Today, broader indices closed today’s session in the green with a bullish sentiment. During the second half RBI also announced its decision to discontinue the I-CRR, which also supported the market’s closure in the green.

Now, focusing on the Nifty50 index, it opened at 19,775, marking a 0.24% increase compared to its previous day’s closing level of 19,727. It began the day with a red candle on the five-minute timeframe, which looks like a bullish hammer candle, suggesting that buyers are showing significant interest in pushing the market higher, despite it having already experienced a strong run-up.

Although the momentum was not so strong, and after reaching a high of 19,793, it fell below the low of the first five-minute candle and created an intraday low of 19,727, which thankfully became the intraday low for the day.

From this low level, it recovered all its losses and surpassed the day’s high around 11:30 AM. After crossing the day’s high, it struggled to maintain its upward pace and started consolidating, trading in a range with an upper boundary at 19,840 and a lower boundary at 19,800.

Around 2:10 PM, it broke out of this range and rallied approximately 30 points, creating a final intraday high of 19,867. However, it eventually failed to sustain the rally and fell back inside the range.

Finally, the Nifty50 closed its session inside the range at 19,820, which is 93 points higher or 0.47% up from its previous day’s closing level.

Calculating the difference between today’s high and low, we find that it traded within a range of 140 points. If we observe today’s candle, although the colour is green, it has wicks on both sides, which doesn’t look promising compared to the previous day’s candle. Surprisingly, Nifty50 has closed in the green every day this week.

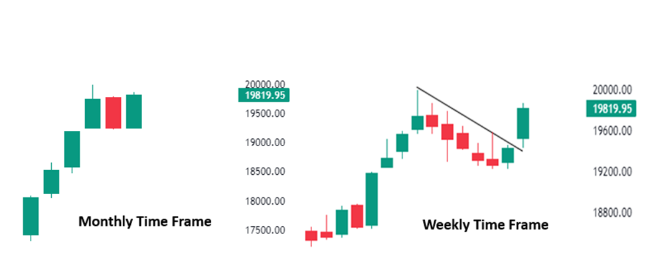

Turning to the weekly data, the Nifty opened the week at 19,525, reached a high of 19,867, a low of 19,433, and closed the week in the green at 19,820. This closing value is 385 points or 1.98% higher than the previous week’s closing level.

As for the current weekly candle, it is a robust green bar that closed on the upper side of the range, showcasing a significant breakout of the continuation pattern, with every day ending in the green.

Looking at the monthly candle, within just six trading sessions, Nifty50 surpassed last month’s high of 19,796 and even closed above it.

The Relative Strength Index (RSI) stands at 66.71 on the daily timeframe, while on the weekly and monthly timeframes, it stands at 69.31 and 66.80, respectively. On higher timeframes, the RSI has improved.

Furthermore, the Nifty50 has closed above all key moving averages, including the 20-day, 50-day, 100-day, and 200-day averages, on the daily timeframe.

Considering the current weekly expiry set for September 14, the Call Open Interest is approximately 13.52 lakhs, while the Put Open Interest stands at 17.25 lakhs. Significant open interest is observed at the 19,900 and 20,000 Call strike prices. On the Put side, substantial open interest is noted at the 19,600 and 19,600 strike prices, suggesting that these levels may serve as immediate resistance and support for the upcoming expiry.

The Put Call Ratio (PCR) currently stands at 1.27, according to data from the National Stock Exchange.

Market participants are expecting the Nifty50 to surpass the 20,000 level with this G20 meeting. Looking at the weekly closing, it will probably be surpassed in the upcoming week. However, for that, we need to wait patiently for the opening of the market next week.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 8, 2023, 8:24 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates