On Wednesday, the US dollar went up to its highest point in the past six months, even though it had previously been losing value. This happened because recent data from the US showed that businesses providing services, like restaurants and shops, did surprisingly well last month.

More people ordered services, and businesses had to charge higher prices, suggesting that prices for things we buy might keep increasing.

As a result, the US dollar became stronger compared to most other currencies. For example, the euro and British pound reached their lowest values in three months, and the Japanese yen also got weaker. However, the US dollar’s strength eased a bit later in the day as trading activity slowed down.

The USD dollar index opened at USD 104.749 and reached an intraday high of 105.024, which is 0.05% higher than its previous day’s closing level of USD 104.789. As of the time of writing this article, it is trading at approximately USD 104.813.

To put it simply, the US dollar became more valuable because of good news about the US economy, making other currencies like the euro and the British pound worth less when compared to the dollar.

Below is the chart presentation of the Dollar Index in the 3-month time frame:

When you are actively participating in the Indian Stock Market, do you ever keep an eye on the Dollar Index?

This surge in dollars will have a significant impact on the import-dependent economy like India. Let’s find out how this can give us insights into trading in the Indian Stock Market.

So, the Indian market moves up and down for various reasons. The Macroeconomics factor affects the entire Indian economy and all the different sectors within it, which then affect individual stocks. The stock market reacts to these factors, and sometimes, it even moves in anticipation of these events.

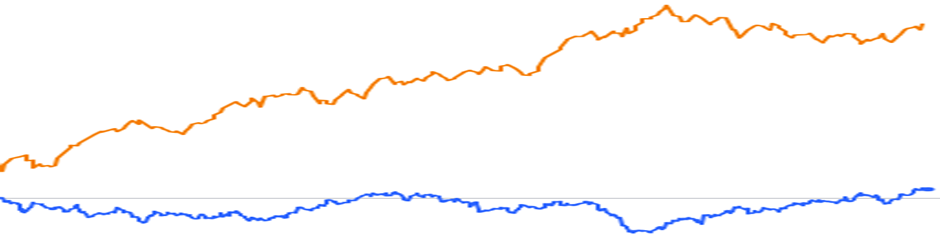

There is an inverse relationship between the dollar index and the Indian stock market. The reason behind this is that when the dollar index falls, FIIs (Foreign Institutional Investors) invest more in Indian stocks as they give higher returns as compared to returns from dollars. As a result of the rising dollar value, the Indian markets suffer. Some sectors in the Indian stock market get hit harder than others.

Below is the chart presentation of the Dollar Index versus the Nifty 50 Index in the daily time frame. Orange represents the Nifty 50, and blue represents the Dollar Index.

So, when the Dollar Index is rising, it can lead to a drop in the stock prices of certain companies, especially in sectors like Banking, Automobiles, Oil and Gas, Capital Goods, Metals, and more.

So, if you’re someone who regularly trades stocks, it’s a smart idea to keep an eye on the Dollar Index and compare it to the NIFTY 50 index using technical charts in your trading analysis.

Currently, Nifty50 is trading at 19,592 which is 0.09% down from its previous closing.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 7, 2023, 12:21 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates