WhiteOak Capital Mutual Fund launched the WhiteOak Capital Special Opportunities Fund, an open-ended equity thematic scheme that invests in opportunities arising from special situations. These situations could include corporate restructuring, government policy changes, technological disruption, new trends, emerging sectors, or temporary challenges faced by companies or sectors. The fund aims for long-term capital appreciation by capitalizing on these situations. The New Fund Offer (NFO) is open for subscription from May 15th to May 29th, 2024. There is no entry load, but an exit load of 1% applies if units are redeemed within 1 month from allotment. The minimum investment amount is Rs 100.

The primary objective of the WhiteOak Capital Special Opportunities Fund is to generate long-term capital appreciation by investing in opportunities presented by special situations such as corporate restructuring (including mergers & acquisitions etc.), government policy and/or regulatory changes, technology-led disruption and innovation, new trends, new & emerging sectors, companies/sectors going through temporary unique challenges and other similar instances.

This NFO of WhiteOak Capital Special Opportunities Fund is suitable for investors who are seeking long-term capital appreciation and investment predominantly in equity & equity-related instruments of special situations theme. Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

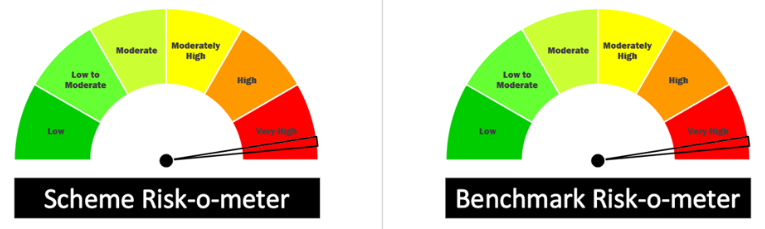

Risk-o-meter:

| Types of Instruments | Risk Profile | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

| Equity & Equity related Instruments of Special Situations theme | Very High | 80 | 100 |

| Equity & Equity related Instruments of other companies | Low to

Moderate |

0 | 20 |

| Debt Securities and Money Market Instruments | Moderately High | 0 | 20 |

| Units issued by REITS and InVITs | High | 0 | 10 |

The performance of the WhiteOak Capital Special Opportunities Fund is benchmarked against the S&P BSE 500 TRI.

Mr. Dheeresh Pathak, aged 41, brings over 16 years of extensive experience in the financial market, specializing in equity. Armed with a B. Com and CA qualification, his expertise lies in navigating the intricacies of equity investments with precision and insight.

Ms. Trupti Agrawal, aged 38, serves as an Assistant Fund Manager in equity, boasting a collective experience of around 15 years. With a solid foundation in B. Com and CA, she adeptly supports fund management activities, leveraging her comprehensive understanding of market dynamics and investment strategies.

Mr. Piyush Baranwal, aged 38, holds a Bachelor of Engineering, PGDBM, and has cleared all three levels of the CFA examination. With over 14 years of experience, he specializes in managing debt securities, bringing a unique blend of analytical rigor and strategic acumen to optimize returns and mitigate risks in debt investments.

| Scheme Name | Launch Date | AUM (Crore) | Expense Ratio (%) | Returns as on – 14-05-2024 in % | ||||

| 2024 | 2023 | 2022 | 2021 | 2020 | ||||

| Tata Housing Opportunities Fund Reg Gr | 02-09-2022 | 565.65 | 2.35 | 3.81 | 39.16 | – | – | – |

| ICICI Prudential Housing Opportunities Fund Gr | 18-04-2022 | 2561.04 | 2.01 | 6.39 | 30.61 | – | – | – |

| HDFC Housing Opportunities Reg Gr | 06-12-2017 | 1430.61 | 2.19 | 9.25 | 39.17 | 13.13 | 29.95 | 2.95 |

| Taurus Ethical Fund Reg Gr | 06-04-2009 | 172.95 | 2.45 | 9.36 | 28.4 | -2.32 | 28.88 | 28.14 |

| Baroda BNP Paribas Business Cycle Fund Reg Gr | 05-09-2021 | 519.66 | 2.45 | 9.38 | 30.98 | 1.44 | – | – |

| Union Innovation & Opportunities Fund Reg Gr | 06-09-2023 | 642.64 | 2.32 | 9.42 | – | – | – | – |

| ICICI Pru India Opportunities Cum | 05-01-2019 | 19072.35 | 1.65 | 10.03 | 36.19 | 19.53 | 49.29 | 7.3 |

| Franklin India Opportunities Gr | 05-02-2000 | 3459.54 | 1.91 | 17.57 | 53.56 | -1.86 | 29.65 | 27.34 |

| Equity: Thematic-Others | – | – | – | 10.06 | 31.11 | 2.04 | 40.19 | 22.16 |

Data as of May 14, 2024

Dreaming of financial freedom? Use our Mutual Fund SIP Calculator to see how regular investments can add up to grow wealth. Take the first step towards your goals. Calculate now!

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: May 15, 2024, 11:51 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates