Issued by the Income Tax Department of India, the PAN card is a unique identification document required by any entity responsible for paying taxes in India. Businesses, individuals, local governments, etc., must obtain a PAN card for financial transactions.

The PAN is a 12-digit unique identification number that connects all taxable income and financial transactions carried out by an entity and makes it easier for the government to track them. The PAN card also applies to non-resident Indians, people of Indian origin, and foreign entities with commercial interests in India.

Although one has to be 18 years old to apply for a PAN card, parents or guardians of a minor can also obtain a PAN card on behalf of a minor. In this blog, we have explained the process of obtaining a minor PAN card and the associated details.

Benefits of Minor PAN Card

A minor PAN card offers a plethora of benefits.

- A minor PAN card is required if the minor is engaged in financial activities

- When they have an income of their own

- Parents can apply for minor PAN cards if they are investing in their child's names. It needs to be provided at the time of carrying out the transaction

- Minors need a PAN card if they are named as a nominee on properties, shares, or other financial assets.

- As the PAN card is a unique identification number, it doubles as identification proof. Moreover, the PAN card number remains unchanged throughout. A minor’s PAN number will also remain the same when they apply for a PAN as an adult

- It helps create a financial record on the child's name

PAN Card for Minor - Application Process

A minor PAN card could be required under different circumstances. The application process for a minor PAN is straightforward and streamlined. One can choose an online or offline route to apply for the same.

A minor PAN card doesn’t carry a photo or signature and hence, can’t be used for identification purposes. According to the procedure, a minor needs to reapply for a PAN when they turn 18. They will be issued a regular PAN card with their photo and signature, but it will have the same number.

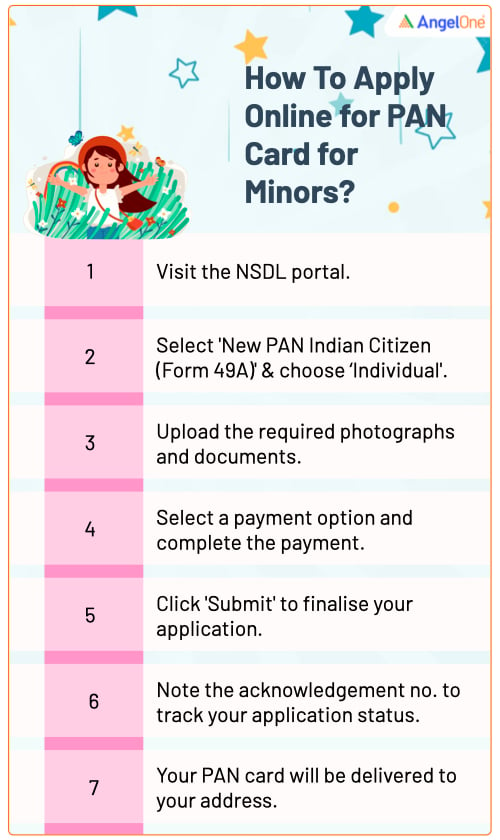

Minor PAN Card Apply Online Process

- Go to the NSDL portal

- Select the application type 'New PAN Indian Citizen (Form 49A)' and choose the category as 'Individual'

- Follow the instructions to fill out Form 49A

- Upload photographs and other essential documents

- Proceed to make the payment. One can pay using a debit or credit card or net banking when applying online

- Click 'Submit'

- You will receive an acknowledgment number, which you can use to check the status of your application

- You will receive the PAN card at your address

Offline Method to Apply PAN Card for Minor

- Download From 49A from the NSDL website

- Fill out the form

- Attach required documents

- Attach two photographs of the child

- Submit the application form to the NSDL/UTIITSL office or a TIN facilitation centre along with the fees

- You will be given an acknowledgement number

- The PAN card will be sent to your address in 10–15 days

Documents Required to Apply for Juvenile PAN Card

Here is a list of minor PAN card documents you need.

- Proof of age: Aadhaar card, birth certificate issued by the municipality, passport

- Proof of address: Aadhaar card, passport, property documents in the applicant’s name, ration card, passbook issued by post office, etc.

- Proof of identity: Aadhaar card, passport, ration card, government-issued photo ID card, etc.

Process to Update Minor Pan Card on Becoming a Major

Once minors become adults, they need to upgrade their PAN cards. Follow these steps for the PAN card application.

- One needs to apply using Form 49A (for Indian citizens) or 49AA (for foreign citizens). One can opt for an online or offline application process

- Fill out the form and submit

- Submit all documents, including photographs, photo ID proof, address proof, etc.

- Pay the required charges

- On successful application, you’ll receive an acknowledgment number

- The PAN will be sent to your address within 10-15 days

Final Words

With knowledge, you can plan your finances more efficiently. If you are a parent, knowing the PAN card rules for your minor child will help you make better financial decisions while you secure their future.