On Friday, the Nifty 50 Index began at 18550.85, reached a peak of 18573.70, and ended the day with a marginal change of 46.35 points, closing at 18534.10. The Nifty Realty Index performed exceptionally well and was the second-best performing index on the NSE, closely followed by the Nifty Metal Index. Starting at 485.20, the Nifty Realty Index briefly dropped to a low of 484.60 before ultimately closing at 490.85. Its highest value in the past 52-weeks was 492.50, whereas the lowest was 366.75. The index achieved an all-time high of 560.90 in November 2021 and is currently trading approximately 12% lower than that peak. Comprising 10 stocks, the Nifty Realty Index has delivered a 19% return over the course of the year.

| Index | Price as on 02 June 2023 | Change | % Change | 52-Week High | 1 Year Return |

| Nifty Realty | 490.85 | 6.85 | 1.42% | 492.5 | 19.5% |

| Nifty 50 | 18534.1 | 46.35 | 0.25% | 1887.6 | 11.5% |

Despite global tightening measures and the Reserve Bank of India’s decision to increase interest rates, the Nifty Realty Index has displayed impressive performance, surpassing the returns of the Nifty 50 Index. Over the past year, the Nifty Realty Index has generated a significant return of 19.5%.

| Company Name | Price as on 02 June 2023 | 1-Month Return | 3-Month Return |

| DLF ltd | 489.75 | 11.60% | 32.60% |

| Mahindra Lifespace Developers ltd | 450 | 16.70% | 23.00% |

| Prestige Estate Projects ltd | 488.55 | -0.10% | 21.30% |

| Godrej Properties ltd | 1,427.00 | 5.60% | 20.30% |

| Brigade Enterprises ltd | 566.45 | 9.70% | 19.00% |

| Macrotech developers ltd | 555 | 22.80% | 12.80% |

| Phoenix Mills ltd | 1,486.00 | 3.70% | 8.30% |

| IB Real Estate ltd | 70.1 | -6.60% | 7.50% |

| Oberoi Realty ltd | 959.05 | 1.80% | 6.30% |

| Sobha ltd | 567.55 | 18.80% | -1.50% |

Historical Returns Analysis:

| Company Name | Price as on 02 June 2023 | 1-Month Return | 3-Month Return |

| DLF ltd | 489.75 | 11.60% | 32.60% |

| Mahindra Lifespace Developers ltd | 450 | 16.70% | 23.00% |

| Prestige Estate Projects ltd | 488.55 | -0.10% | 21.30% |

| Godrej Properties ltd | 1,427.00 | 5.60% | 20.30% |

| Brigade Enterprises ltd | 566.45 | 9.70% | 19.00% |

| Macrotech developers ltd | 555 | 22.80% | 12.80% |

| Phoenix Mills ltd | 1,486.00 | 3.70% | 8.30% |

| IB Real Estate ltd | 70.1 | -6.60% | 7.50% |

| Oberoi Realty ltd | 959.05 | 1.80% | 6.30% |

| Sobha ltd | 567.55 | 18.80% | -1.50% |

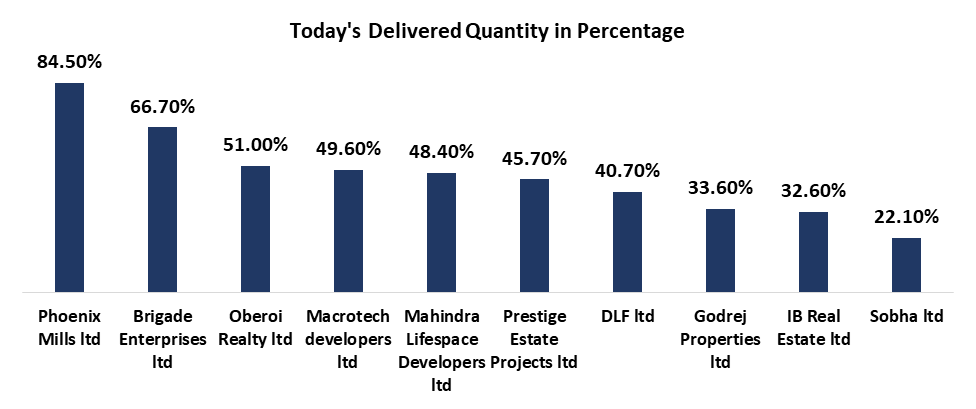

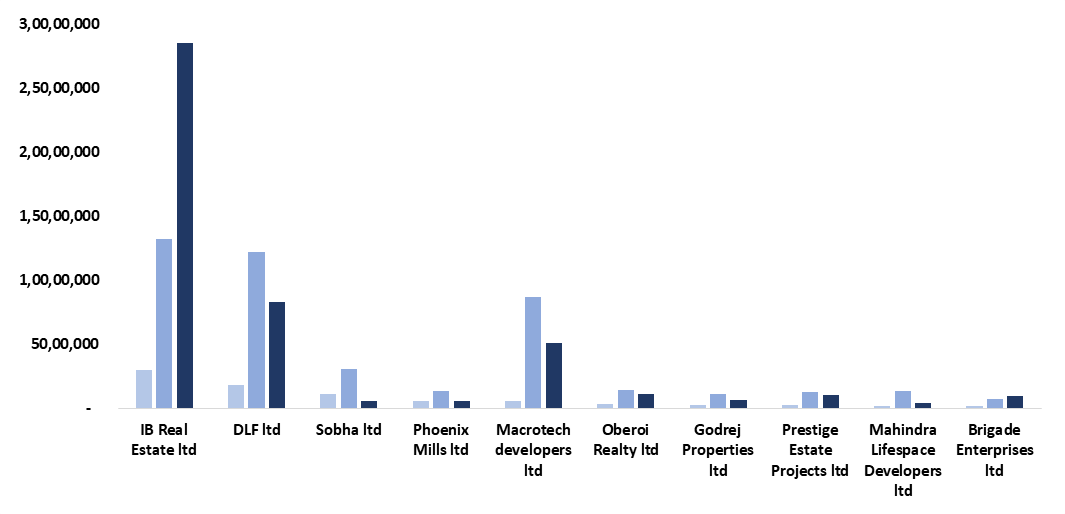

Delivery Analysis:

| Company Name | Delivered Quantity as on 02 June 2023 | Dlv Qty out of Total Traded Qty | 28 May – 03 June | 21 May – 27 May |

| IB Real Estate ltd | 29,92,229 | 32.60% | 1,32,37,497 | 2,85,26,173 |

| DLF ltd | 17,65,089 | 40.70% | 1,21,53,679 | 82,50,680 |

| Sobha ltd | 10,82,624 | 22.10% | 30,45,527 | 5,80,772 |

| Phoenix Mills ltd | 5,78,258 | 84.50% | 13,01,430 | 5,29,001 |

| Macrotech developers ltd | 5,76,581 | 49.60% | 87,02,707 | 50,58,550 |

| Oberoi Realty ltd | 3,48,903 | 51.00% | 14,33,710 | 10,74,942 |

| Godrej Properties ltd | 2,37,562 | 33.60% | 10,82,813 | 6,63,875 |

| Prestige Estate Projects ltd | 1,96,064 | 45.70% | 12,73,601 | 10,33,717 |

| Mahindra Lifespace Developers ltd | 1,55,503 | 48.40% | 13,04,413 | 4,24,859 |

| Brigade Enterprises ltd | 1,29,372 | 66.70% | 6,66,213 | 9,70,586 |

Among the stocks listed in the table above, Phoenix Mills Ltd recorded the highest delivery percentage of 84.50%, indicating a significant number of shares being delivered during trading. Following closely behind, Brigade Enterprises Ltd achieved a delivery percentage of 66.70%. In contrast, Sobha Ltd had a comparatively lower delivery percentage of 22.10% out of the total traded quantity on both the NSE and BSE exchanges.

From the chart provided, it is evident that three stocks i.e. IB Real Estate Ltd, DLF, and Macrotech Developers garnered investor interest in terms of higher delivery percentages, indicating that investors bought these stocks for investment purposes. In contrast, the remaining stocks experienced nominal trading volumes. While this observation suggests the involvement of FII and DII in buying these stocks, it is essential to note that delivery percentage is just one parameter to consider when making investment decisions. It is always advisable for investors to conduct their own thorough research before making any investment choices. It is recommended to monitor the price behaviour of these stocks in the upcoming week and keep them under close observation.

Published on: Jun 5, 2023, 11:57 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates