Indian Renewable Energy Development Agency (IREDA) which is a Mini Ratna government enterprise in the business of promoting, developing, and extending financial assistance for new and renewable energy (RE) projects, as well as energy efficiency and conservation (EEC) projects registered a significant surged in its shares since its listing on the India market.

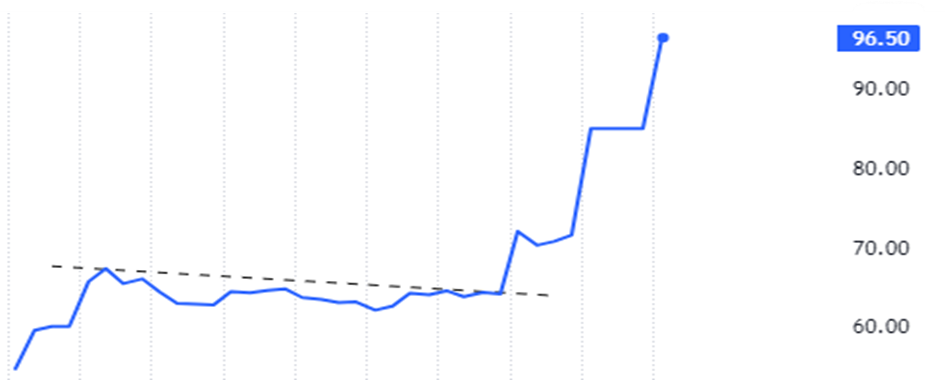

Since its listing, the shares have consistently attracted investor interest, ultimately resulting in a surge in the stock price. Furthermore, today stock touches a significant milestone of Rs 100 per share.

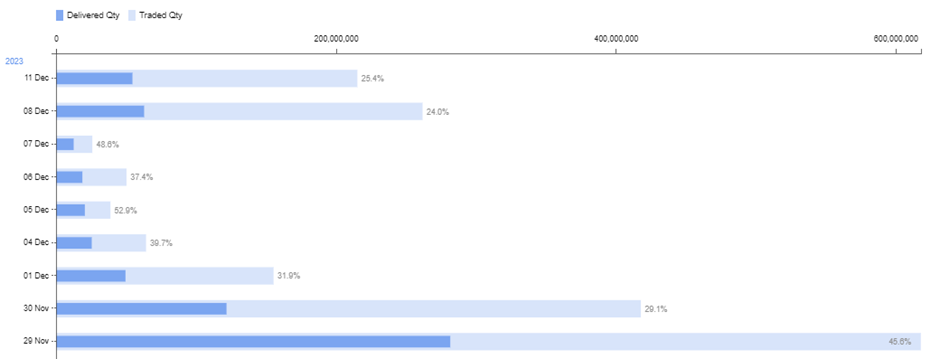

On the day of listing, the shares debuted at a remarkable premium of 56% over its final IPO issue price of Rs 50 per share on the BSE. Eventually, it concluded the day at Rs 59.99 per share. Within 15 days of its listing, the stock reached Rs 100 per share today, marking an impressive multibagger return of over 200% from its final IPO issue price. As of writing the article it is trading at around Rs 96.5 per share on the BSE.

On November 23, 2023, the final day of the IPO window, the IPO witnessed an impressive response, especially compared to other recently-listed IPOs, with a subscription rate of 38.80 times. The public issue received mixed interest, with the retail category being subscribed 7.73 times, the QIB category achieving a subscription rate of 104.57 times, and the NII category reaching a subscription rate of 24.16 times.

The IPO price range was set between Rs 30 and Rs 32, with a face value of Rs 10 per share and a lot size of 460 shares. The total size of the company’s IPO was Rs 2,150 crore, and the final share issue price was fixed at Rs 32 each.

The Indian Renewable Energy Development Agency Limited, based in India, is classified as a systemically important non-deposit-taking non-banking financial (NBFC-ND-SI) company. Its primary focus lies in fostering, advancing, and extending financial support for emerging renewable energy (RE) initiatives and endeavours in energy efficiency and conservation projects. The company delivers an extensive array of financial products and associated services, from project inception to post-implementation, catering to renewable energy projects and allied activities within the value chain like equipment manufacturing and transmission.

Across various renewable energy sectors such as solar power, wind power, hydropower, transmission, and biomass, the company has provided financial backing for numerous projects. Moreover, it offers a comprehensive range of financial products and services, encompassing both fund-based and non-fund-based options. Furthermore, it extends loans to government entities and financing programs tailored for suppliers, manufacturers, and contractors within the renewable energy sector.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Dec 12, 2023, 11:32 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates