Coffee Day Enterprises’ shares experienced a significant surge today. The trading began at Rs 39.01, remaining unchanged from the previous day’s closing price. During the intraday session, the stock demonstrated a substantial 18% surge, accompanied by significant trading volume.

Upon analysing today’s share volumes, it’s evident that there has been a considerable increase of over 7.5 times in trading volumes in comparison to its average volumes on the BSE. At the time of writing this article, the company’s shares have risen by Rs 5.75, equivalent to a 14.70% increase, and are currently trading at Rs 44.75 each on the BSE.

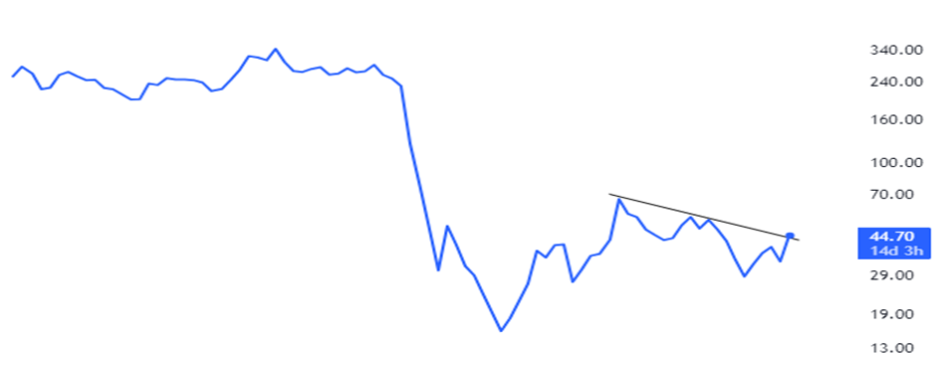

The stock’s 52-week high and low stand at Rs 73.50 and Rs 26.40, respectively. With a market capitalization of Rs 945 crore, the stock has demonstrated impressive performance in recent periods, yielding an outstanding 24% return in just one week. However, the company’s historical performance indicates that it has not generated an impressive return over a longer time horizon.

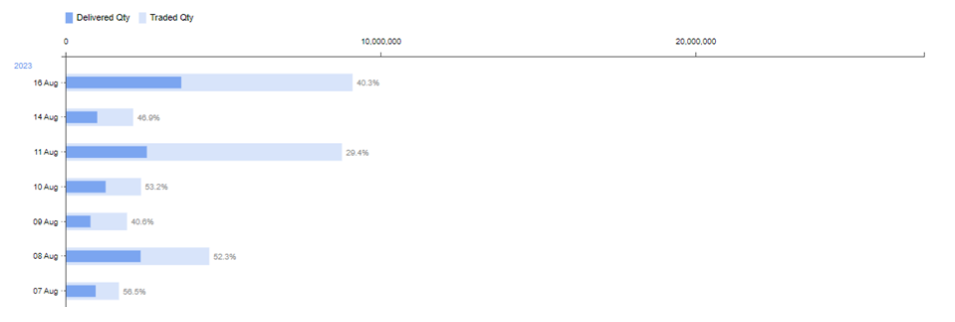

Below are the daily trading and delivery volumes of the shares in both NSE and BSE:

Financial Performance

The company released its June quarter results on August 14. The revenue from operations saw a YoY increase of 17.5%, rising from Rs 210 crore to Rs 247 crore. The operating profit showed growth from Rs 23 crore to Rs 47 crore; however, on a sequential basis, it decreased from Rs 52 crore to Rs 47 crore. The operating profit margin stood at 19%, a rise from the previous 11% during the same period last year.

In contrast, the net profit of the company reached Rs 23 crore, in contrast to a net loss during the corresponding period last year. The net profit margin stood at 9.3% in Q1 FY24.

As of now, the company’s return on capital employed (ROCE) and return on equity (ROE) remain negative. The book value of the company stands at Rs 152, implying that the stock is trading at a Price-to-Book value of 0.3 times in the market.

Business Overview

Coffee Day Enterprises Ltd is the holding company of the Coffee Day Group. The Group is in the business of coffee retail and exports, hospitality, and consultancy services. This is the flagship business of the company handled by the company’s subsidiary Coffee Day Global Ltd. Its flagship cafe chain brand Cafe Coffee Day (CCD) presently owns & operates approximately 495 cafes in 158 cities and 285 CCD Value Express kiosks. 38,810 vending machines dispense coffee in corporate workplaces and hotels under the company’s brand.

Here is the chart presentation of the company’s shares on the monthly time frame:

Published on: Aug 17, 2023, 3:05 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates