Shares of Shreyas Shipping and Logistics Limited witnessed a significant surge today. The stock opened trading at Rs 350.95, which was almost flat compared to the previous day’s closing price of Rs 351.45 per share on the BSE. Despite the flat opening, it surged by 20% today.

During the intraday session, the stock not only hit the upper circuit limit of 20% but also reached a 52-week high price of Rs 421.70 per share. Finally, the stock concluded the day at Rs 421.70 apiece on the BSE.

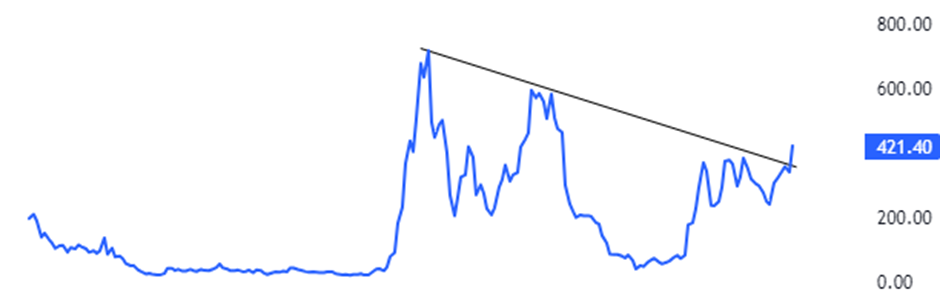

What’s more, it has broken out from the downward-sloping trendline that started in July 2015, where it faced resistance three times on the same trendline and fell back. Today, it broke through decisively with significant volumes and a bullish candle.

Furthermore, it has been struggling to cross and close above approximately Rs 380 since 2021. While the month is yet to complete, looking at the bullish monthly candle, it is unlikely to reverse from here, but the future is always uncertain, and the market is supreme.

With a market capitalization of Rs 925 crore, the stock has demonstrated outstanding performance in recent periods, yielding an 86% return in the last six months. Furthermore, it has generated an impressive multibagger return of 600% over the last three years.

If we observe the daily candlestick chart of the company’s stock, it is evident that it engulfs more than 10 previous days’ candles on the daily timeframe, depicting significant bullishness on the chart.

Here is the chart presentation of the company’s shares on the monthly timeframe:

Established in 1994, Shreyas Shipping & Logistics Limited is India’s first container feeder-owning and operating company. The company owns and operates vessels for container feeder operations between Indian and international container trans-shipment ports and has diversified into logistics, transportation, warehousing, and distribution services.

In the June quarter of FY24, the company experienced a significant decline in revenue from operations, with a year-on-year decrease of 53%, dropping from Rs 150 crore to Rs 71 crore. The company reported an operating profit of Rs 7.4 crore, compared to Rs 85.55 crore in the corresponding quarter of the previous year, resulting in an operating profit margin of 11.4%.

Meanwhile, the company’s net profit amounted to Rs 1.3 crore, compared to a profit of Rs 73.56 crore in the corresponding quarter of the previous year. In the last quarter of FY23, the company reported a net profit of Rs 18 crore.

The company’s Return on Equity (ROE) and Return on Capital Employed (ROCE) stand at 18.8% and 25%, respectively. The price-to-book value ratio is 1.13 times, and the shares are trading at a price-to-earnings ratio of 7.4 times in the market.

Analysing the company’s quarterly results, they are not impressive and do not meet expectations. However, on the chart, it has broken out from a major trend line that has been established since 2015, and looking at the candle, it appears promising. Investors who want to invest long-term can wait for the company to announce its September quarter results.

Investors can keep this stock on their radar.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 26, 2023, 6:28 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates