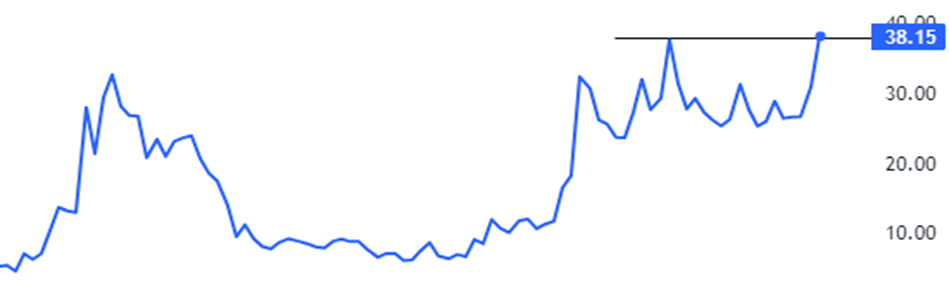

Shares of KM Sugar Mills witnessed a significant surge today. The stock opened trading at Rs 33.90, marking a nearly 1% increase compared to the previous day’s closing price of Rs 33.65 per share on the BSE. Furthermore, it surged by 16.5% during the intraday trading session.

As of writing this article, the stock is trading at Rs 38.75, representing a 14.30% increase from its previous closing price. Moreover, it has reached a 52-week high price of Rs 39.20 per share on the BSE.

With a market capitalisation of Rs 351.44 crore, the stock has demonstrated outstanding performance in recent periods, yielding a 53% return in the last six months. Furthermore, it has generated an impressive multibagger return of 280% over the last three years.

What is more attractive is the chart, where the current month’s candle looks appealing with a full-bodied green candle and significantly high volume, suggesting strong upward momentum in the near future and the potential to explore blue-sky zones.

KM Sugar Mills, a prominent company in the sugar industry, is engaged in the manufacturing of sugar, ethanol (and related products), and power. Its manufacturing units are located in the Ayodhya District of Uttar Pradesh.

The company was originally formed as a partnership firm known as Kamlapat Motilal in Kanpur. The founding partners were the Jhunjhunwalas and Singhanias, and they established a small sugar milling plant in Kanpur in the year 1942. This plant was later relocated to its current site in Faizabad in 1950.

The Sugar Division of the company boasts a crushing capacity of 9,500 tons per day and produces white crystal sugar and raw sugar for both domestic consumption and export. The Distillery division has a capacity of 50 KLPD and manufactures Rectified Spirit, Ethanol, and other related products.

Furthermore, the company operates its own bagasse-based co-gen Power plant with a capacity of 25 MW in Motinagar, Ayodhya, Uttar Pradesh. The company supplies power to the Uttar Pradesh Power Corporation Limited (UPPCL).

In the June quarter of FY24, the company’s revenue from operations experienced a significant increase of 83% YoY, rising from Rs 137 crore to Rs 251 crore. The company reported an operating profit of Rs 27 crore, compared to Rs 11 crore in the corresponding quarter last year, resulting in an operating profit margin of 11%.

Meanwhile, the net profit of the company amounted to Rs 12 crore, marking a magnificent fourfold increase compared to the profit of Rs 3 crore in the corresponding quarter last year. In the last quarter of FY23, the company reported a net profit of Rs 1 crore.

The company’s ROE and ROCE stand at 8.76% and 8.84%, respectively. The shares are trading at a price-to-earnings ratio of 11 times in the market.

Investors should keep an eye on this stock as it appears promising on the chart and could potentially outperform in the future.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 25, 2023, 2:43 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates