This strategy is an excellent choice for long-term investors, offering a disciplined and low-risk approach that suits investors of all risk appetites, helping them stay the course and avoid emotional decisions in the stock market

The Nifty 50 index and NiftyBees are essential investment products in the Indian stock market. The Nifty 50 index represents a basket of the 50 largest and most liquid stocks listed on the National Stock Exchange of India (NSE).

NiftyBees, an exchange-traded fund (ETF), closely tracks the Nifty 50 index, exhibiting a high correlation between them. This correlation makes NiftyBees a convenient means for investors to access the Nifty 50 index, allowing them to buy and sell NiftyBees units on the NSE or BSE just like regular stocks.

Now, let’s delve into the Nifty 50 Investment on Dips strategy:

This strategy capitalizes on the 100-week simple moving average (SMA) of the Nifty 50 index, viewing it as a pivotal support level. When the Nifty 50 touches its 100-week SMA, investors buy NiftyBees units, gaining exposure to a diversified basket of Indian stocks.

The beauty of this strategy lies in its discipline. Investors follow a simple rule—buy NiftyBees whenever Nifty 50 touches its 100-week SMA, irrespective of market conditions. This disciplined approach mitigates emotional investing and fosters consistent returns over the long term.

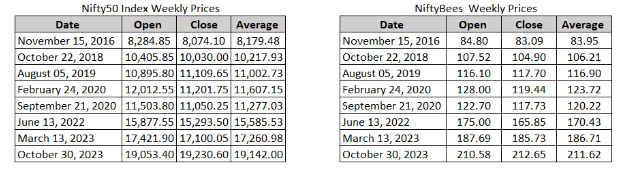

The following table shows the dates on which Nifty 50 touched its 100-week SMA and the average price of Nifty Bees units on those dates. The Nifty 50 SIP with Weekly SMA 100 strategy has been backtested over the past 7 years, and it has generated a positive return over the period. This suggests that the strategy has the potential to generate positive returns for investors over the long term.

| Particulars | Amount (Rs) |

| Investment on Dips | 1,00,000.00 |

| Number of Shares bought till date | 5,750.70 |

| Average price of Investment (weighted) | 121.72 |

| Total Investment | 7,00,000.00 |

| Price as of October 30, 2023 | 211.62 |

| Investment worth now | 12,16,933.77 |

| Returns in percentage | 73.85% |

Over the past seven years, the Nifty 50 SIP with Weekly SMA 100 strategy has shown the potential to generate positive returns for investors. As of October 30, 2023, an investment of Rs 7,00,000 has grown to Rs 12,16,933.77, yielding a return of 73.85%.

The NiftyBees SIP with Weekly SMA 100 strategy, which started in November 2016, has provided an average annual return of approximately 8.22%, turning the Rs 7,00,000 investment into Rs 12,16,933.77 with a 73.85% return.

This strategy is an excellent choice for long-term investors, offering a disciplined and low-risk approach that suits investors of all risk appetites, helping them stay the course and avoid emotional decisions in the stock market.

Now, envision the path towards fulfilling your dreams, like the “European Adventure.” Imagine embarking on “The European Adventure” using the money strategically invested in this 100 SMA strategy, Picture embarking on a 7-day escapade for two to the enchanting landscapes of Europe. Your journey could involve strolling through the romantic streets of Paris, experience the Eiffel Tower, Montmartre’s charm, and French cuisine. Explore Rome’s Colosseum, Vatican artistry, and sip espresso. In Barcelona, marvel at Gaudí’s architecture, savor tapas, and watch the sunset on Barceloneta Beach. Seven days of unforgettable exploration. Savoring the historical treasures of Rome, or relishing the alluring vibes of Barcelona.

A typical 7-day European tour for two costs around Rs 2.5 lakh, covering flights, accommodations, cuisine, and activities. With the Nifty 50 Investment on Dips strategy, your financial prudence can transform these dreams into cherished realities.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 6, 2023, 6:32 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates