Kirloskar Industries is engaged in the business of iron castings, investments (securities and properties), wind power generation, and real estate. The company owns lands, buildings, apartments, and offices in Pune, New Delhi, and Jaipur. It has leased most of these lands, buildings, and offices to the group and other companies on a lease and license basis. Today, the company experienced a significant surge in its share price with a record volume.

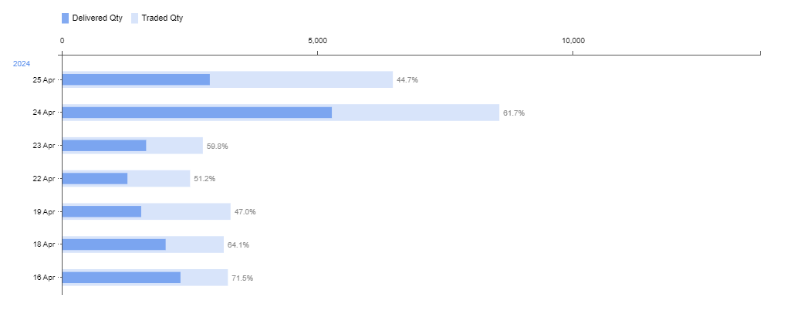

At the start of the day’s trading session, the stock opened at Rs 4399.95 per share, marking an increase compared to the previous day’s closing figure of Rs 4630.15 per share on the BSE. In the course of the intraday trading session, the company’s stock achieved a significant milestone, reaching Rs 5,000 per share for the first time ever. At its peak during the intraday session, it reached an all-time high of Rs 5415.80 per share. As of the latest available data, the stock is currently trading at Rs 5226 per share, showcasing an impressive rally of 14.47% on the BSE. Today, the company’s shares have achieved a record trading volume on the BSE, exceeding its average volumes by over 12 times.

During the COVID market downturn, the stock reached a low price of Rs 398 per share, matching levels last seen in August 2014. From this point, the stock experienced a remarkable rally of approximately 396% over around 450 days, reaching a high of Rs 1974 per share in June 2021. Following this peak, the stock underwent a retracement or pullback phase lasting almost a year. Subsequently, it resumed its upward trajectory, rallying by 342% and reaching significant levels of Rs 5000 per share in around 700 days, as depicted in the provided image.

The company’s current market capitalisation stands at Rs 5188 crore, and the stock has generated a return of 102% in the past year and an impressive return of around 336% in the past three years.

During the December quarter of FY24, the company reported a decline in revenues, registering a 3.28% year-on-year (YOY) decrease, reaching Rs 1554 crore compared to the revenue of Rs 1606 crore in the same quarter last year. The company’s operating profit stood at Rs 228 crore, resulting in an operating profit margin of 15%, compared to Rs 242 crore with the same operating profit margin. Moreover, the company reported a net profit of Rs 105 crore, compared to a net profit of Rs 133 crore in the corresponding period. The net profit margin stood at 6.8% during the quarter.

The company’s ROCE and ROE stands at 13.4% and 8.23% respectively while the shares of the company are trading at a PE of 28.5 times in the market.

Kirloskar Industries Limited is an India-based holding company operating across various sectors, including agriculture, manufacturing, food and beverage, oil and gas, infrastructure, and real estate. Its segments include Wind power generation, Investments (securities and properties), Real Estate, Iron casting, Tube, and Steel. The Wind Power Generation segment includes the sale of its generated wind power units to third-party consumers. The Company has approximately seven wind energy generators in Maharashtra with a total installed capacity of 5.6 Megawatts. The Investments (properties and securities) segment includes investing in group companies, securities, and leasing of properties. The Company is engaged in the manufacturing of iron castings, real estate development, and manufacturing of seamless tubes, cylinder tubes, components, and engineering steels.

Investors should keep this stock on their radar.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Apr 26, 2024, 4:30 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates