Investors and analysts alike are eagerly awaiting the culmination of lock-in periods, which vary in duration from as short as 30 days to as long as two years. This wide range of lock-in durations adds a fascinating layer of complexity to the impending market dynamics. As the clock ticks down, the market braces for the potential impact of significant liquidation by private equity and institutional investors, making this a closely monitored development in the weeks to come.

Before delving into the anticipation surrounding the conclusion of lock-up periods, let’s establish the basics. A lock-up period is a specific timeframe that comes after a company’s initial public offering (IPO). It imposes restrictions on certain individuals known as insiders, including company founders, executives, and early investors. These restrictions typically extend for a duration ranging from 90 days to a year or even longer. The primary objective of a lock-up period is to deter insiders from inundating the market with their shares right after an IPO. This precautionary measure aims to prevent any significant downward pressure on the stock price.

Extensive evidence supports the notion that upon the conclusion of a lock-up period, stock prices tend to undergo a lasting decline, typically falling within the range of 1% to 3%. It’s also noteworthy that prior to a company’s initial public offering (IPO), it frequently undergoes an underwriting process, with a bank acting as the underwriter.

Yes Bank

The conclusion of Yes Bank’s lock-up period in March 2023 coincided with a notable decline in the stock price, with a substantial drop of nearly 15% occurring within the same month.

Moreover, several stocks have witnessed substantial declines recently. For instance, Zomato saw a sharp drop of almost 11% as its IPO lock-in period for promoters concluded. Similarly, SBI Cards and Payment Services, along with Mankind Pharma, experienced declines of 15% and 5%, respectively, immediately following the expiration of the 30-day lock-in period for anchor investors.

The lock-in periods for approximately 17 IPOs are set to conclude this year.

Utkarsh SFB (Nov 30, 2023 – 90 Days Lock-in)

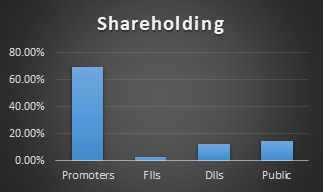

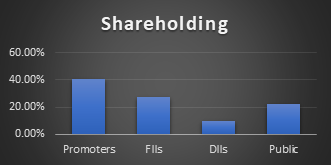

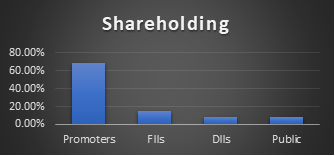

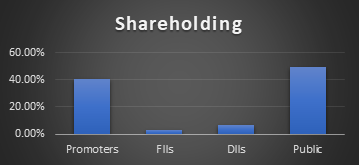

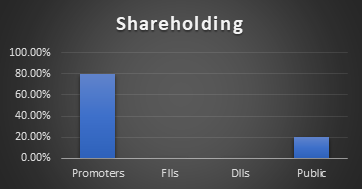

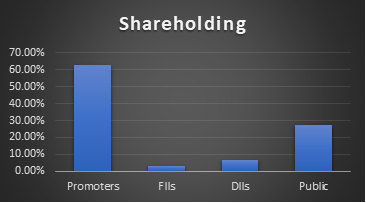

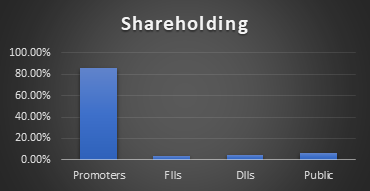

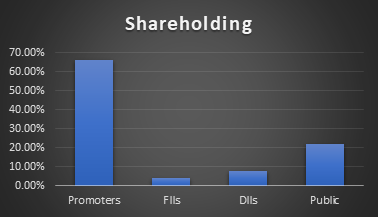

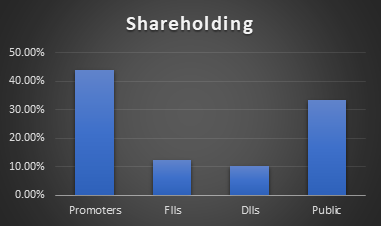

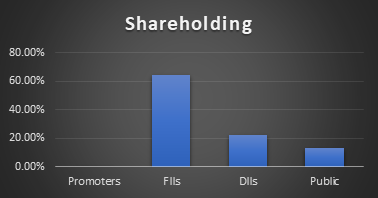

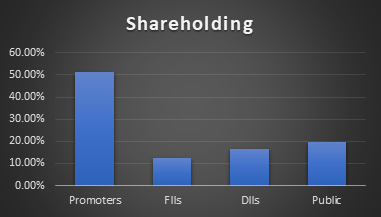

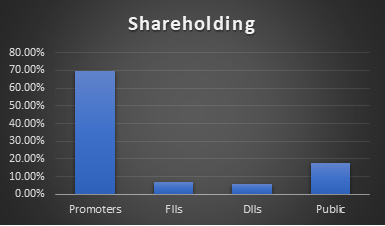

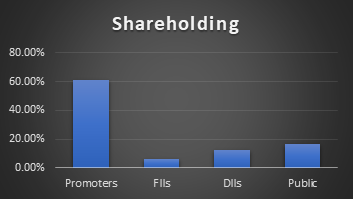

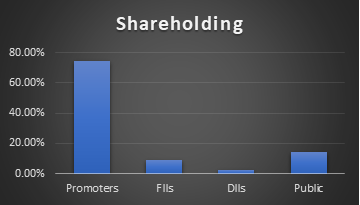

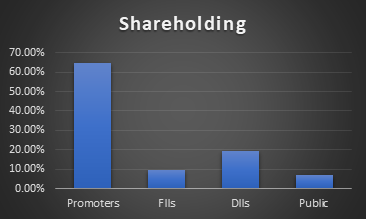

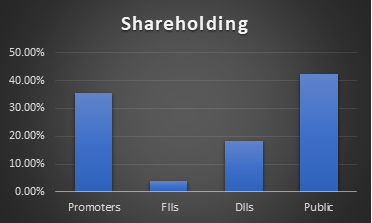

Shareholding

Restaurant Brands Asia (Oct 1, 2023 – 45 Days Lock-in)

Senco Gold (Nov 21, 2023 – 90 Days Lock-in)

Jupiter Life Line (Oct 30, 2023 – 30 Days Lock-in)

EMS Limited (Nov 1, 2023 – 30 Days Lock-in)

RR Kabel (Nov 6, 2023 – 30 Days Lock-in)

JSW Infra (Nov 16, 2023 – 30 Days Lock-in)

Yatharth Hospital (Dec 14, 2023 – 90 Days Lock-in)

Zaggle Prepaid (Nov 7, 2023 – 30 Days Lock-in)

Samhi Hotels (Nov 7, 2023 – 30 Days Lock-in)

Signature Global (Nov 10, 2023 – 30 Days Lock-in)

Sai Silks (Nov 10, 2023 – 30 Days Lock-in)

Manoj Vaibhav Gems (Nov 10, 2023 – 30 Days Lock-in)

Yatra Online (Nov 8, 2023 – 30 Days Lock-in)

Tracxn Technologies (Oct 18, 2023)

As we approach the culmination of post-IPO lock-in periods for 17 companies, which notably includes several anchor investors, this month promises to usher in significant shifts in the market landscape. Insights from Nuvama Institutional Equities suggest that the conclusion of these lock-in periods frequently acts as a catalyst for market volatility. This phenomenon stems from the anticipated liquidation of shares by private equity and institutional investors, making it an event of considerable significance in the financial markets.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 10, 2023, 3:47 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates