The interim Budget session of the Parliament is scheduled to commence on January 31st, where Finance Minister Nirmala Sitharaman will present the Union Interim Budget for the fiscal year 2023-2024 (FY24) at 11:00 am on February 1st. This will be the last financial plan to be presented by the PM Narendra Modi-led government before the nation heads into general elections in 2024.

Crux of the matter

Depending on the budgetary announcements, Nifty may experience significant fluctuations in either direction. Our markets have witnessed a rise of 186% from the lows of March 2020 and 29% from the lows of March 2023.

Thus, for fully invested investors, it is recommended to hedge their portfolios (fully or partially) ahead of such major events. This can be achieved by acquiring Nifty Put Options. However, it’s crucial to understand that hedging is akin to insurance, and it comes with associated costs.

Traders well-versed in derivatives (comprehending both risks and rewards) who aim to capitalize on volatility resulting from interim budget announcements can execute the trading strategies outlined in this report.

For traders well-versed in derivatives and seeking to capitalize on market volatility surrounding the upcoming 2024 interim budget announcement, consider a Long Strangle strategy for NIFTY. This approach becomes particularly relevant if there are announcements related to tax, as such alterations can introduce substantial fluctuations in the Nifty index.

Additionally, it’s noteworthy that India VIX is presently at historically low levels, standing at 14.34%, compared to the preceding 10-budget average of approximately 19% (eight days before the budget). Given this context, there is a heightened probability that any budgetary announcements may induce an increase in market volatility.

In the event of heightened volatility, there is a greater likelihood of Option Implied Volatility (Option IV) experiencing an uptick. This potential rise in option premiums can prove advantageous for traders employing Long Strangle strategies, providing favourable conditions for option buyers. Therefore, keeping an eye on these factors and adapting trading strategies accordingly could yield benefits in the context of the 2024 interim budget.

The strategy should be executed one week before budget day the given values below are only for understanding, this is not an exact time to buy those strike prices

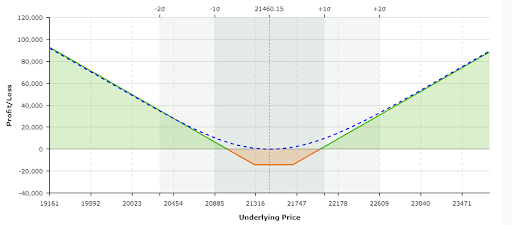

NIFTY SPOT (CMP 21485) Lot size 50 EXPIRY 01 FEB 2024

Leg 1: Buy 1 Lot NIFTY 21700 CALL at Rs. 149.55

Leg 2: Buy 1 Lot NIFTY 21300 Put at Rs. 136.15

Maximum Profit: Unlimited Maximum Loss Rs 14,285,

Upper Breakeven Point: 21015

Lower Breakeven Point: 21985

Approx. Margin requirement: Rs. 14,285

Pay-off graph

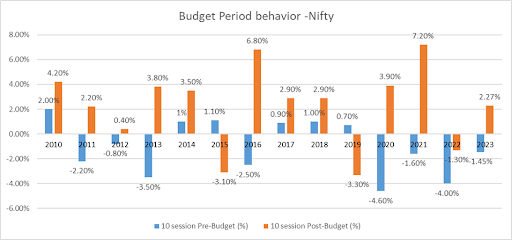

Nifty’s Price Movement Before/After 10 Trading Days of The Budget

To get the Budget 2024 live update, click here.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jan 23, 2024, 5:42 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates