Page Industries Limited holds the exclusive license for manufacturing, distributing, and marketing the JOCKEY® brand in India, Sri Lanka, Bangladesh, Nepal, and the UAE on behalf of JOCKEY International Inc. The company was incorporated in the year 1995.

JOCKEY stands as the flagship brand of Page Industries and holds a dominant position as a market leader in the innerwear category. Together, Page Industries and Brand Jockey have been pioneered in various aspects of the innerwear industry. Through the brand Jockey, the company has successfully established the premium segment within the innerwear category in India.

Furthermore, Page Industries serves as the exclusive licensee for Speedo International Limited responsible for the manufacturing, marketing, and distribution of the Speedo brand in India.

Why are we covering this company today? The answer is simple: it has made a significant move on the charts by surging over 4.5% during the intraday session. Furthermore, on the chart the stock is looking very interesting and promising, suggesting potential performance in the near term.

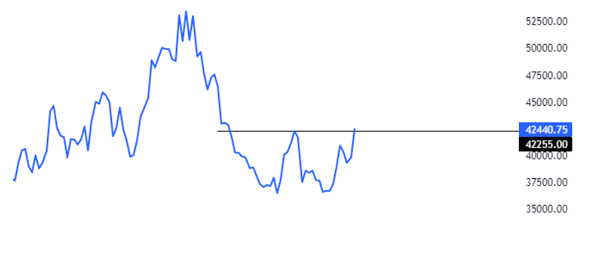

On observing the chart, the stock fell from its peak price of Rs 54,349 which was registered in the month of October 2022 to Rs 34,953, marking approximately a 36% drop from its peak price. However, it has since recovered approximately 21% from its lower levels, which were registered on May 26, 2023.

On the weekly time frame, it has formed a bullish pattern resembling a double bottom. On the line chart in the weekly time frame, today the stock price closed above the neckline of the pattern at Rs 42,255. Finally, the stock closed at Rs 42,409.95 today, which represents a Rs 1,604.70 increase or a 3.93% rise from its previous day’s closing price.

Upon scrutinising today’s share volumes, it becomes apparent that there has been a substantial increase of over 2.10 times in trading volumes compared to its average volumes on the BSE.

In the June quarter of FY24, the company’s revenue from operations experienced a decline of 7.55% YoY, dropping from Rs 1,341 crore to Rs 1,240 crore. The company reported an operating profit of Rs 242 crore, compared to an operating profit of Rs 298 crore in the corresponding quarter last year. On a sequential basis, the operating profit grew from Rs 134 crore to Rs 242 crore, with an operating profit margin of 20%.

However, the company incurred a net loss of Rs 158 crore, in contrast to a profit of Rs 207 crore in the corresponding quarter last year. The net profit margin stood at 13%. Notably, the company’s ROCE (Return on Capital Employed) and ROE (Return on Equity) are impressive at 53.8% and 46.4%, respectively.

Here is the chart presentation of the company’s shares on the weekly time frame:

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 7, 2023, 7:02 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates