SBI Mutual Fund launched a new open-ended equity scheme named SBI Automotive Opportunities Fund on May 17, 2024. This thematic fund aims for long-term capital appreciation by investing in equity and equity-linked instruments of companies involved in the automotive and allied industries, both domestically and internationally. The investment in this sector-specific scheme will be benchmarked against the Nifty Auto TRI.

The new fund offer will be open for subscription until May 31, 2024, with a minimum investment of Rs 5,000. There is no entry load, but an exit load of 1% of the applicable NAV applies if units are redeemed or switched out within one year from the allotment. This exit load becomes nil after one year. It’s important to note that the AMC reserves the right to modify the load structure in the future.

The investment objective of the scheme is to generate long-term capital appreciation to unit holders from a portfolio that is invested in equity and equity related instruments of companies engaged in automotive & allied business activities. However, there can be no assurance that the investment objective of the Scheme will be realized.

This NFO of Samco Special Opportunities Fund is suitable for investors who are seeking long-term capital appreciation Investment in equity and equity-related instruments of companies engaged in and/or expected to benefit from the growth in automotive & its allied business activities theme.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

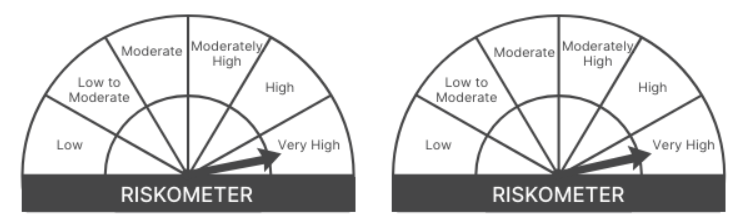

| Equity and equity related instruments of companies engaged in automotive & allied business activities theme (including equity derivatives) | Very High | 80 | 100 |

| Equity & equity related instruments of companies other than above (including equity derivatives) | Very High | 0 | 20 |

| Debt & debt related instruments (including securitized debt & debt derivatives) and money market instruments including tri-party repos | Low to Medium | 0 | 20 |

| Units issued by REITs and InvITs | Medium to High | 0 | 10 |

The performance of the Samco Special Opportunities Fund is benchmarked against the Nifty Auto TRI.

Mr. Tanmay Desai is a 40-year-old fund manager who has been managing the scheme since its inception. He holds a B.E in Electronics, an MBA in Finance, and is a CFA Level III candidate (USA). With close to 15 years of work experience, Mr. Desai has over 6 years of experience in Indian capital markets, bringing a substantial depth of knowledge and expertise to his role.

Mr. Pradeep Kesavan, the dedicated fund manager for overseas investments, is 44 years old and has been managing the scheme since its inception. He holds a B.Com degree, an MBA in Finance, and is a CFA charter holder (USA). Mr. Kesavan joined SBIFML in July 2021 and has over 18 years of experience in the financial services sector, contributing significant insight and expertise to his position.

The Mirae Asset Global Electric & Autonomous Vehicles ETFs Fund of Fund, managed by Mirae Asset Mutual Fund, currently has an NAV of Rs 9.927 as of May 14, 2024. The fund maintains a size of Rs 82.98 crore. Its expense ratio is 0.51%.

Mirae Asset Global Electric & Autonomous Vehicles ETFs & FoF is another automotive fund in the Indian mutual fund market, but it invests in global companies.

Elevate your savings strategy with our easy-to-use SIP Return Calculator. See the impact of consistent investing. Your future self will thank you. Start planning today!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 17, 2024, 12:10 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates