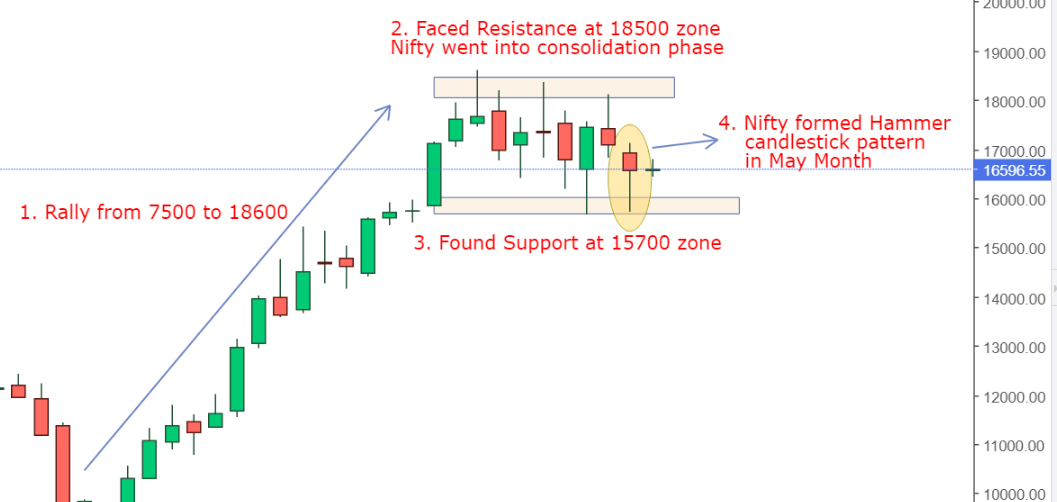

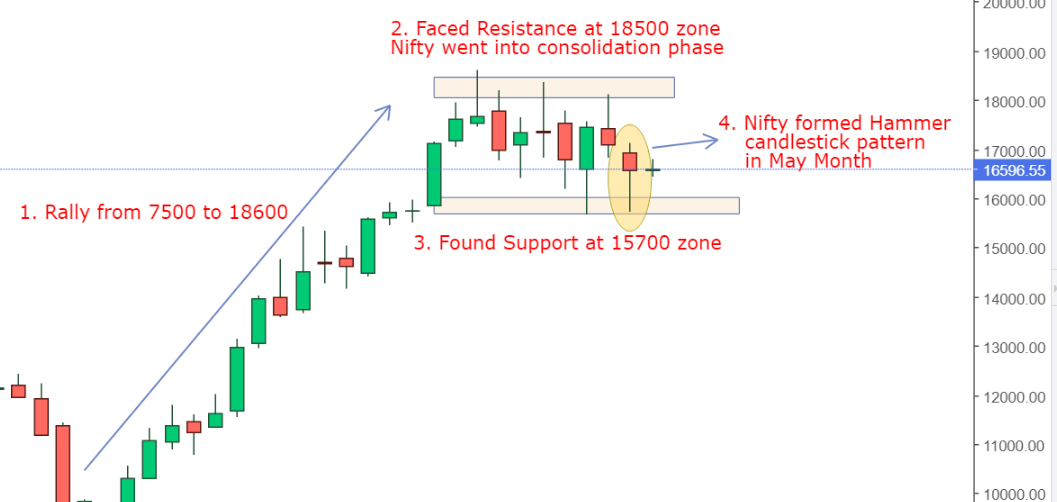

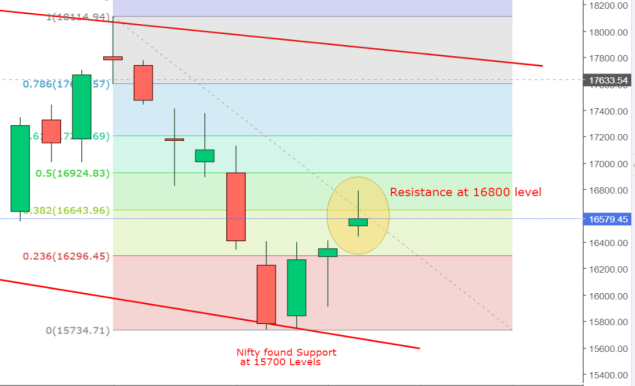

1. Monthly Time-frame Analysis :

- From the lows of Mar20, Nifty rallied from the level of 7500 to 18500 between Apr20 to Oct21 (19 Months)

- Since Oct 21, Nifty’s rally halted and gone into ‘Consolidation Phase’ till date.

- Recently, in May month Nifty formed a Hammer pattern from the support zone of 15700-16000.

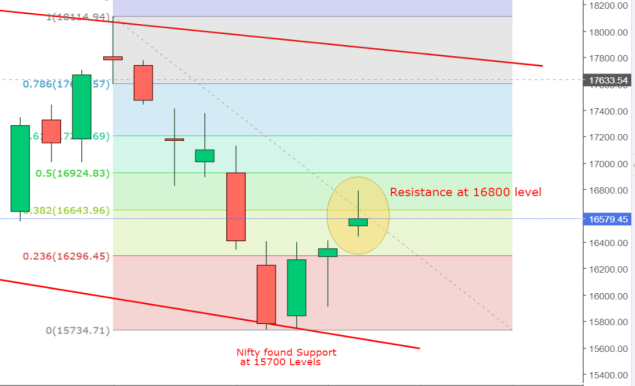

2. Weekly Time-frame Analysis :

- Nifty in a falling range with Lower High – Lower Low formation.

- Found Support at 15700 levels.

- From the support of 15700 levels, Nifty started moving upwards, with 3 green weekly candles.

- However, last week candle forms a Shooting Star pattern at 38.2 Fibonacci level forming resistance at 16800 level.

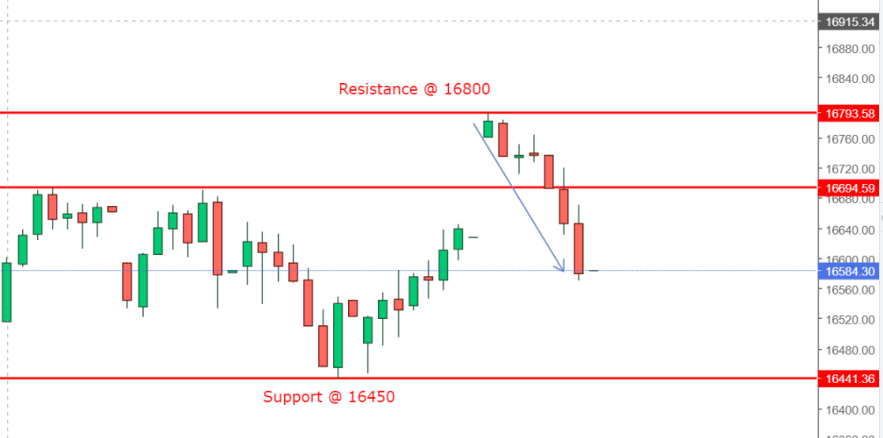

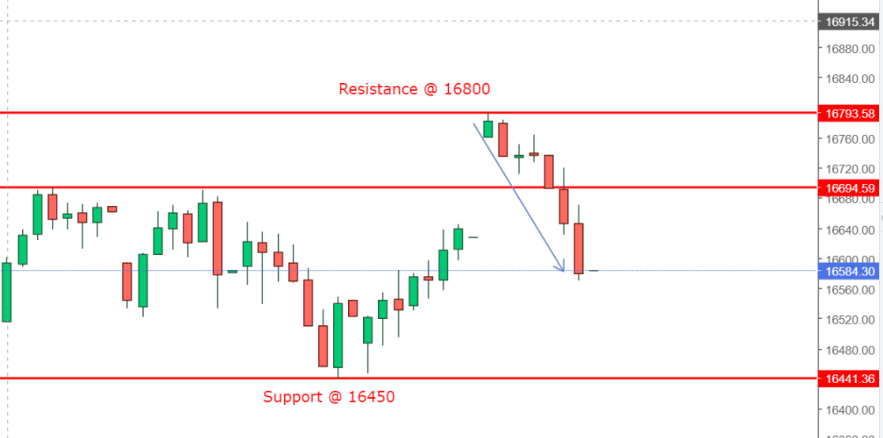

3. Daily Time-frame Analysis :

- Gap of May 05 got filled in past week.

- From the Support of 15700, Nifty formed W pattern and broke the resistance of 16400.

- In Past week, Nifty formed tested 16400 level and moved up-to 16800.

- On Friday, formed a bearish Marubozu candle from the high of 16800.

4. Hourly Time-frame :

- From the tight range of 16450 – 16700, Nifty gave a false breakout and then reversed back from the high of 16800.

Time-frame Analysis Summary:

Monthly – Consolidation phase with Support of 15700.

Weekly – Falling Range with LH-LL formation, took support of 15700 & then Shooting star candle with High of 16800.

Daily – Breakout of resistance level of 16400 with W pattern, with Red Marubozu candle with high of 16800.

Hourly – Impulsive down-move from the high of 16800.

Range for Current Week:

Narrow Range: Support 16400 – Resistance 16800

Broader Range: Support 16000 – Resistance 17200

Possible Scenarios:

- Nifty can moves up to 16700-16800 level and shows weakness and starts falling again.

- Nifty can moves down to 16450 levels and shows support and start moving up.

- Nifty can breaks16800 resistance and can go up to 17200.

- Nifty can breaks 16450 support, can go down to 16000.

- Nifty can be in narrow range.

Possible Strategy:

- Scenario1: Buy ATM Put option or Sell OTM Call Option (with SL)

- Scenario2: Buy ATM Call option or Sell OTM Put Option (with SL)

- Scenario3: Buy ATM Call option or Sell OTM Put Option (with SL)

- Scenario4: Buy ATM Put option or Sell OTM Call Option (with SL)

- Scenario5: Short Strangle (Short Call 16800, Short Put 16400)

- Scenario6: Short Strangle (Short Call 17200, Short Put 16000)

Try Insta Trade

The easiest Options Trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Trade Now