On Friday, The NSE Nifty 50 index rose by 1.41%, while the BSE Sensex increased by 1.39%, as of 12.30 pm. This uptrend was further reinforced by robust domestic economic growth, with the Indian economy expanding by 8.4% in the October-December quarter, driven by strong performances in manufacturing and construction activities.

Amidst the positive market sentiment, NCC Limited, a key player in construction and infrastructure, has revealed the acquisition of two new contracts worth Rs 1,476.01 crores (excluding GST) in February 2024. One of these contracts, valued at Rs 1,303.70 crores, is related to the Transportation Division, with NCC shares representing 50% of the total order received by the J. Kumar-NCC Joint Venture. Additionally, the company has secured another contract worth Rs 172.31 crores for its Building Division.

The acquisition of these new orders is significant for NCC Limited, representing almost 10% of its current market capitalisation. This substantial inflow of new projects underscores the company’s robust business prospects and strengthens its position in the construction and infrastructure domain.

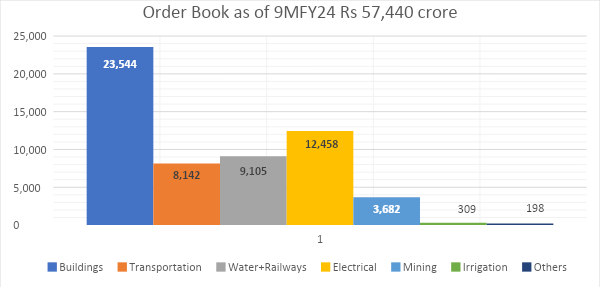

Currently, NCC Limited boasts an impressive order book of Rs 57,440 crores, which is approximately 3.6 times its current market capitalisation. This sizable order book provides solid revenue visibility for the company and underscores its growth potential in the foreseeable future.

NCC Limited, formerly known as Nagarjuna Construction Company Ltd., has evolved from modest beginnings to become a diversified conglomerate in the construction and infrastructure sector. The company’s core focus has always been on delivering projects on time while adhering to the highest quality standards. NCC operates across various business verticals, including Building, Transportation, Water & Environment, Electrical (T&D), Irrigation, Mining, and Railways.

Conclusion:

NCC Limited’s successful acquisition of new orders worth Rs 1476 crores reaffirms its strong market presence and growth trajectory in the construction and infrastructure sector. With a robust order book and a proven track record of execution, NCC is well-positioned to capitalize on emerging opportunities and drive value for its stakeholders in the coming years.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Mar 1, 2024, 4:12 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates