Indian equity markets are currently experiencing a period of low volatility, with the India VIX, a key measure of market risk expectations, plunging to a record low on Tuesday. This 20% tumble reflects investor confidence in the ruling party retaining power and a recent easing of tensions in the Middle East, according to market participants.

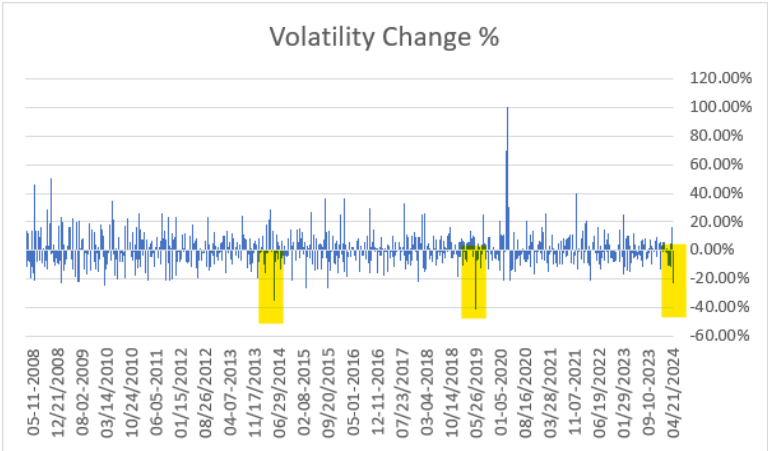

The declining VIX suggests that investors anticipate the benchmark Nifty 50 Index to hold steady throughout the election period. The Nifty 50 has gained nearly 3.21% so far in 2024 and is on track for a modest gain of nearly 0.33% this month. Historically, India’s VIX tends to cool down after major political events. It fell significantly following the general election results in both 2014 and 2019.

However, some analysts caution that a sustained low VIX reading is necessary to confirm continued subdued volatility. With the next phase of the election scheduled for April 26th, most polls predict a third consecutive term for Prime Minister Narendra Modi’s party. The final results will be announced on June 4th.

While investor sentiment leans towards optimism, this hasn’t translated into a surge in trading activity. Cash trading value in India has contracted by about 25% this year. This cautious approach can be attributed to several factors, including:

The National Stock Exchange Nifty 50 Index recently experienced its first weekly decline in over a month, reflecting the increased global market volatility and concerns about stretched valuations in the Indian market.

The Indian stock market appears to be taking a wait-and-see approach during the extended election period. The low VIX reading indicates investor confidence in a stable political outcome. However, muted trading volumes suggest some degree of caution, likely due to a confluence of global and domestic factors.

Looking ahead, investor sentiment will likely remain influenced by:

While the near-term outlook appears cautiously optimistic, investors will be closely monitoring these factors to gauge the future trajectory of the Indian stock market.

Conclusion

India’s ongoing national elections are impacting the country’s stock market in two key ways. First, a record-low VIX reading points towards investor confidence in a stable political outcome. Second, trading volumes have slumped due to a combination of global and domestic factors. As the elections progress and other economic data are released, investors will have a clearer picture of the Indian market’s future direction.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 25, 2024, 4:52 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates