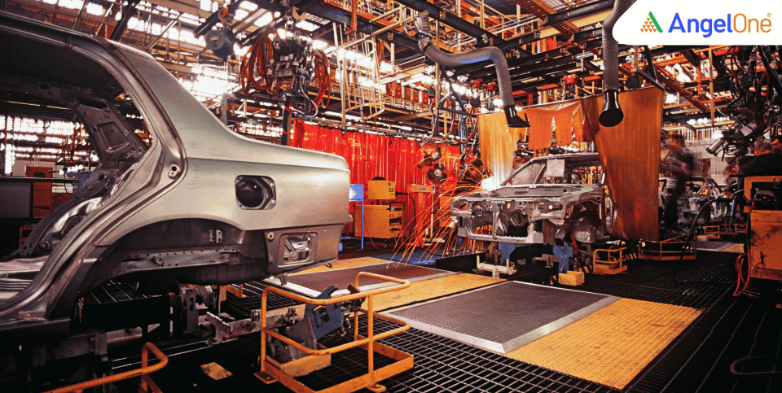

On January 12, 2026, Maruti Suzuki India Limited announced that its Board has approved the acquisition of land at Khoraj Industrial Estate from Gujarat Industrial Development Corporation. This strategic move aims to expand the company's production capacity to meet growing market demand.

Maruti Suzuki's existing production capacity stands at approximately 24 lakh units annually across its facilities in Gurugram, Manesar, Kharkhoda, and Hansalpur.

The company's capability extends to producing up to 26 lakh units per annum, which includes output from the erstwhile Suzuki Motor Gujarat Private Limited, now amalgamated with Maruti Suzuki. Currently, the company's production capacity is fully utilised.

The Board has proposed an addition of up to 10 lakh units to the existing capacity. The timeline for this capacity addition will be finalised and approved by the Board during the planning phases.

The investment required for this expansion will also be determined in these phases. The cost for land acquisition, development, and preparatory activities has been approved at ₹4,960 crore.

The expansion will be financed through a combination of internal accruals and external borrowings. The primary rationale behind this expansion is to cater to the growth in market demand, including exports.

Read More: Mahindra & Mahindra Share Price in Focus After Announcing December 2025 Production, Sales, and Export Report!

As of January 12, 2026, at 10:12 AM, Maruti Suzuki India share price on NSE was trading at ₹16,402 down by 0.60% from the previous closing price.

Maruti Suzuki India's decision to acquire land for capacity expansion reflects its strategic response to increasing market demand. With a proposed investment of ₹4,960 crore, the company is poised to enhance its production capabilities significantly.

Disclaimer: This blog has been written exclusively for educational purposes. The securities or companies mentioned are only examples and not recommendations. This does not constitute a personal recommendation or investment advice. It does not aim to influence any individual or entity to make investment decisions. Recipients should conduct their own research and assessments to form an independent opinion about investment decisions.

Investments in the securities market are subject to market risks, read all the related documents carefully before investing.

Published on: Jan 12, 2026, 12:05 PM IST

Team Angel One

We're Live on WhatsApp! Join our channel for market insights & updates