The second part of the Economic Survey for the fiscal year 2016-17 presents a fairly mixed picture of the Indian economy. There have been some positives in the form of lower inflation and the implementation of GST, both of which could have long-term positive implications for the Indian economy. On the downside, the Economic survey has acknowledged some distinct short-term costs to demonetization as well as some palpable risks on the fiscal front. The Economic Survey encompasses 6 key themes as under:

GST could be a game changer for India in the long run

The Economic survey has specifically underlined that notwithstanding the teething troubles, GST will surely reduce corruption and tax leakage in the economy. GST is likely to bring more of the unorganized sector under the tax ambit and that will broaden and widen the tax base. The bigger advantage of the GST, as noted by the Survey will be the creation of a common single market across India. Currently, too much of transport efficiency and logistical smartness is lost due to impediments to domestic transit of goods. By creating a simplified and unified all-India structure, the GST eliminates these roadblocks altogether. The survey has also highlighted that when the impact of Input Tax Credit (ITC) is also considered, the eventual impact of GST could actually be much lower.

Low inflation, it appears, is here to stay…

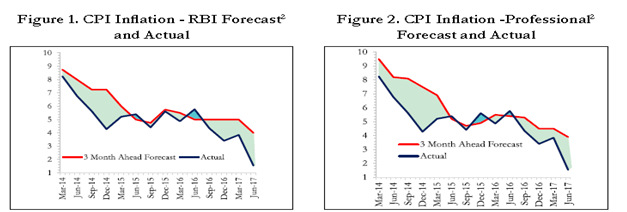

For a long time, India has been a high-inflation economy. Any fall in inflation typically saw a reversion to the mean. Two things have changed according to the survey. Firstly, agricultural production has been setting records in the last 2 years and secondly global oil prices are finding a new equilibrium at lower levels. The crux of the argument in the Survey is that India may be shifting to a low-inflation normal wherein mean reversals to a higher level are less likely to happen. Consider the chart below…

For a better part of the last 3 years, the actual inflation has been clearly below the RBI forecast as well as the market consensus forecast. That is typically indicative of a larger shift in inflation to a lower trajectory, something that is not being captured by past models. Lower long term inflation has positive implications for debt market performance and long term value creation through equities. Above all, it will be a key trigger for the RBI to adopt a more dovish rate policy.

Loan waivers could have larger macroeconomic implications

The Economic Survey has raised some concerns that the spate of loan waivers could have negative implications for state fiscal deficits. The focus has traditionally been on the central fiscal deficit but the Economic Survey suggests that the real challenge could be on the state fiscal deficits. Already, states like Uttar Pradesh, Karnataka and Maharashtra have announced billions of dollars in bank write-offs to farmers. This will be in addition to the UDAY scheme where the respective states have taken over nearly 2/3rd of the debt of the State Discoms. This is one red flag that the survey has raised and state deficits will now have to be tracked more closely.

Valuations are not exactly in sync with the real economy…

This is again a word of caution coming from the Economic Survey. According to the Survey, most data points like IIP, GVA, credit growth and capacity utilization have all been hinting at an economic deceleration. However, equity markets are close to historic highs with bonds rallying and Indian equities quoting at a trailing P/E ratio of 25. While this may not be close to the froth of 2008 and 2010, the Survey has pointed that a 700 bps P/E spread over the mean is not justifiable in a decelerating economic scenario. This is surely an important word of caution at a time when the markets are largely being driven by a lot of exuberance and strong liquidity flows into India.

Agriculture production presents a curious paradox

This is something most of us were aware of. Farm output is setting new records while farmers are still languishing in debt. Nowhere is this more visible than in the case of pulses which have recorded negative inflation for over 8 months now. The Indian farmer has enjoyed normal monsoons in 2016 and 2017 after 2 successive years of drought. That has impelled farmers to expand their output substantially. This has created a glut situation in the economy push down prices sharply. Additionally, the strong rupee is also resulting in a glut of imports of food products. The net result has been that farm output is rising but farmers are still languishing as they are not able to get remunerative prices for their produce. In fact, negative food inflation has been largely driven by weak food prices. While celebrating low inflation, the Survey points out that, one cannot overcome the impact on the rural economy.

Demonetization has long term benefits, but had short term costs too

The Survey has been honest to take a more pragmatic approach to demonetization. As Arvind Subramanian has pointed out, demonetization has surely pushed the economy on the digital path and helped to curb the creation of black money. However, it has also had its downsides. The IIP, the PMI numbers and the GDP growth have been under pressure since November 2016 and a large part of the accountability lies on demonetization. The second implication is slightly more complex. Due to the additional cost (seigniorage)incurred by the RBI on printing fresh notes, its annual dividend payable to the government in 2016-17 has fallen by half from $9 billion to $4.5 billion. This will have to be compensated to keep the fiscal deficit in check. However, the Survey also points out that the long term benefits of Demonetization will far outweigh the cost.

Published on: Aug 14, 2017, 12:00 AM IST

We're Live on WhatsApp! Join our channel for market insights & updates