Nifty snapped its three-day gains and retreated from the historic high touched the previous week, falling a third of a percent. Profit booking was in line with expectations given the rally since the beginning of the current month.

Godrej Consumer Products (GODREJCP) – 993.70, down by 0.83% on Monday.

The Godrej Consumer Products Stock has broken the parallel supports and entered into a decisive downtrend, forming a series of strong, bearish candles. It is trading below all key moving averages, with all moving averages in a downtrend, including the Moving Average ribbon. The stock is 3.42% below the 50DMA and 2.20% below the 20DMA. The MACD has given a fresh bearish signal below the zero line, while the RSI has shifted into the bearish zone. The Elder’s impulse system has formed a series of bearish bars, and the stock is below the Anchored VWAP support and Ichimoku cloud. Both the KST and TSI indicators have given fresh bearish signals. In short, the stock has broken key supports, and a move below Rs. 993 is negative for the stock in the short-term, with the next support seen at the level of Rs. 975. On the upside, immediate resistance is placed at Rs. 1003.

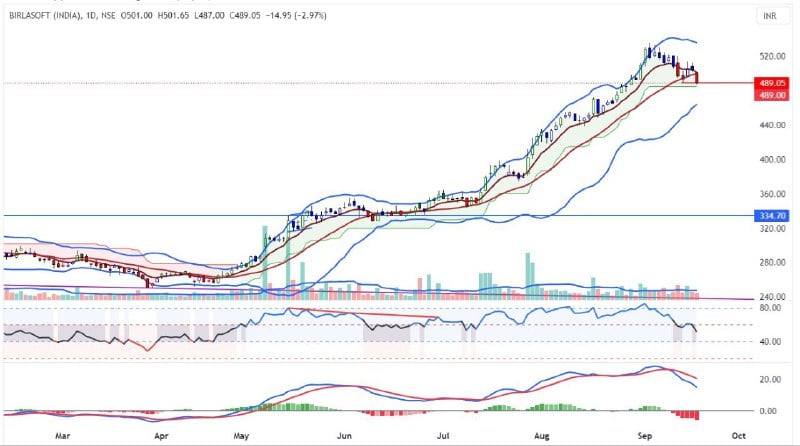

Birlasoft (BSOFT) – 489.25, down by 2.93% on Monday.

The Birlasoft stock has broken key supports and closed below the 20DMA after rallying 109%, entering into a counter-trend. The Bollinger bands have begun to contract, and the stock is 2.13% below the 20DMA. The MACD shows strong bearish momentum, while the RSI has shifted its range from a strong bullish zone to the neutral zone. The Elder’s impulse system has formed a strong bearish bar, and both the KST and TSI indicators are in a bearish setup. The stock is also at the super trend support. In short, the stock has broken support, and a move below Rs. 489 is negative, with the next support seen at the level of Rs. 462. On the upside, resistance is seen at Rs. 496.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 20, 2023, 9:01 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates