Warren Buffett’s Berkshire Hathaway Inc. announced its quarterly results for the Financial Year 2023 on Saturday.

As per the company’s report, in Q3 FY23, the company experienced a substantial 21% year-over-year increase in its total revenue, rising from USD 76,940 million to USD 93,210 million. When examining revenue by segment, within the “Insurance and Other” segment, the company reported USD 66,967 million in revenue for the quarter, compared to USD 62,688 million in the same quarter last year, reflecting a 6.8% increase. Notably, revenue from insurance premiums earned saw a significant surge of 13.9% YoY from USD 18,754 million to USD 21,360 million.

In the segment encompassing Railroad, Utilities, and Energy businesses, revenue for the segment increased by 21% year-over-year, rising from USD 76,904 million to USD 93,210 million. Within this segment, utility and energy operating revenue saw a remarkable 212% year-over-year growth, surging from USD 6,090 million to USD 19,033 million.

Rising interest rates boosted yields on Berkshire’s vast US Treasury bill holdings above 5%, while fewer car accidents and a quiet Atlantic hurricane season respectively bolstered the Geico car insurer and reinsurance businesses.

Shifting the attention to the company’s bottom line during the quarter, the net loss expanded significantly, increasing over fourfold from USD 2,798 million to USD 12,767 million.

The results included losses of USD 23,500 million from investments, primarily attributed to a 12% decline in the stock price of Apple, the iPhone maker, in which Berkshire held a stake valued at approximately USD 177,600 million.

Berkshire’s net results show substantial fluctuations from one quarter to another due to accounting regulations that require the reporting of investment gains and losses, even when no buying or selling activity has occurred.

Warren Buffett has been at the helm of Berkshire since 1965. According to Forbes magazine, his net worth of USD 117,500 million ranks fifth globally. In the current year, Berkshire shares have risen by 14%, matching the performance of the Standard & Poor’s 500.

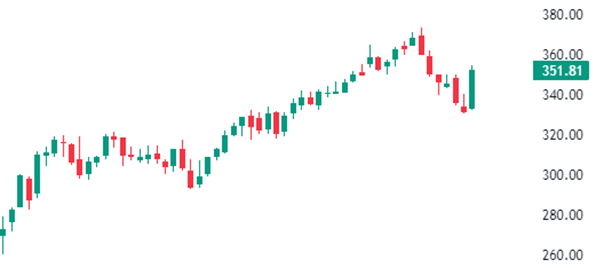

The Berkshire shares concluded the trading session on Saturday at USD 351.81 per share on the New York Stock Exchange, representing a modest 0.80% gain compared to the previous day’s closing price of USD 349 per share. Throughout the session, it reached intraday highs and lows of USD 354.35 and USD 349.79, respectively.

As of the current moment, the company’s market capitalisation stands at USD 767 billion, and the stock has delivered a return of approximately 23% over the past year. Furthermore, the stock is presently trading at a 6% discount from its all-time high price of USD 373 per share.

Disclaimer: This article is intended solely for educational purposes. The securities mentioned are for illustrative purposes and not indicative of recommendations. It is based on information gathered from various secondary sources and is subject to change. Consult with a financial expert before making investment decisions.

Published on: Nov 6, 2023, 1:06 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates