Thursday witnessed one of the most dramatic price movements as the Nifty opened the session with a substantial gap up of 157.45 points, only to sharply decline by over 300 points from its intraday high. However, it showed resilience by recovering more than 250 points within the same day. These rapid fluctuations, occurring on a derivative expiry day, triggered stop losses on both sides of the market. By the end of the day, the Nifty formed a hanging man candle, indicating potential exhaustion in the uptrend.

The striking aspect was the Nifty achieving a new lifetime high at 22,619, although it failed to sustain above the previous high of 22,529.95 and closed below the previous day’s high. This closing pattern raises concerns about the sustainability of the ongoing trend. Moreover, trading volumes were higher than the previous three days, with a significant portion recorded during the opening and closing hours. The hanging man candlestick pattern, coupled with increased volatility at the lifetime high and elevated selling volumes, suggests characteristics of a potential topping formation. The RSI remains above the 60 zone, indicating continued bullish momentum, while the MACD histogram shows increased bullishness due to the positive close. However, the Relative Strength line is still declining and remains below the 21 EMA, particularly when compared to the broader market index, Nifty-500. HDFC Bank’s strong performance contributed significantly to Thursday’s positive close.

In this scenario, we cannot be aggressive on both sides. The intraday swing will hurt the trading decisions. Stay calm and sidelined for some time. Continue the positional longs as long as they are above the stop losses.

The Nifty witnessed a very volatile session. A move above 22,555 is positive, and it can test 22,640. Maintain a stop loss at 22,500. Above 22,640, continue with a trailing stop loss. But, a move below 22,500 is negative, and it can test 22,441. Maintain a stop loss at 22,555. Below 22,441, continue with a trailing stop loss.

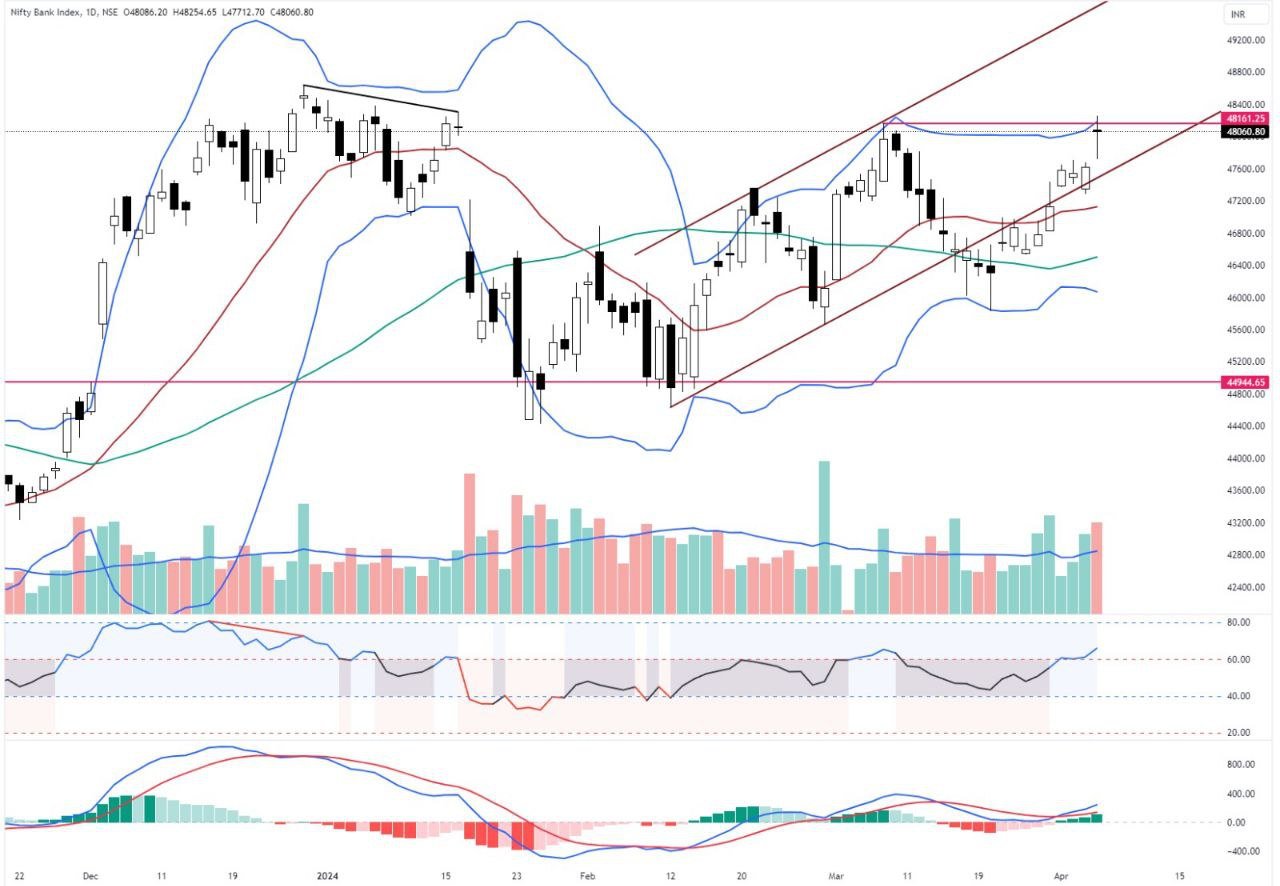

As we expected, the Bank Nifty tested the previous swing high and closed above the 48,000. The Dragonfly Doji candle has formed at a swing high with higher volume. The private sector banks, particularly HDFC Bank, contributed to the gains on Thursday. The index opened with a 462-point gap up and sharply declined by 542 points within the first two hours. Later it recovered 433 points. After a volatile session, it ended with a 436.55-point gain and closed above the 48,000 psychological resistance. It also closed at the highest level after 15th January. The RSI decisively above 65 and above the prior swing high is a bullish signal. The MACD showed added bullish momentum. In any case, the index sustains above 48,100, and stays positive for more rallies. But, it closes below 48,000 is not a good sign. Continue existing long positions with the first hour’s low as a stop loss.

The Bank Nifty crossed the psychological resistance. A move above 48,100 is positive, and it can test 48,324. Maintain a stop loss at 47,983. Above 48,324, continue with a trailing stop loss. But, a move below 48,983 is negative, and it can test 47,770. Maintain a stop loss at 48,100. Below 47,700, continue with a trailing stop loss.

Check: Top 2 Stocks to Watch Today

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions

Published on: Apr 3, 2024, 4:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates