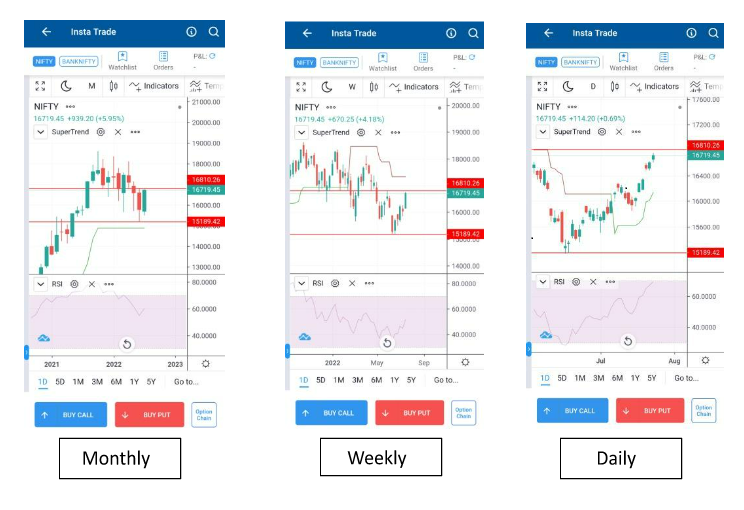

Let’s start this expiry outlook with analysis of: Monthly, Weekly, Daily time-frames.

| Time Frame | Trend | CandleStick | RSI | Resistance | Support |

| Monthly | Bullish | Bullish | 60 (Neutral to Overbought) | 16800 | 15500 |

| Weekly | Bearish | Bullish | 51 (Neutral) | R1 -16800 R2 -17350 |

S1 – 16150 S2 – 15850 |

| Daily | Bullish | Neutral | 70 (Overbought) | R1 -16800 R2 -17000 |

S1 – 16500 S2 – 16350 |

Chart analysis indicates that 16800-17000 level will act as important resistance zone, also RSI at daily and hourly time frame is at Over Boought zone suggests that in near-term Nifty may not go up with same pace. It may retrace upto the point when RSI cools-off to the level of 40.

So we may see Nifty retracing upto the level of 16350-16500 level in coming week. Upside seems limited in coming week.

The easiest Options trading platform! Get Charts, Watchlist, Positions & live P&L in single screen

Published on: Jul 22, 2022, 6:10 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates