Yesterday marked the deadline for institutional investors (14/11/2023) to disclose their 13F positions as of September 30. Among the notable figures in the financial world, all eyes are on Michael Burry’s Scion Asset Management.

Burry’s Semiconductor Short Position: Burry’s most significant move in the third quarter was the acquisition of puts against 100,000 shares of the iShares Semiconductor ETF (SOXX). This position now constitutes a staggering 47.86% of his 13F portfolio, signalling a pronounced bearish outlook on the semiconductor industry.

![]()

Source: whalewisdom

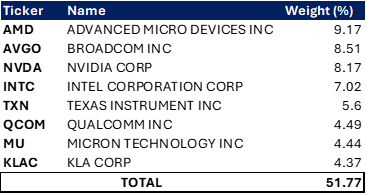

The SOXX ETF includes 30 semiconductor stocks, with major players like AMD, Broadcom, and Nvidia holding substantial weight.

Understanding SOXX Composition: SOXX’s composition provides insights into Burry’s targeted stance. With Advanced Micro Devices (AMD) leading the pack with a weight of 9.17%, followed by Broadcom and Nvidia at 8.51% and 8.17%, respectively, Burry’s puts directly align with a bearish view on these specific semiconductor giants.

Source: iShares ETF

The ETF’s reliance on these stocks makes it a strategic choice for expressing a negative sentiment toward the broader industry.

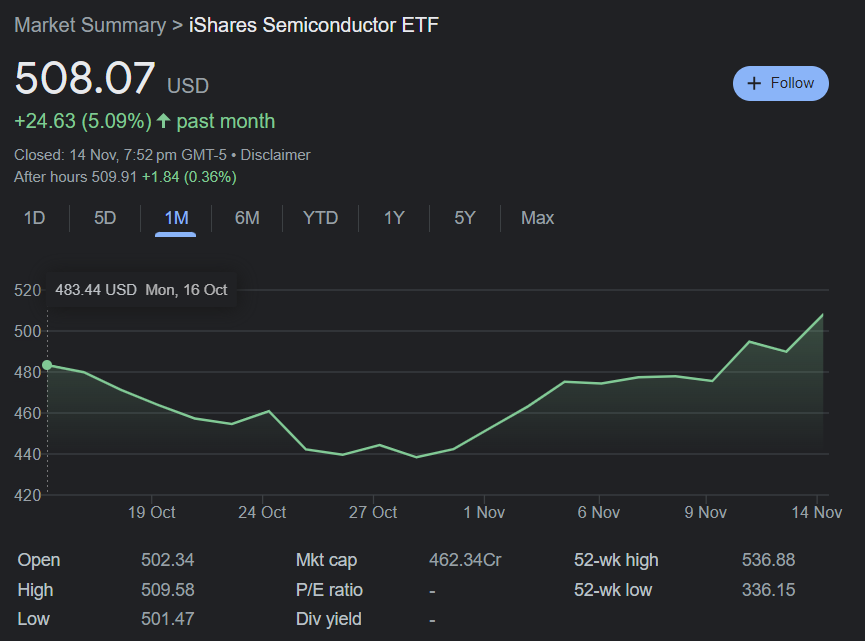

Timing and Potential Losses: The exact timing of Burry’s entry into the semiconductor short is unclear. However, considering SOXX’s 6.5% increase from October 2 to the present date and 5.09% increase in the past month, he might already be facing potential losses.

This move comes amidst a year where semiconductor stocks, particularly Nvidia (NVDA), have witnessed remarkable gains, with NVDA surging nearly 250% year-to-date, driven by the artificial intelligence (AI) revolution.

Portfolio Rebalancing – Closing Previous Positions: Burry’s actions extend beyond the semiconductor sector. In a notable shift, he closed his short positions against the SPDR S&P 500 ETF (SPY) and the Invesco QQQ Trust (QQQ). In the second quarter, his largest positions were puts against 2 million shares of SPY and QQQ. The decision to exit these positions hints at a recalibration of his overall investment strategy, possibly in response to changing market dynamics.

Portfolio Summary:

Source: US SEC, Form 13F (Scion Asset Management, LLC)

Market Performance and Profitability Uncertainty: The market performance of SPY and QQQ during the period from June 30 to the end of September saw declines of about 3.5%. While Burry’s decision to close these short positions may have been influenced by these movements, the exact profitability of these trades remains uncertain. The dynamic nature of the market suggests that the timing of the exit is crucial in determining the ultimate success or failure of these short positions.

As institutional investors scrutinize Michael Burry’s 13F filing, the spotlight is firmly on his bold move against semiconductor stocks. The substantial short position in SOXX reflects Burry’s conviction in the potential downturn of the semiconductor industry, a sector that has thrived on the AI revolution. As the market watches how these bets unfold, only time will reveal the wisdom behind Burry’s latest strategic manoeuvre in the ever-evolving landscape of financial markets.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 15, 2023, 11:40 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates