falling Option price due to time decay, you must trade Intraday only because, Options prices decay as time passes. Therefore, you should be very fast and agile with your trades.

You should not hold trades for a long time if you have bought Options.

So, it's better to take Intraday Trades when Buying Options

Why Options selling is probably not for you?

If you will Buy options, someone must be selling them. They are Option sellers.

Option selling is not recommended for beginners, because of the below reasons:

- Need Large Capital

- Has Unlimited Risk

- Needs constant Hedging.

It needs large capital:

| Index | Strike (ATM) | Call/Put | Price | Qty | Option Buying Capital Req. | Option Selling Capital Req. |

| Nifty | 16400 | Call | 130 | 1lot (50Qty) | 6500 | 101000 |

| Nifty | 16400 | Put | 120 | 1lot (50Qty) | 6000 | 99000 |

As you can see in the above table, the big difference in Capital Requirement between Option Buying & Options Selling.

It has Unlimited Risk

| Index | Strike (ATM) | Call/Put | Price | Qty | Option Buying Max Risk | Option Selling Max Risk |

| Nifty | 16400 | Call | 130 | 1lot (50Qty) | 6500 | Unlimited |

| Nifty | 16400 | Put | 120 | 1lot (50Qty) | 6000 | Unlimited |

In Option selling risk is unlimited.

It needs constant hedging

There are several strategies and adjustment methods that are needed to manage unlimited risk in options, which need high-level skills to execute. Also, which needs lots of capital. Hence, for beginners Option selling is not recommended.

Options selling is done by Big Hedge Fund and Desks who:

- Have large capital

- Can borrow unlimited capital from the market

- Have huge loss taking capacity

- Fast and reliable infrastructure (e.g. co-location server) for hedging.

Try Insta Trade

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Next Article – When To Enter A Trade

Previous Article – Options Trading Basics - Part 1