Shares of Abhinav Capital Services witnessed a significant surge today. The stock commenced trading at Rs 135, marking a 2.2% increase compared to the previous day’s closing price of Rs 132. During the intraday session, the stock exhibited a remarkable 20% surge accompanied by significant trading volume.

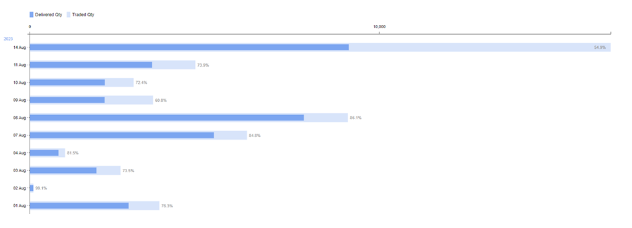

Upon scrutinising today’s share volumes, it becomes apparent that there has been a substantial increase of over 2.95 times in trading volumes compared to its average volumes on the BSE. As of writing this article, the shares of the company are up by Rs 26.41 which is 20% and are trading at Rs 158.48 each on the BSE.

The stock’s 52-week high and low are Rs 158.48 and Rs 68.30, respectively. Possessing a market capitalisation of Rs 110 crore, the stock has showcased outstanding performance in recent periods, yielding a remarkable 63% return in the last months and an impressive 368% return in the past two years.

In the June quarter of FY24, the company’s revenue from operations experienced a decline of 17.40% YoY, going from Rs 7.99 crore to Rs 6.60 crore. The operating profit of the company fell from Rs 7.77 crore to Rs 6.31 crore and on a sequential basis it increased significantly from Rs 2.26 crore to Rs 6.31 crore, the operating profit stood at 95.61%.

Whereas the net profit of the company amounts to Rs 5.28 crore, the net profit margins stood at 80% in Q1 FY24.

The company’s return on capital employed (ROCE) and return on equity (ROE) are at 23.2% and 18.1%, respectively. The Book value of the company is Rs 93 which means the stock is trading at Price to book value of 1.7 times in the market, whereas the price-to-earnings ratio is 12.8 times.

Abhinav Capital Services Ltd, a finance company based in India, primarily specializes in loan financing. It was incorporated on 8th December 1994 in Mumbai. The company extends financial assistance in the form of upfront capital, short-term loans, and alternative funding to corporations, corporate entities, and partnerships. Furthermore, the company allocates funds for investments in stocks and securities. The primary revenue source for the company is the interest accrued from the loans it disburses.

Keep a close eye on this scrip for the upcoming sessions!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Aug 16, 2023, 2:57 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates