JSW Infrastructure, the second-largest commercial port operator in India and a subsidiary of the US$23 billion JSW Group, secured the bid for the construction of a greenfield port in Keni, Karnataka. This all-weather, deep-water port development is part of a Public-Private Partnership (PPP) initiative, with the Karnataka Maritime Board, under the Government of Karnataka, issuing the Letter of Award (LOA) to JSW Infrastructure.

Keni Port development project, with an estimated cost of Rs 4,119 crore, will have an initial capacity of 30 MTPA. The strategically located port lies between two operational major ports, Mormugao Port in the north and New Mangalore Port in the south.

JSW Infrastructure’s Joint MD and CEO, Mr. Arun Maheshwari, expressed enthusiasm about the project, stating, “Karnataka is targeting impressive industrial growth and there has been an increased emphasis on the expansion and growth in maritime infrastructure in the region. Once the concession agreement is signed, we will start working to develop the Keni Port as an integral part of the State’s maritime infrastructure and trade gateway.”

The development of this greenfield port aligns with the Karnataka Government’s mission to meet the logistics demand of a rapidly growing state and the region’s economy. The Keni port is expected to play a crucial role in addressing the rising import and export trade momentum of the region upon completion.

The proposed Keni Port will feature modern, environment-friendly mechanized facilities for handling cape-size vessels. It is envisioned as an all-weather, greenfield, multi-cargo, direct berthing, deep-water commercial port capable of handling all types of cargoes on the west coast in North Karnataka to serve the industries in the area covering Bellary, Hosapete, Hubballi, Kalaburagi, and South Maharashtra.

Initially, the port’s capacity will be 30 MTPA in the initial phase, with further potential for substantial expansion in the long run. The proposed rail connectivity to the Keni Port site will be on the southern side and will be connected with the existing Konkan line to the north of the Ankola Station. The proposed railway alignment will be developed with a total length of approximately 8 km.

JSW Infrastructure Limited is a part of the JSW Group and India’s second-largest commercial port operator in terms of cargo handling capacity. In Fiscal 2023, JSW Infrastructure operated environment-friendly seaports and terminals. It manages nine state port concessions strategically located on the west and east coasts of India.

The company’s existing ports and terminals are capable of handling a wide range of cargo and vessels up to Cape size. Its largely mechanized cargo handling system enables quick turnaround times while ensuring efficient resource utilization. The strategic locations of these facilities make its ports a preferred option for customers.

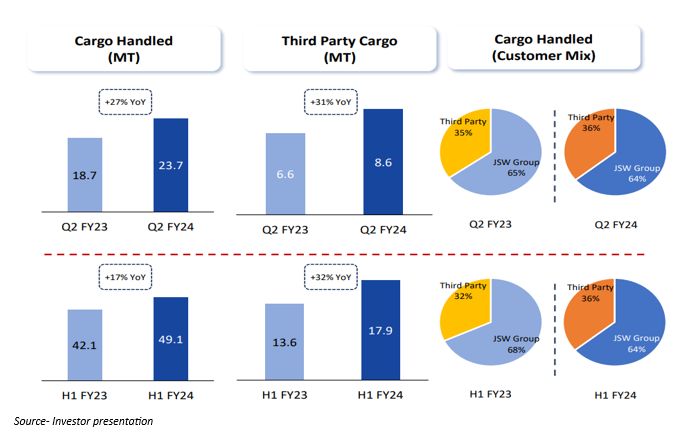

JSW Infrastructure Limited has expanded its cargo mix by leveraging its locational advantage and maximizing asset utilization. As part of its future growth strategy, the company plans to enhance its overall cargo-handling capacity to 300 MTPA by 2030. It is also strengthening its market position by focusing on value-added offerings with end-to-end logistic support and a diversified cargo profile.

| Particulars | Q2 FY24 | Q2 FY23 | H1 FY24 | H1 FY23 |

| Total Revenue | 895 | 697 | 1,814 | 1,558 |

| Revenue Growth | 28.41% | – | 16.43% | – |

| Total Expenses | 396 | 321 | 823 | 710 |

| EBITDA | 499 | 375 | 991 | 848 |

| EBITDA Margin | 55.80% | 53.90% | 54.60% | 54.40% |

| Profit After Tax | 256 | 138 | 578 | 331 |

| PAT Growth | 85.51% | – | 74.62% | – |

| Diluted EPS (Rs/share) | 1.37 | 0.74 | 3.09 | 1.79 |

Figures in Rs crore

The company’s strong financial performance is underpinned by its robust operational performance, efficient cost management, and strong balance sheet. JSW Infrastructure is a net debt-free company with cash and cash equivalents of Rs 5,333 crore and gross debt of Rs 4,261 crore as of September 30, 2023.

In conclusion, JSW Infrastructure’s recent success in securing the Keni Port project reflects its commitment to enhancing maritime infrastructure and contributing to Karnataka’s industrial growth. With a solid operational and financial foundation, the company is poised for sustained success through strategic expansions and diversified offerings.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Nov 17, 2023, 12:42 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates