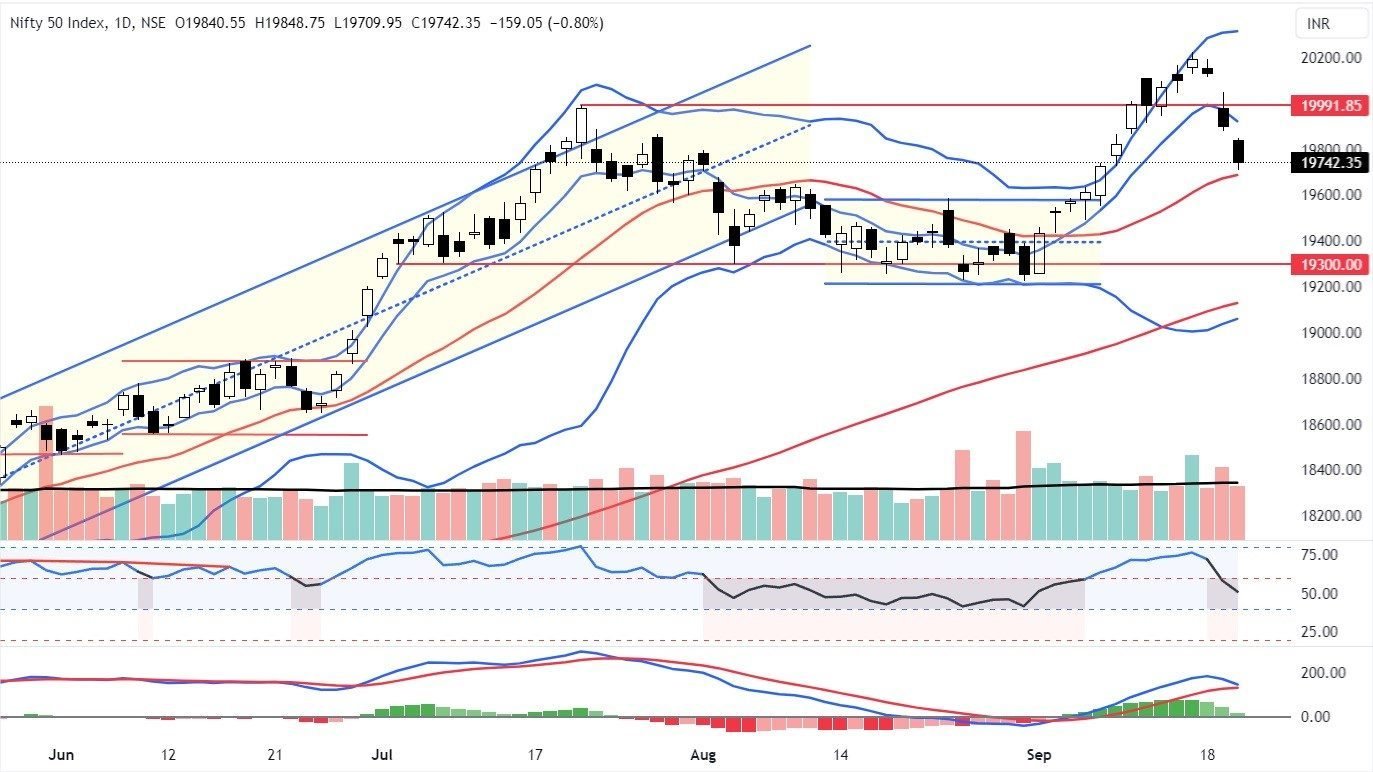

Nifty:

Nifty declined sharply over 500 points from its all-time high level of 20,222.45 registered on September 15. We cautioned about this decline, as the market was impulsively overextended. The index is below the previous low and also below the prior breakout level. It retraced 50 per cent of the prior rally in just three days. The index took support at a 50 per cent retracement level (19,723), of the prior up trend for the day. It is about 0.20 per cent above the 20 DMA (19,686) and 0.51 per cent above the 50 DMA (19,620). These immediate supports are crucial for the market. The index has also closed below the moving average ribbon while the RSI is back to the 50 zone from an extreme level and the MACD is declining from an overbought zone. Going ahead, a decline below the 50 DMA, MACD will give a fresh, bearish signal. Historically, the RSI takes support at the 40-45 zone, let’s hope the Nifty index may bounce from the 19,600 zone as this is a very crucial support level.

The Elder’s impulse system has formed a strong bearish bar after August 31, expect a volatile move on the weekend. If Thursday’s low of 19,709 is held, we may see a small bounce. But the bounce must close above the level of 19,849 to negate the further bearishness. Until and unless this level is not crossed on the upside, we may see more liquidation of long positions or the creation of fresh short positions i.e. a sell-on-rise kind of situation. For now, the technical structure has changed in the last three days and registered another distribution day. If the index declines below the 50 DMA with an added distribution day, the market structure will change to a downtrend. Stay away from the highly leveraged positions.

Nifty – Strategy for the day

The Nifty closed at an important support. A move above the level of 19,780 is positive, and it can test the level of 19,835. But, a move below the level of 19,740 is negative and can test the level of 19,686. Maintain a stop loss at the level of 19,780. Below the level of 19,686, continue with a trailing stop loss.

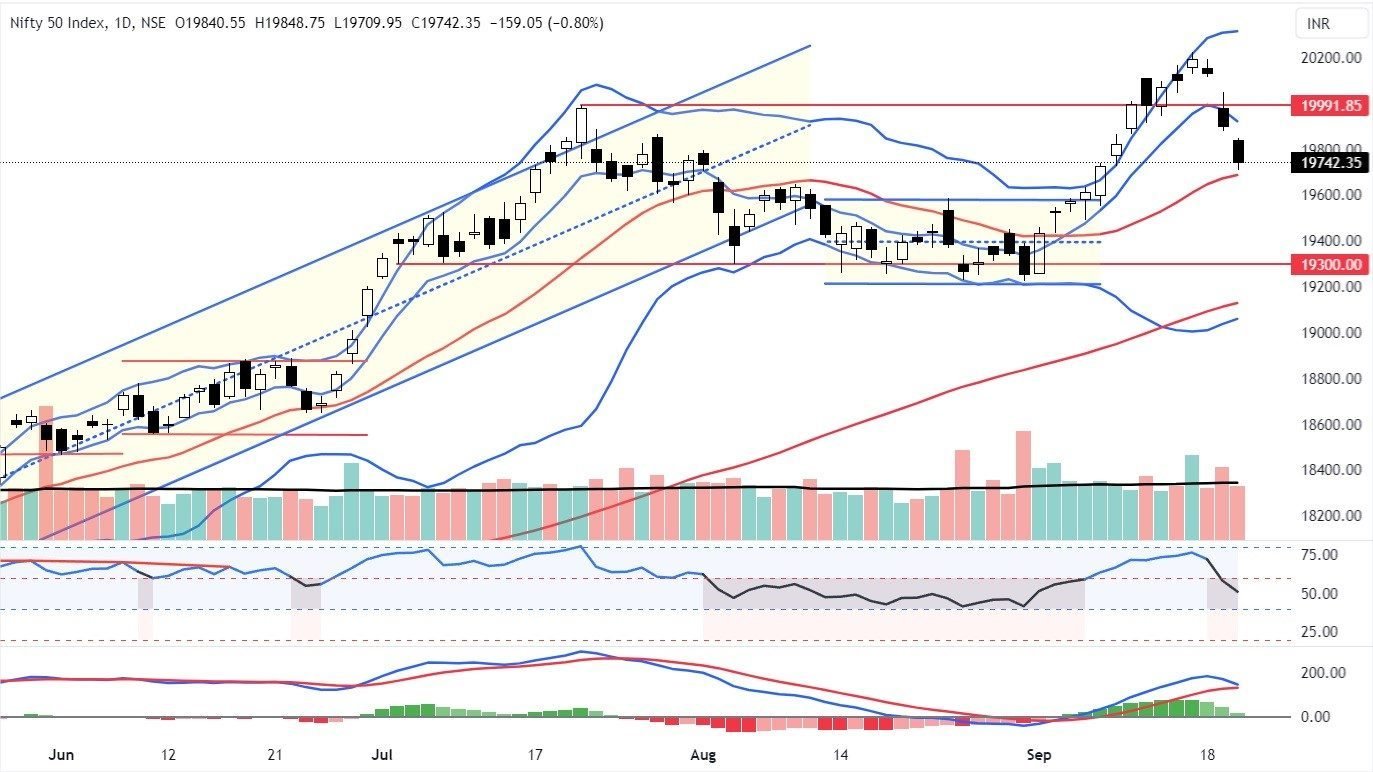

Bank Nifty:

The Bank Nifty has registered another high voltage decline for the third straight day. It declined below the 61.8% retracement level. It also declined below the 20 DMA and 50 DMA. The MACD is about to give a bearish signal. The RSI declined to 44, near the bearish zone. On a weekly chart, the price pattern looks like a double top. If the 43,400-600 zone of support breaks, the double top breakdown will be a reality, which is a long-term bearish sign. The index has declined by 3.71% in just three days. The index closed below the rising trendline drawn from March lows. A close above the level of 45,276 will improve the sentiments. The index may try to pull back as the indicators are in near oversold condition on an hourly chart. Be ready with some sharp, short-covering bounces. Be with the utmost caution on leveraged positions.

Bank Nifty – Strategy for the day:

The Bank Nifty has registered a sharp decline and closed near the day’s low. A move only above the level of 44,780 is positive, and it can test the level of 45,000. But, a move below the level of 44,600 is negative and can test the level of 44,400. Below the level of 44,400, continue with a trailing stop loss.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet, and is subject to changes. Please consult an expert before making related decisions.