Kotak Special Opportunities Fund is an open-ended equity thematic scheme that aims for long-term capital appreciation by investing in companies undergoing special situations like specific events, restructuring, policy changes, technological disruptions, or temporary challenges launched by Kotak Mutual Fund. The scheme benchmarks its performance against the Nifty 500 TRI. There is no exit load if you redeem or switch up to 10% of your initial investment within a year, but a 1% exit load applies if you redeem or switch more than 10% within the first year. No exit load applies after one year. The minimum investment amount is Rs. 100 for lumpsum and SIP purchases. The NFO opens today June 10, 2024, and closes on June 24, 2024.

The investment objective of the Kotak Special Opportunities Fund is to generate long-term capital appreciation by investing predominantly in opportunities presented by Special Situations such as Company Specific Events/Developments, Corporate Restructuring, Government Policy change and/or Regulatory changes, Technology led Disruption/Innovation or companies going through temporary but unique challenges and other similar instances. However, there is no assurance that the objective of the scheme will be achieved.

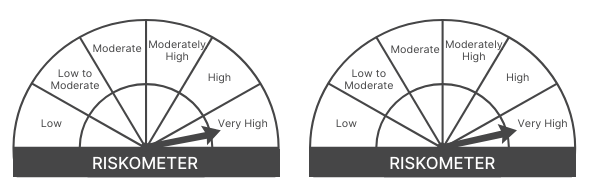

This NFO of Kotak Special Opportunities Fund is suitable for investors who are seeking long term capital growth and investment in a portfolio of predominantly equity & equity-related securities following Special Situation Theme.

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity and Equity Related Securities of special situations theme | Very High | 80 | 100 |

| Equity and Equity Related Securities Other than of special situation’s theme and Overseas Mutual Funds schemes/ETFs /Foreign Securities | Very High | 0 | 20 |

| Debt and Money Market Securities | Low to Moderate | 0 | 20 |

| Units of REITs & InvITs | Very High | 0 | 10 |

The performance of the Kotak Special Opportunities Fund will be benchmarked to the performance of Nifty 500 TRI.

Mr. Devender Singhal – Fund Manager

With over 22 years of industry experience in Indian equity markets, Mr. Devender Singhal has established himself as a seasoned professional. His tenure at Kotak Mahindra AMC spans more than 15 years, during which he has honed his expertise in fund management for over 8 years. Mr. Singhal’s deep understanding of the consumer, auto, and media sectors, cultivated from his previous roles as an analyst, provides him with a comprehensive perspective on market dynamics, contributing to his successful track record in managing funds.

| Scheme Name | AUM (Crore) | Expense Ratio (%) | 1 Year Returns (%) | Since Launch Ret (%) |

| Franklin India Opportunities | 3459.54 | 1.91 | 69.56 | 14.03 |

| HDFC Housing Opportunities | 1430.61 | 2.19 | 57.2 | 13.51 |

| ICICI Pru India Opportunities | 19072.35 | 1.65 | 46.81 | 23.51 |

| Axis Special Situations Fund | 1216.85 | 2.23 | 32.19 | 15.86 |

| Union Innovation & Opportunities Fund | 642.64 | 2.32 | – | 21.23 |

| Nippon India Innovation Fund | 1454.62 | 2.12 | – | 31.76 |

| Category Average | – | – | 44.82 | 25.91 |

| NIFTY 500 TRI | – | – | 35.85 | 12.67 |

Data as of June 7, 2024

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Jun 10, 2024, 5:41 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates