HDFC Bank’s fourth-quarter results are scheduled for April 20, which falls on a Saturday. Given its significant weighting in the Nifty and Bank Nifty indices, the anticipation surrounding the outcome is substantial.

Over the past two years, starting from January 2021, HDFC Bank’s stock has traded within the range of Rs. 1340 to Rs. 1725. Currently, it is positioned close to the midpoint of this range. Notably, the stock has exhibited a pattern of lower highs and lower lows, trading below both the 10 and 40-week averages. This behavior suggests a consolidation phase resembling a rectangle pattern. Both weekly and daily Relative Strength Index (RSI) indicators are in the neutral zone, forming a lower low, while the daily Moving Average Convergence Divergence (MACD) is poised to give a bearish signal.

Two days ahead of the earnings announcement, the Implied Volatility has surged to 25, its highest level since February 28. Consequently, option premiums have become relatively expensive. Stock futures are trading either without any premium or with a negligible premium, such as Re 1. Notably, the 1550 strike Call option holds the highest open interest of 18,942 contracts, while the 1500 strike Put option exhibits the highest open interest. These levels are crucial as potential support and resistance zones.

In light of the aforementioned analysis, two potential strategies emerge:

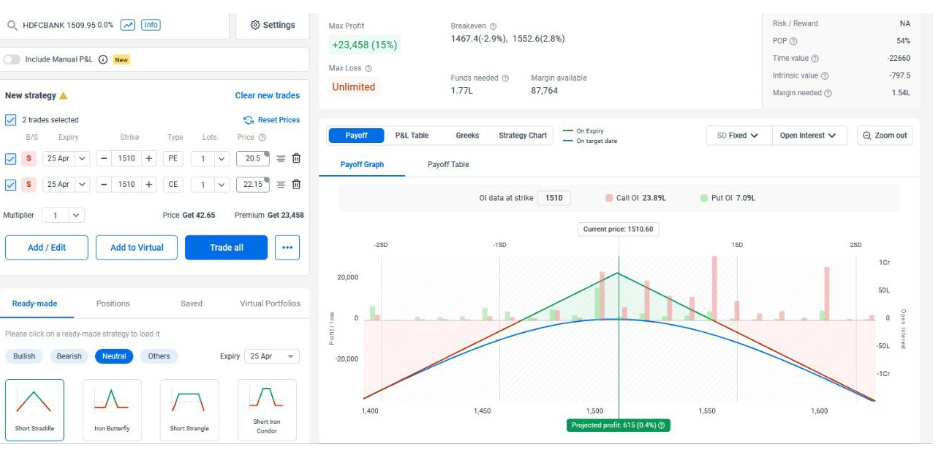

1. Short Straddle at Rs. 1510

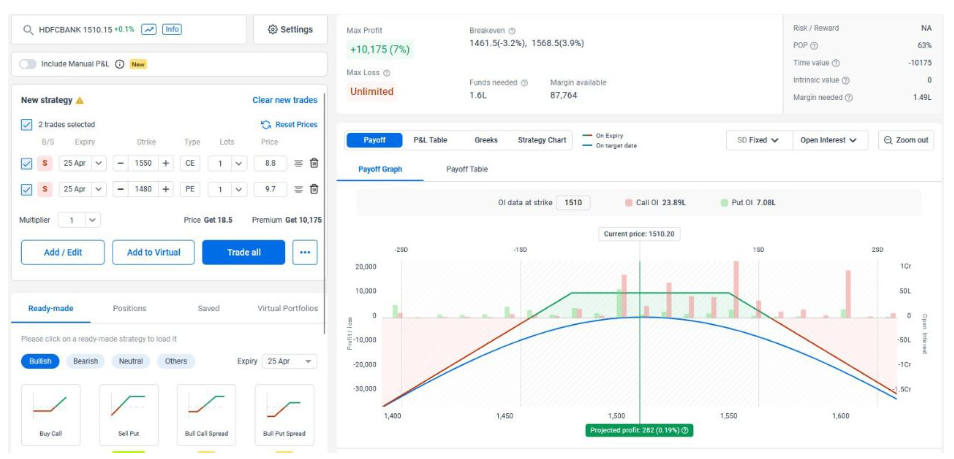

2. Short Strangle

Considering ample capital availability, both strategies can be implemented concurrently to maximize potential returns.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 18, 2024, 4:15 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates