Why do investors need to know Gross profit and Gross margin

Investors want to earn money from their investments through three channels primarily -

- Capital appreciation i.e. increase in the price of the shares they hold

- Dividends i.e. regular payment of large cash amounts from the company for each share held

- Interest i.e. in case the investor has made investments through bonds, they want to make sure that the company is solvent enough to pay back the loan

In each of the above cases, a company that earns high profits is more likely to be able to provide money to the investor through the above channels. If a company earns profits, it is more likely to have the cash to pay both interest and dividends. Moreover, if a company is earning high profits, then traders and investors in the stock market are likely to have greater confidence in the stock of that company and thus will be ready to pay a higher amount than the original share price to buy the share.

What is Gross Profit

Gross Profit is the profit that a business makes after deducting its costs and expenses involved in making and selling products or the costs that are incurred for providing its services. Gross profit is calculated after subtracting Cost of Goods Sold (COGS) from the revenue, and it appears on a company’s income statement. Gross profit is also referred to as Gross Income or Sales Profit. That said, Gross Profit should not be associated as operating profit as the latter is arrived at by deducting operating expenses from Gross Profit.

The Gross Profit Formula

Gross Profit = Total Revenue or Net Sales - Cost of Goods Sold

Here,

Cost of Goods Sold = Direct cost associated with producing the goods i.e. total labour costs plus the total cost of materials

The concept of gross profit does not consider fixed costs i.e. costs incurred independent of the level of output like rent, advertising, insurance, salaries etc. (unless you are performing absorption costing).

Gross profit for a period tells us how much income is obtained from simply the sales of the goods and services in that period - it is not necessary that the goods and services sold be also produced in exactly the same time period as goods produced in previous periods and stored in the inventory and then sold in the particular period may also be considered under Cost of Goods Sold in the period.

If the number obtained is positive, then that means that the amount obtained from the sales is higher than the amount spent to make the sales possible. A higher absolute value of the gross profit indicates that the size of the company’s revenue has grown and/or the size of the cost of goods sold has gone down.

In case of goods produced this year but not sold yet, the value will not be included in the cost of goods sold. Instead, it will be considered in the balance sheet as inventory on the Assets side and will be incorporated into the net income value (derived from the income statement) under the Equity section of the balance sheet.

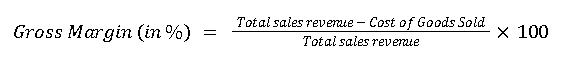

What is Gross Margin

Gross profit margin is a metric that businesses use to evaluate a company's financial performance by calculating the amount of money left over from product sales after subtracting the cost of goods sold (COGS). Most commonly referred to as the gross margin ratio, gross profit margin is usually denoted as a percentage of sales.

How to use gross profit and gross margin?

Gross Profit primarily aids in determining the scale of operations and profits of the company and its production process. It acts as a metric that looks at variable costs — that is, costs that change with the level of production and output. As a metric it is useful for comparing a business’s efficiency in production and delivering goods and services over time. However, Gross profit should not be the only measure to determine the financial performance of a company.

One must use gross profit to also calculate the gross profit margin of a business entity.This is because one cannot simply compare gross profits from year to year or quarter to quarter as they can be misleading to understand the company’s performance. It is a known fact that gross profits can rise while gross margins fall which would be a worrying incident as that means that every rupee spent is yielding a lesser amount of money to the company.

We can use Gross margin and Gross profit to compare businesses across sectors in order to understand the profitability of each sector. They give us insights into the peculiarities of the sector, the company, the financial and managerial structure of the company, the impact of the level of technology used etc.

Conclusion

As we can see, Gross profit and gross margin are two of the building blocks of any financial statement. Investors, before investing in a company should definitely look into both figures in order to understand how profitable the company is in relation to its competitors, other sectors and over time. If you want to invest in a company through the stock market, but do not have a demat account, try to open demat account today with India’s trusted online broker.