Secure Your Funds and Securities

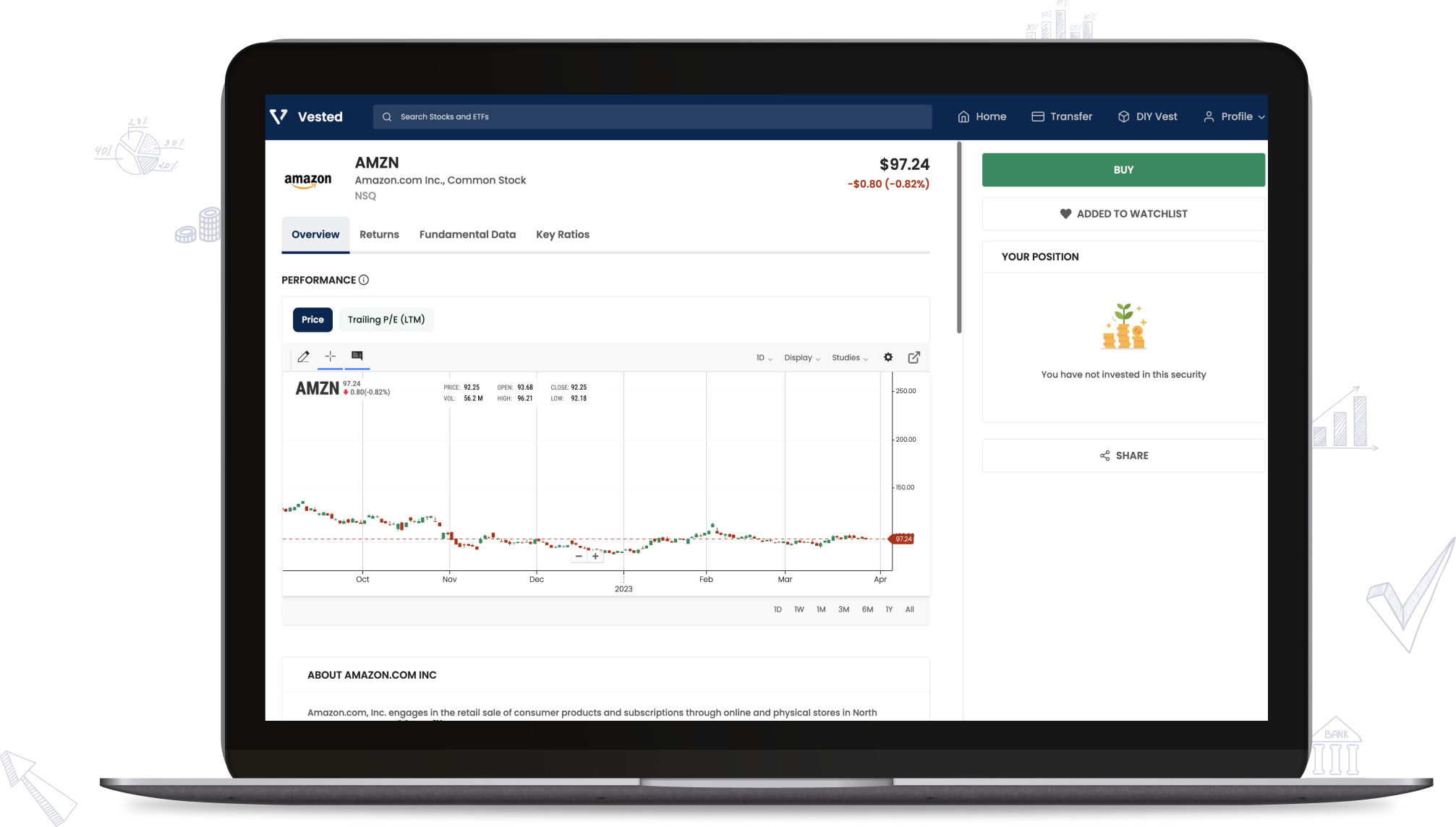

Why Invest in US Stocks via Angel One

Seamless fund transfer

Transfer funds seamlessly with Vested's partner banks

Fractional Investing

Invest in less than one share of high-priced companies like Amazon and Google with as low as $1

Easy Digital A/c opening

Open your account within a matter of minutes digitally and enjoy simplified fund transfer processes

Readymade curated portfolios

Invest and diversify with Vests - the readymade portfolios curated for different investor goals

Calculate Your Share Market Returns

FAQs

What is the process to start investing via Angel One?

The process to start investing in international stocks via the Angel One app is quick and simple. You can open a US brokerage account within a matter of 5 minutes*. Here’s a step-by-step guide.

- Open the Angel One mobile app.

- Click on the ‘International Investing’ tab and select the ‘Start Investing’ option.

- Click on ‘Start KYC.’

For the KYC process, you need to upload a clear image of the following documents.

- PAN (for ID proof)

- Aadhaar/Bank statement (for address proof)

Once you have submitted your KYC, it takes around 1-3 business days for your account to get approved. After that, you can fund your account from your bank in India (or, if you have another US brokerage/bank account, you could fund your account through that option as well).

When your funds are received, you can start investing in the US stocks, ETFs and the custom portfolios.

What is the minimum investment required to start investing in the US stocks?

Do I need to open a bank account in the US to fund the brokerage account?

What is the process of withdrawing the funds?

Withdrawing your funds is easy. You can sell any shares/ETFs at any time. There is no lock-in period. After selling your investments, you may choose to:

- Keep the funds (in USD) in your brokerage account

- Buy/sell other investment products

- Withdraw your funds

On selling the securities, your funds will settle and be available for withdrawal after 2 business days. Here’s the step-by-step process to withdraw your funds.

Step 1: Click on the ‘Fund Transfer’ option.

Step 2: Click on ‘Withdrawal.’

Step 3: Enter the bank account details.

Step 4: Confirm the withdrawal.

Also, here are a few pointers to note.

- The current charges for getting the funds back to your Indian bank account are 11 USD per withdrawal.

- We do not profit from the wire fees as they are charged by the bank in the US.

- We continuously strive to make this lower by engaging with new partners.

Is investing in US stocks even legal or possible?

What are the tax implications for me?

Tax implications come into play under two categories, namely capital gains and dividends.

Taxes on capital gains:

You will be taxed in India for the capital gains you earn on selling your investments. You will not be taxed in the US for these earnings. The amount of taxes you have to pay in India depends on how long you hold the investment.

- To qualify as a long-term capital asset, the shares must be held for at least 24 months. The gain will then be taxed at the long-term capital gains tax rate of 20% (plus applicable surcharge and cess fees), with indexation benefits.

- ● If you hold the shares for less than 24 months, the gains qualify as short-term capital gains. They will be taxed as a part of your regular income in India. The tax rate is based on the tax bracket that you fall under, according to your total income.

Taxes on dividends:

Unlike capital gains, the dividends you earn from your US investments will be taxed in the US at a flat rate of 25%. For example, if Microsoft gives an investor in India $100 as dividend, $25 will be withheld as tax. Subsequently, this post-tax dividend is included as taxable income in India (as normal income).

Fortunately, the US and India have a Double Taxation Avoidance Agreement (DTAA), which allows taxpayers to offset income tax already paid in the US. The 25% tax you already paid in the US is made available as Foreign Tax Credit. You can use it to offset the income tax payable in India.

At the end of fiscal year, we will send you a consolidated statement of your transactions, capital gains and dividend that will help simplify the tax process for you.

I see only a limited number of shares and ETFs on the platform. Why is it so?

What are Vests?

What is fractional investing?

Fractional investing is one of the unique things about the US stock markets. Investors can own fractions of stocks, unlike in countries like India. So, for instance, you could own 0.01 of an Amazon stock.

Fractional investing is useful because of the following reasons:

- You can decide to invest based on a certain amount of money. For instance, if a stock is valued at $100 and you decide to invest $10 in it, you will still get 0.1 shares.

- Many US stocks are really high-priced. For example, Amazon’s shares cost around $2,000 each. So, with fractional stocks, you could effectively build a diversified portfolio even with small amounts of money.

Disclaimer

Angel One Limited (formerly known as Angel Broking Limited), Registered Office: 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai - 400093. Telephone: (022) 42319600 , Fax: (022) 42319607, CIN: L67120MH1996PLC101709, SEBI Registration No.: INZ000161534-BSE Cash/F&O/CD (Member ID: 612), NSE Cash/F&O/CD (Member ID: 12798), MSEI Cash/F&O/CD (Member ID: 10500), MCX Commodity Derivatives (Member ID: 12685) and NCDEX Commodity Derivatives (Member ID: 220), CDSL Registration No.: IN-DP-384-2018, PMS Registration No.: INP000001546, Research Analyst SEBI Registration No.: INH000000164, Investment Adviser SEBI Registration No.: INA000008172, AMFI Registration No.: ARN–77404. Compliance officer: Mr. Bineet Jha, Tel: (022) 39413940 Email: compliance@angelbroking.com Brokerage will not exceed SEBI prescribed limits *Angel broking limited is offering insurance product /services in associated with ICICI Lombard General Insurance Company Limited

Disclaimer: Investments in securities market are subject to market risk, read all the related documents carefully before investing.

*T&C Apply These are not exchange traded products and we are just acting as a distributor. All disputes with respect to the distribution activity would not have access to Exchange investor redressal forum or Arbitration mechanism.”

Privacy Policy: We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. We do not sell or rent your contact information to third parties.

- Involvement of Angel Broking Ltd. is restricted to Referral Only. Angel Broking Ltd. does not offer this product directly to customers.

- Client’s details will be shared with a third party stock broker (Vested Finance Inc.) with expressed consent from clients.

- All dealings including KYC will be executed by a third party stock broker (Vested Finance Inc.) directly with client and Angel Broking Ltd. will not incur any personal financial liability.

- Relationship of Angel Broking Ltd. with third party stock broker (Vested Finance Inc.) is only that of a Referral.

*Account would be opened after all procedures relating to IPV and client due diligence is completed.

Any securities quoted are exemplary and are not recommendatory.

Copyright - All rights reserved | Angel One Limited (formerly known as Angel Broking Limited)