Aditya Birla Sun Life Mutual Fund has launched a new open-ended index fund named Aditya Birla Sun Life Crisil IBX Gilt June 2027 Index Fund. The objective of this scheme is to track the returns of the CRISIL IBX Gilt Index – June 2027, to generate similar returns while minimizing deviations from the index. This scheme offers investors the opportunity to invest in government securities (G-Secs) maturing in June 2027. The minimum investment amount is Rs. 1000 and the new fund offer will be open for subscription until June 4th, 2024.

The investment objective of the Aditya Birla Sun Life Crisil IBX Gilt June 2027 Index Fund is to generate returns corresponding to the total returns of the securities as represented by the CRISIL IBX Gilt Index – June 2027 before expenses, subject to tracking errors

This NFO of Kotak Aditya Birla Sun Life Crisil IBX Gilt June 2027 Index Fund is suitable for investors who are seeking income over the target maturity period and an open-ended Target Maturity Index Fund that seeks to track CRISIL IBX Gilt Index – June 2027

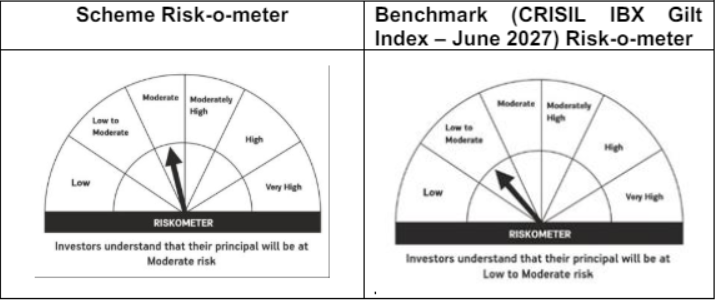

Potential Risk Class: it’s a close-ended scheme, with relativelymoderate interest rate risk and relatively low credit risk (A – II).

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Instruments forming part of the CRISIL IBX Gilt Index – June 2027 | Moderate | 95 | 100 |

| Debt/Money Market Instruments, cash and cash equivalent | Low | 0 | 5 |

The performance of the Aditya Birla Sun Life CRISIL IBX Gilt June 2027 Index Fund is benchmarked against CRISIL IBX Gilt Index – June 2027.

Mr. Bhupesh Bameta, 44 years old, is a highly qualified professional with a B.Tech from IIT Kanpur and a CFA Charterholder from the CFA Institute, USA. With over 16 years of experience in the financial services industry, he has developed significant expertise in various financial domains. Mr. Bameta joined Aditya Birla Sun Life AMC (ABSLAMC) in December 2017 as an Analyst in Fixed Income, where he has been integral to the investment team, collaborating closely with other fund managers and team members.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 21-05-2024 in % | ||

| 2024 | 2023 | 2022 | ||||

| ABSL Crisil IBX Gilt Apr 2028 Index Fund | 15-03-2023 | 27.69 | 0.76 | 2.64 | – | – |

| PGIM India CRISIL IBX Gilt Index Apr 2028 Fund | 22-02-2023 | 30.64 | 0.51 | 2.72 | – | – |

| HSBC CRISIL IBX Gilt June 2027 Index Fund | 23-03-2023 | 226.76 | 0.45 | 2.72 | – | – |

| Bandhan CRISIL IBX Gilt June 2027 Index Fund | 17-03-2021 | 8249.84 | 0.41 | 2.74 | 7.33 | 1.8 |

| Bandhan CRISIL IBX Gilt April 2028 Index Fund | 23-03-2021 | 4963.80 | 0.41 | 2.76 | 7.49 | 1.99 |

| SBI CRISIL IBX Gilt Index – April 2029 Fund | 04-10-2022 | 2121.36 | 0.45 | 2.93 | 7.8 | – |

| Bandhan Crisil IBX Gilt Apr 2032 Index Fund | 15-02-2023 | 381.32 | 0.46 | 3.29 | – | – |

Data as of May 21, 2024

Dreaming of financial freedom? Use our Online SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 22, 2024, 11:44 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates