March 2024 turned out to be volatile for investors in small and mid-cap companies. A brutal sell-off swept through these segments, leading to significant price swings. This turbulence wasn’t confined to the cash market; it also had a ripple effect on the derivatives segment, the F&O (Futures & Options). Here, we explore how the small-cap and mid-cap meltdown impacted the turnover of the F&O market in March 2024.

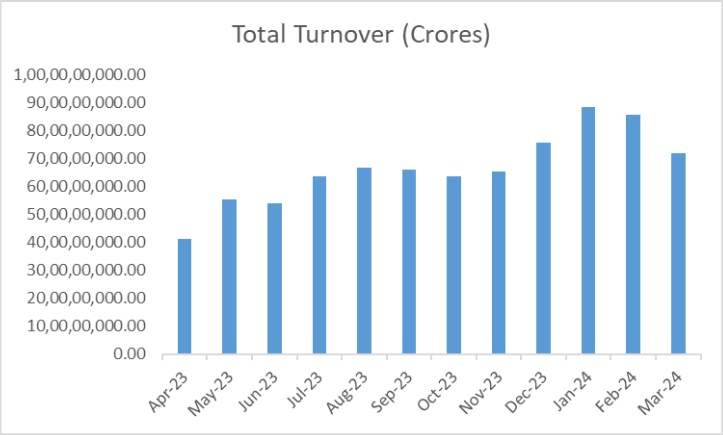

Trading activity in the equity markets experienced a notable decline during March amidst considerable volatility in stock prices. The combined trading turnover for the future and options segment, encompassing the National Stock Exchange (NSE), decreased by 16.01% to Rs 7,218 lakh crore, marking its lowest point since November 2023.

Observers noted that the decline could have been more pronounced were it not for significant block deals observed in companies like ITC, Tata Consultancy Services, and IndiGo throughout the month. Meanwhile, turnover in index options contracts dropped by 25% to Rs 11.27 lakh crore, representing the most substantial month-on-month decrease in F&O turnover since October 2022.

The F&O turnover on the BSE experienced a 2.13% month-on-month decrease to Rs 1,519 lakh crore, while that of the NSE declined by 16.01% to Rs 7,218 lakh crore in March. It looks like attributed losses incurred by several traders to the erratic fluctuations witnessed in stock prices over recent weeks.

During March, the Nifty Small-cap 100 index declined by 4.42% and saw a drawdown of 11.48%, while the Nifty Mid-cap 100 saw a drop of 0.5% and saw a drawdown of 6.29%. In contrast, the benchmark Nifty 50 remained relatively stable, experiencing an increase of 1.57% and a drawdown of 1.24%.

Source: NSE Website

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Apr 1, 2024, 4:32 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates