ICICI Prudential Mutual Fund has introduced the ICICI Prudential Nifty200 Value 30 ETF, an open-ended index Exchange-Traded Fund (ETF) that tracks the Nifty200 Value 30 Index. This smart beta product uses a factor-based strategy, designed to provide value-driven investments at a low cost. The New Fund Offer (NFO) opens on September 30, 2024, and will remain open until October 14, 2024.

The Nifty200 Value 30 Index is composed of 30 companies selected from the Nifty 200 Index, based on a proprietary ‘Value Score.’ This score takes into account several valuation metrics, making it an ideal tool for value-conscious investors. The index focuses on companies with strong long-term growth potential, offering a well-rounded exposure to the market.

The Nifty200 Value 30 Index covers a diverse set of sectors including Financial Services, Oil & Gas, Metals & Mining, Power, Construction Materials, Chemicals, and Telecommunication. This exposure adjusts based on the value score, ensuring the portfolio remains aligned with market conditions and opportunities.

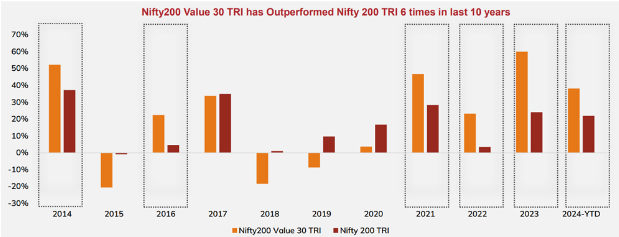

Historically, the Nifty200 Value 30 Total Returns Index (TRI) has outperformed the broader Nifty200 TRI six times in the last decade, underscoring the effectiveness of value investing during certain market phases.

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 27, 2024, 1:27 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates