Brimming with festive cheer, Diwali illuminated green markets and buoyant consumer sentiments, propelling the Indian economy to a robust 7.2% growth in Q2. Amidst this economic vibrancy, the spotlight turns to the auto industry’s Q2 performance, particularly the volume metrics.

Established in 1981 through a joint venture with Suzuki Motor Corporation, the company became SMC’s largest subsidiary, holding a market leadership position in India’s passenger vehicle segment. Specializing in motor vehicle manufacturing and sales.

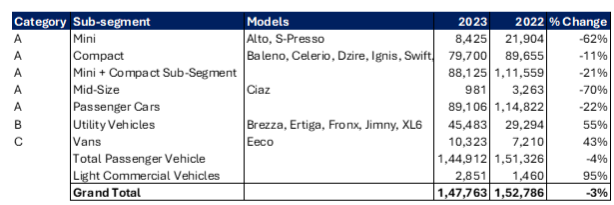

These insights suggest that the Indian passenger vehicle market is shifting towards utility vehicles, while sales of mini and compact cars are declining. The sharp decline in Ciaz sales may be due to the launch of new competitors in the mid-size sedan segment.

Mahindra & Mahindra Ltd, established in 1945, stands as India’s diversified automobile giant, spanning 2-wheelers, 3-wheelers, PVs, CVs, tractors, and more. Beyond automobiles, its extensive presence includes financial services, hospitality, IT, aerospace, and energy through subsidiaries and group entities. Co-founded by Ghulam Mohammad and Mahindra Brothers, it was renamed Mahindra & Mahindra in 1948.

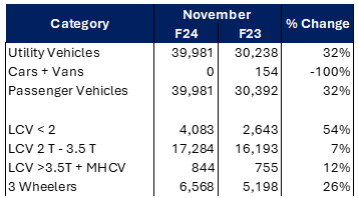

These insights suggest that Mahindra and Mahindra is performing well in the Indian automotive market, with strong growth in key segments such as utility vehicles, LCVs, and 3-wheelers.

Incorporated as Swaraj Vehicles Ltd in 1983, SML ISUZU LIMITED had initial ties with Mazda Motor Corporation and Sumitomo Corporation. After the 2004 expiration of the Mazda collaboration, Sumitomo acquired a full stake, and a technical assistance agreement with Isuzu Motors followed. Renamed SML ISUZU in 2011, it now sees ownership with Sumitomo Corporation and Isuzu Motors holding 44% and 15% stakes, respectively.

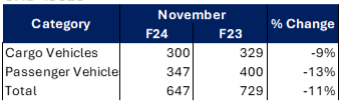

These insights suggest that SML-ISUZU is facing challenges in the Indian commercial vehicle market. The decline in sales may be due to several factors, such as rising inflation, and increased competition from other commercial vehicle manufacturers.

As a prominent global automobile manufacturer, Tata Motors Group, a part of the esteemed Tata Group, delivers a diverse range of vehicles, including cars, SUVs, trucks, buses, and defence vehicles worldwide. Operating in India, the UK, South Korea, South Africa, China, Brazil, Austria, and Slovakia, it maintains a robust international presence through subsidiaries, associate companies, and joint ventures, featuring key entities like Jaguar Land Rover in the UK and Tata Daewoo in South Korea.

These insights suggest that the PV segment is the driving force behind Tata Motors’ overall sales growth. The CV segment is facing some challenges, but the company is still able to maintain positive growth in the overall vehicle sales segment.

Overall, the data shows that Tata Motors is performing well in the Indian automotive market, with strong growth in the PV segment. The company needs to address the challenges in the CV segment and improve its international PV sales to maintain its growth momentum in the coming months and years.

Despite facing various challenges, the Indian automotive industry continues to show signs of resilience, with some segments experiencing significant growth.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. The information is based on various secondary sources on the internet and is subject to change. Please consult with a financial expert before making investment decisions.

Published on: Dec 4, 2023, 7:37 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates