What is futures?

A futures contract is an agreement between two parties to buy or sell an asset at a certain time in future at a certain price. These are basically exchange traded, standardized contracts. The exchange stands guarantee to all transactions and counterparty risk is largely eliminated. The buyers of futures contracts are considered having a long position whereas the sellers are considered to be having a short position. It should be noted that this is similar to any asset market where anybody who buys is long and the one who sells in short.

The standardized items in a futures contract are :

- Quantity of the underlying

- Quality of the underlying

- The date and the month of delivery

- The units of price quotation and minimum price change

- Location of settlement

Why should you do Futures trading?

Futures Trading will be of interest to the following type of traders :

- The one who develops a view on the market movements and buys/sells accordingly

- The one who wishes to hedge risks of changing market prices of underlying assets

- Since the investor is required to pay a small fraction of the value of the total contract as margins, trading in Futures is a leveraged activity since the investor is able to control the total value of the contract with a relatively small amount of margin

Thus the Leverage enables the traders to make a larger profit (or loss) with a comparatively small amount of capital.

What are advantages and disadvantages of using futures?

Futures Contracts - Advantages

- Pay less commission for trade activities using futures investments compared to other investment choices

- They are financial instruments that provide high liquidity

- Futures Contract let’s you reverse your reverse your position and allows you to open short or long positions

- They provide a high leverage in order to gain maximum gains with limited investments

Futures Contracts - Disadvantages

- Some investment strategies can lead to high risks due to the leverage provided by future contracts

- It usually follows set standards for defined amounts and terms giving less flexibility options in investing

- Only partial hedging is facilitated by Future Contracts

- The consequence of low commission charges can be over-trading by traders

What is payoff profile?

The payoff graph for futures displays a linear or symmetrical style. This means there are infinite possibilities for getting profits and losses through futures.The payoffs can get interesting when merged with options and the underlying assets.

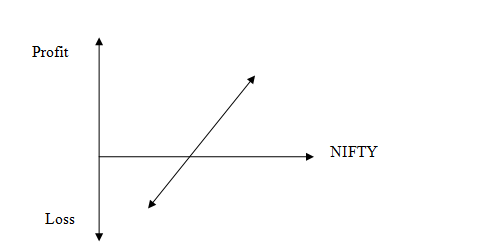

Payoff for buyer of futures: Long futures

The payoff for a person who buys a futures contract is similar to the payoff for a person who holds an asset. He has a potentially unlimited upside as well as a potentially unlimited downside.

Take the case of a speculator who buys a two-month Nifty index futures contract when the Nifty stands at 8700.

The underlying asset in this case is the Nifty portfolio. When the index moves up, the long futures position starts making profits, and when the index moves down it starts making losses.

The figure above shows the profits/losses for a long futures position. The investor bought futures when the index was at 8700. If the index goes up, his futures position starts making profit. If the index falls, his futures position starts showing losses.

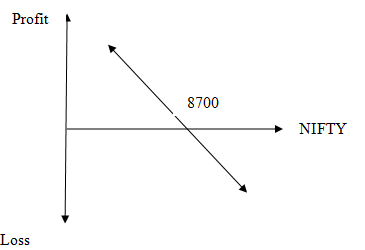

Payoff for seller of futures: Short futures

The payoff for a person who sells a futures contract is similar to the payoff for a person who shorts an asset. He has a potentially unlimited upside as well as a potentially unlimited downside. Take the case of a speculator who sells a two-month Nifty index futures contract when the Nifty stands at 8700. The underlying asset in this case is the Nifty portfolio. When the index moves down, the short futures position starts making profits, and when the index moves up, it starts making losses.

The figure shows the profits/losses for a short futures position. The investor sold futures when the index was at 8700. If the index goes down, his futures position starts making profit. If the index rises, his futures position starts showing losses.