India’s pharmaceutical industry has established itself as a global leader, celebrated for its cost-effective medications and cutting-edge treatments. Known as the “Pharmacy of the World,” India has earned this title by providing affordable, high-quality medicines, including lifesaving HIV treatments and vaccines. With a robust history of over 5,000 years, the industry has transformed from traditional practices to a modern powerhouse.

Since gaining independence in 1947, India’s pharmaceutical sector has undergone remarkable changes. Initially reliant on outdated technology and limited capital, the industry faced numerous challenges. However, the 1980s and 1990s marked a turning point with modernisation and liberalisation efforts.

By the early 2000s, the Indian pharmaceutical sector gained significant momentum due to domestic demand, rising exports, and a strategic focus on generics. India emerged as a leading supplier of affordable medications globally, playing a pivotal role in combating diseases like HIV/AIDS by providing cost-effective treatments.

The industry has evolved into a major player globally, ranking third in drug production by volume and 14th by value. It contributes around 1.72% to India’s GDP. A recent EY FICCI report forecasts that the Indian pharmaceutical market will reach $130 billion by 2030, while the global pharmaceutical market will surpass $1 trillion in 2023.

The Indian government has played a crucial role in revitalising the pharmaceutical sector through various initiatives:

As of August 9, 2024, top pharma companies as per market capitalisation are Sun Pharmaceutical Industries Ltd, Zydus Lifesciences Ltd, and Divi’s Laboratories Ltd have recorded impressive 5-year CAGR of 32.43%, 40.38%, and 23.97%, respectively, underscoring their significant contributions to the industry’s expansion.

Sun Pharma is the largest pharmaceutical company in India, holding over 8% of the domestic market share as of September 2023. The company is also ranked No. 1 by more than 12 different doctor groups. Specialising in complex products, Sun Pharma offers a wide range of therapies and owns 35 of the top 300 pharmaceutical brands in India. Its top 10 brands contribute about 18% of the company’s revenue in India.

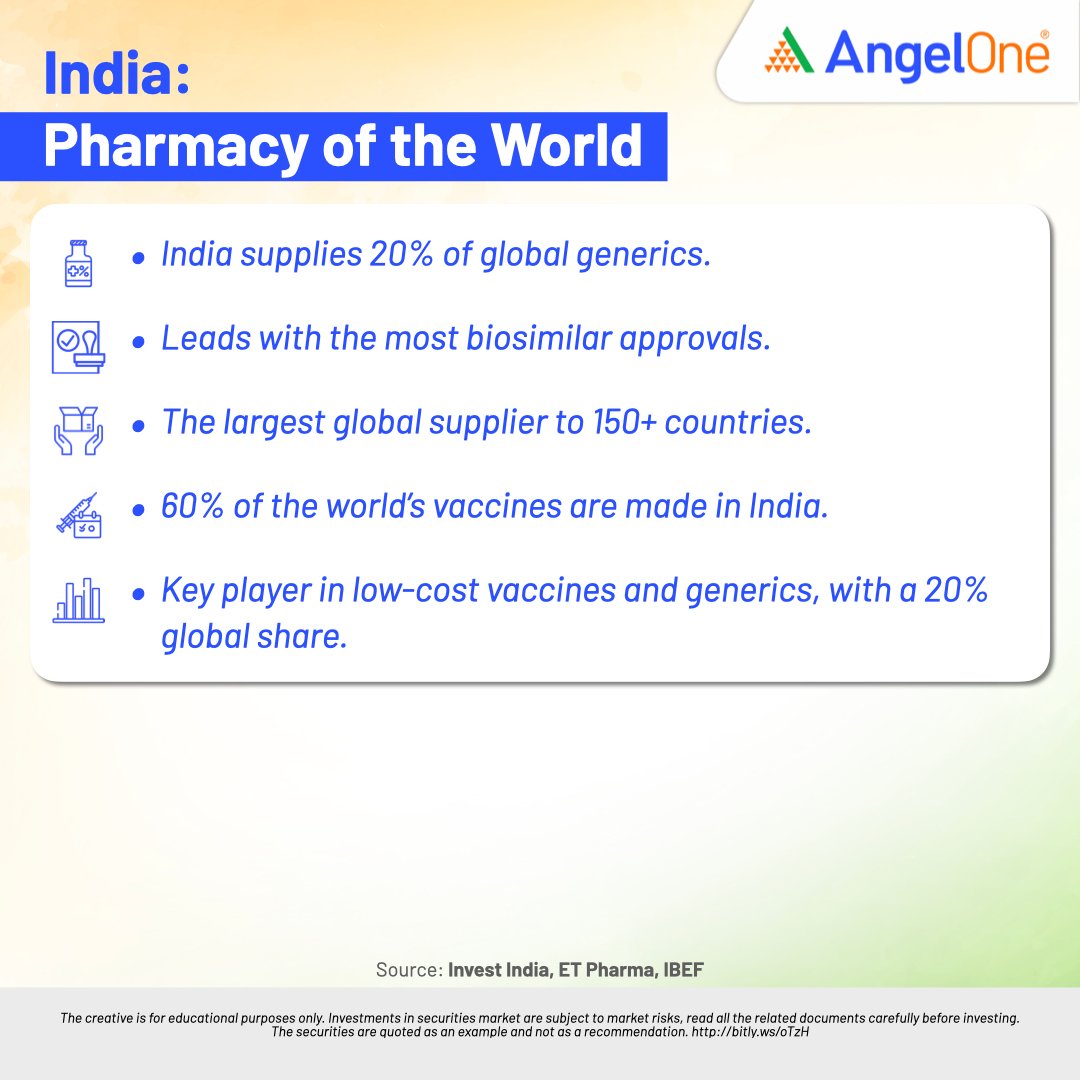

India’s pharmaceutical industry is among the top 10 sectors for foreign investment, exporting to over 200 nations, including highly regulated markets like the USA, West Europe, Japan, and Australia. India is also the world’s largest provider of generic medicines, with generics accounting for 20% of global export volume. The country exported $2.43 billion worth of drugs and pharmaceuticals in April 2024 alone, up from $2.26 billion in April 2023. In FY23, exports stood at $25.36 billion.

Several recent initiatives reflect the government’s commitment to advancing the pharmaceutical sector:

The Indian pharmaceutical market is on a trajectory of significant expansion, with projections indicating that it will reach $65 billion by 2024, $130 billion by 2030, and $450 billion by 2047. Presently, the sector is valued at approximately $50 billion, with more than $25 billion derived from exports. The biotechnology sector, which was valued at $70.2 billion in 2020, is expected to grow to $150 billion by 2025.

Additionally, the medical devices market, currently worth $11 billion, has ambitious targets to reach $50 billion by 2030. Pharmaceutical exports have seen a year-over-year increase of 9.7% in FY24, amounting to $27.82 billion, reinforcing India’s position as a leading global exporter, with generic drugs constituting 20% of global exports.

India’s pharmaceutical sector has evolved from its early days to become a global leader in drug production. The industry is set for continued growth with ongoing government support, strategic investments, and a focus on addressing chronic diseases. As India strengthens its position in global pharmaceuticals, it remains dedicated to providing affordable, high-quality medications worldwide.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 19, 2024, 6:13 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates