In the world of stock investing, there’s a term that every ambitious investor aspires to understand and achieve – ‘multibagger.’ It’s a term that symbolizes the pinnacle of success, where an investment multiplies many times over.

Peter Lynch once said, ‘Know what you own, and know why you own it.’ In this case, it’s a stock that not only defied the odds but also lived up to Lynch’s belief in the power of smart investing. Join us as we unlock the secrets behind KPIT, the IT powerhouse that transformed into a tenbagger, outperforming even the wildest expectations in the ever-evolving world of technology investments.

KPIT Technologies, a global tech leader, specializes in embedded software, artificial intelligence (AI), and digital solutions, propelling mobility into an autonomous, clean, smart, and interconnected future. With a global team of over 6,000 dedicated ‘Automobelievers,’ KPIT works alongside industry leaders, establishing a significant presence in Europe, the United States, Japan, China, Thailand, and India. Their mission is to accelerate the adoption of next-gen mobility technologies

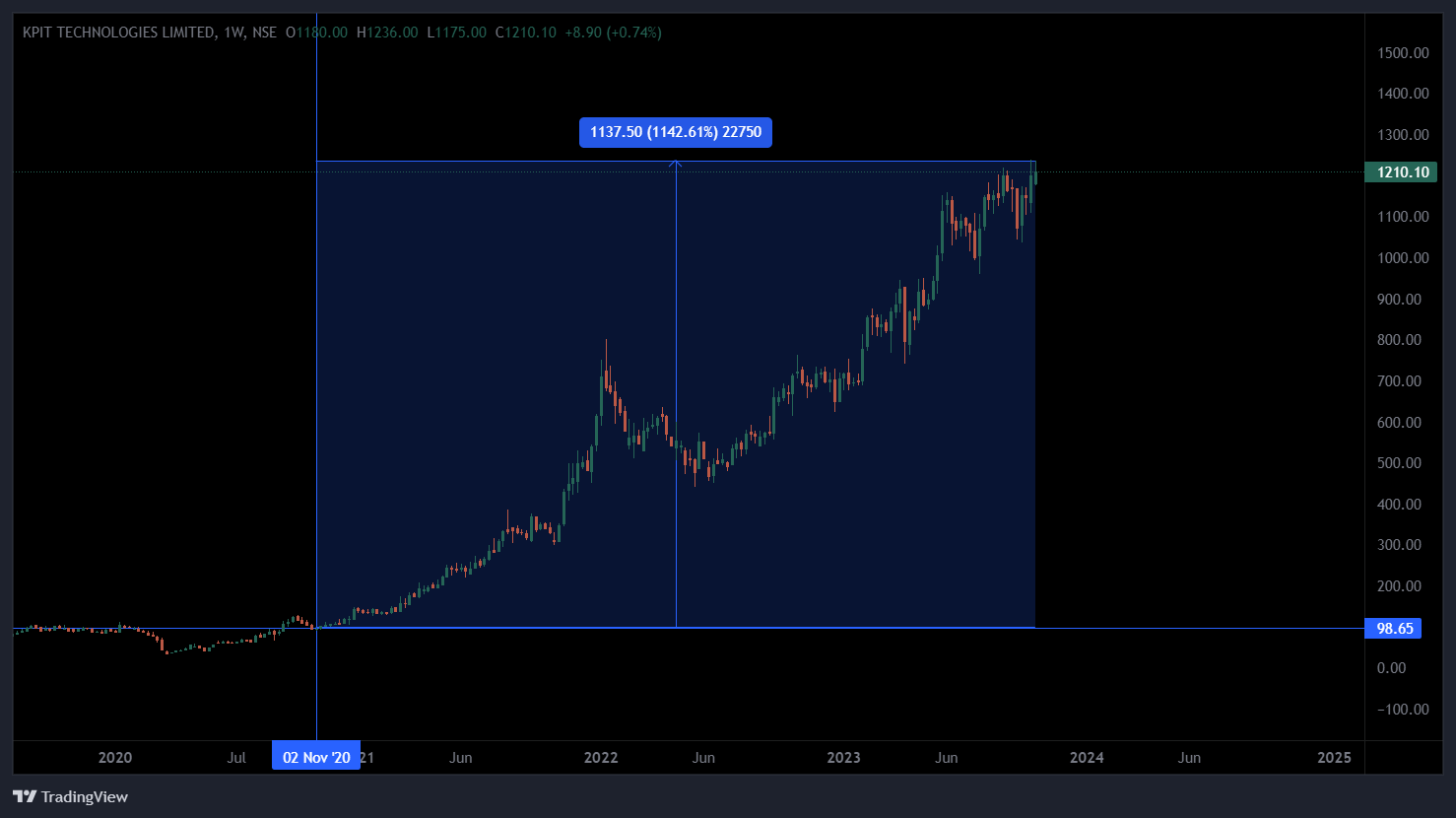

Investment Horizon: 02-Nov’20 to 20-Oct’23

Returns: 1142.61%

Imagine investing a humble sum of Rs. 1,00,000 in stock priced at just Rs. 98.65. Fast forward three years, and you find yourself gazing at a stock price of Rs. 1,200. It’s a financial journey that can turn heads and capture the imagination. In this tale of financial wizardry, your initial investment has grown into a substantial Rs. 12,16,700, an almost magical transformation. That’s a jaw-dropping return of Rs. 11,16,700 – the stuff investors dream about.

It’s the kind of story that reminds us why the world of stocks and investments can be so captivating. And it’s also a reminder that in the world of finance, incredible opportunities do exist, just waiting to be discovered.

| KPIT Technologies (Rs. Crore) | ||||

| Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| Sales | 2,156 | 2,036 | 2,432 | 3,365 |

| Expenses | 1,866 | 1,729 | 1,981 | 2,732 |

| Operating Profit | 290 | 307 | 451 | 633 |

| KPIT Technologies (Rs. Crore) | ||||

| Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| Net Profit | 148 | 147 | 276 | 387 |

| EPS in Rs | 5.38 | 5.33 | 10 | 13.9 |

| EPS growth | -0.9% | 87.6% | 39.0% | |

| KPIT Technologies (Rs. Crore) | ||||

| Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| OPM % | 13% | 15% | 19% | 19% |

| NPM | 6.9% | 7.2% | 11.3% | 11.5% |

| KPIT Technologies | ||||

| Mar-20 | Mar-21 | Mar-22 | Mar-23 | |

| FA (% to Total Assets) | 32.1% | 29.3% | 27.4% | 50.4% |

| IA (% to Total Assets) | 6.1% | 5.2% | 7.2% | 30.3% |

In our exploration of KPIT Technologies’ future prospects, we dive into their strategic moves. The company has set its sights on expansion and innovation, with the acquisition of a majority stake in PathPartner, specializing in advanced technology. Additionally, they’ve invested in Future Mobility Solutions (FMS), a key player in autonomous driving and vehicle safety. Last year, they made a significant move by acquiring four entities from Technia Group, leaders in automotive system prototyping technology, for a total consideration of Rs 640 crore.

In conclusion, the remarkable journey of KPIT Technologies serves as a beacon of hope for investors seeking multibagger opportunities in the dynamic world of stocks. From its humble beginnings to a 1000% surge in just three years, KPIT’s success story reflects the potential of well-timed investments and an eye for transformative technologies.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Oct 20, 2023, 4:02 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates