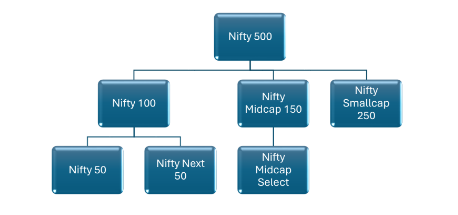

In the dynamic landscape of financial markets, smart asset allocation stands as a cornerstone of successful investment strategies. One avenue for optimising allocation is by delving into the breakdown from the Nifty500 to the Nifty Midcap Select indices. This approach allows investors to gain deeper insights and potentially uncover opportunities within different segments of the market. In this article, we explore how understanding this breakdown can enhance asset allocation decisions and provide a clearer perspective on navigating the complexities of the market. The major Nifty indices can be broken down for easier understanding:

Comparative Sector weights Nifty Next 50 vs. Nifty50 vs. Nifty Midcap Select

| S No | Sector | Nifty Next 50 | Nifty 50 | Nifty Midcap Select |

| 1 | Financial Services | 23.8 | 33.53 | 17.77 |

| 2 | Capital Goods | 11.91 | – | 15.73 |

| 3 | Consumer Services | 11.57 | – | 9.48 |

| 4 | FMCG | 10.62 | 8.15 | – |

| 5 | Oil & Gas; Consumable Fuels | 6.5 | 12.87 | 4.2 |

| 6 | Power | 6.07 | 2.9 | – |

| 7 | Automobile & auto Component | 5.71 | 7.57 | 7.76 |

| 8 | Chemicals | 4.59 | – | 7.48 |

| 9 | Construction materials | 3.9 | 2 | – |

| 10 | Metals & Mining | 3.72 | 3.79 | – |

| 11 | Realty | 3.18 | – | 3.63 |

| 12 | Consumer Durables | 2.98 | 2.92 | 3.49 |

| 13 | Services | 2.79 | 1 | 3.35 |

| 14 | Healthcare | 2.71 | 4.44 | 9.64 |

| 15 | Information Tech. | – | 13.04 | 13.1 |

| 16 | Construction | – | 4.52 | – |

| 17 | Telecommunication | – | 3.25 | 1.43 |

| 18 | Textiles | – | – | 2.93 |

Source: niftyindices.com

It is also interesting to note that, based on the methodology used in index construction, there is no overlap of stocks between the Nifty 50 index, Nifty Next 50 index and the Nifty Midcap Select index. Thus it forms an interesting strategy for asset allocation across different stocks for equity investing.

Once the sectoral allocation has been understood, there are various investment instruments in the form of ETFs, Mutual Funds and index derivative products that can be chosen by the investor to suit their investment goals and risk appetite.

In summary, the Nifty indices provide a comprehensive view of the market cap led broad based view of the Indian stock market by capturing companies of varying sizes and market capitalisation levels.

Published on: Apr 26, 2024, 4:51 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates