Trading futures always excites me, and I’m constantly looking forward to learning and exploring more about it. However, one thing that has always persisted in the back of my mind is that it requires a substantial amount of capital to trade in futures contracts. Have you faced this problem like me? What if I told you a secret that could reduce your margin requirement for futures trading by 50%? Are you excited? Let’s explore this together, but first, let’s quickly understand what futures contracts are.

A futures contract is a standardised agreement between two parties to buy or sell an underlying asset at a predetermined price on a specified future date. In any futures contract, you have the option to take either the position of a purchaser or a seller. If the price rises, buyers reap profits since they bought assets at lower prices. If the prices drop, sellers take profits since they sell at higher prices.

Let’s understand this with an example. Suppose you want to trade in the Nifty future, and the Nifty has a lot size of 50. The Nifty Futures Contract (December Month) is at 21,385, which means the total future contract value comes out to be Rs 10,69,250. Obviously, the broker would not charge you the entire contract value to trade in it, but they will provide you leverage by asking for an upfront margin and letting you trade the contract.

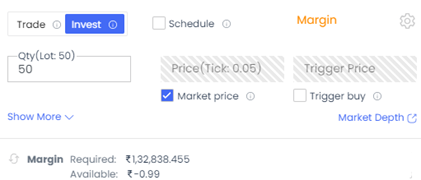

Post-margin benefits, they will ask you for around Rs 1,32,838, which is approximately 12.5% of the total contract value as shown in the image below. If you still need extra leverage to trade this futures contract, then you are just one step away from it.

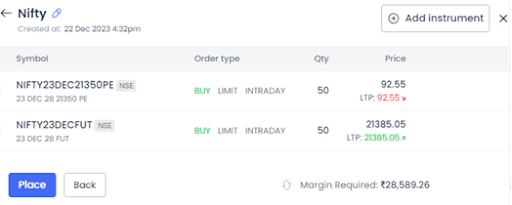

So, to trade futures contracts with less margin, you simply need to add an option contract to your basket. Let’s say you have a bullish view and foresee Nifty will go up in the upcoming days. Then, you need to buy a put option contract of Nifty and then buy a futures contract; this would cost you around Rs 28,590, as shown in the image below.

The catch here is that you need to add the options contract first: if you are bullish, then add a Put option contract, and if your view is bearish, then add a Call option contract before adding the futures contract.

One thing you need to keep in mind is that adding At-the-Money (ATM), In-the-Money (ITM), or Out-of-the-Money (OTM) options carries a different set of risks. You need to check the option Greeks before placing the order, especially the delta for your spread, which will eventually tell you how much money you are going to earn based on how many points Nifty moves in your direction or vice versa. Additionally, if you carry this spread, there is a Mark-to-Market (MTM) risk in the future and theta risk in the option contract.

In the case of buying Options, your maximum risk is limited to the money you have spent on these options. If your prediction proves completely inaccurate and your options become worthless by the contract’s expiration, you may incur a loss equivalent to your initial investment. Contrastingly, with futures contracts, you face unlimited liability. You are obligated to cover daily losses by injecting additional capital through a margin call. Daily losses might compel you to persist in the trade even if the underlying asset moves unfavourably. If most of your investment is in futures contracts and you lack funds to meet margin calls, you might potentially accumulate debt.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 22, 2023, 6:31 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates