Meaning

Authorised share capital refers to the maximum number of shares that a company is allowed to issue according to its Articles of Association. It's a limit that is set by the company's founders or board of directors, and it can be increased or decreased through a special resolution passed by the company's shareholders.

The authorised share capital of a company is an important aspect of its corporate governance structure. It determines the amount of capital that a company can raise from the sale of its shares and can have significant implications for the company's ability to grow, expand and undertake new business ventures.

Significance of Authorised Share Capital

One of the primary reasons why companies set an authorised share capital limit is to protect the interests of shareholders. By limiting the number of shares that can be issued, the company ensures that its existing shareholders are not diluted by the issuance of new shares. It also helps to maintain a stable ownership structure and prevent hostile takeovers or other unwanted changes in the company's ownership.

Authorised share capital can also have implications for the company's ability to raise capital. If a company's authorised share capital is too low, it may not be able to issue new shares to raise additional capital, which could limit its ability to expand or undertake new business ventures. Conversely, if a company's authorised share capital is too high, it may be seen as a sign of overvaluation or financial instability.

Depending on the jurisdiction, authorised share capital is sometimes also called "authorised stock," "authorised shares," or "authorised capital stock.

Important terms related to authorised Share Capital

Authorised Share Capital is a broad term which can refer to every kind of share a company can possibly issue to raise funds.

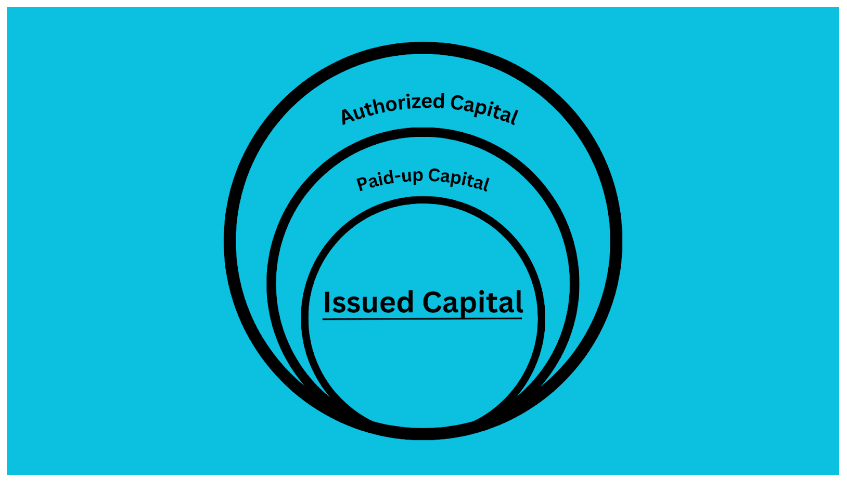

Authorised Share Capital has three components - Subscribed capital, Paid-up Capital and Issued Capital.

Subscribed Capital

When a company releases an IPO, potential buyers who agree to buy shares from the company’s treasury and the calculated capital on this basis is called subscribed Capital. Frequently Foreign Institutional Investors, Domestic Instituional investors and High Net Worth Individuals are the ones who buy substantial amount of shares.

Paid-up Capital

Once the company knows the status of the subscription of shares, it invites the prospective shareholders to pay partial or full amount of the shares. The total money recieved is called the Paid-up capital. In simpler words, the portion of the subscribed capital for which the company has received payment from the subscribers is known as paid-up capital.

Issued Capital

When the company finally issues shares to the shareholders, the money received by it is called Issued Capital. The shares are sold to the shareholders that can be retail investors, instiutional investors, etc. The shareholders can further take the decision wether to hold the shares or sell it off and recieve the money.

Look at the picture attached below to understand it better.

Example of authorised Share Capital.

Imagine a company which is allowed to issue maximum 1,00,000 shares at 10 Rupees each. The authorised share capital will be 10,00,000 Rupees only. Now, the company decides to dilute only 10,000 shares out of it and company invites the interested share holders to pay 5 Rupees per share as a proof of conformance. If all the 10 thousand shares get subscribed, the paid up capital will be 50,000 Rupees. And when the company finally issues all the shares to the shareholders, it will be called as the issued capital.

Final Words

In conclusion, authorised share capital is an important aspect of a company's corporate governance structure. It determines the maximum number of shares that a company can issue, and can have significant implications for the company's ability to raise capital, grow and expand. By setting an appropriate authorised share capital limit, companies can protect the interests of their shareholders, maintain a stable ownership structure, and position themselves for long-term success.Now that you have understood the concept of authorised share capital, open Demat account with Angel One and start building wealth.