Shares of Dynamatic Technologies Limited witnessed a significant surge today. The stock opened trading at Rs 4137.75, remaining flat compared to the previous day’s closing price of Rs 4137.75 per share. Furthermore, the stock achieved a significant milestone today, reaching Rs 4500 per share, marking a 9% increase during the intraday session.

In addition to this, the stock reached a 52-week high today, with its 52-week high and low being Rs 4510 and Rs 2156, respectively. Finally, the stock concluded today’s trading session at Rs 4467 per share, representing an 8.25% increase from its previous closing price.

With a market capitalization of Rs 3,056 crore, the stock has demonstrated outstanding performance in recent periods, yielding a 17.5% return in just one month. Moreover, it has generated an impressive multibagger return of 511% over the last three years.

When analysing today’s share volumes, it becomes apparent that there has been a substantial increase of over 5.21 times in trading volumes compared to its average volumes on the BSE.

Dynamatic Technologies Limited is an India-based manufacturer of engineered products for the aerospace, metallurgy, and hydraulic industries. The company manufactures hydraulic gear pumps and automotive turbochargers.

It also produces precision, flight-critical, and complex airframe structures, and aerospace components, serving as a supplier to global aerospace original equipment manufacturers (OEMs) and primes, including Airbus, Boeing, BEL, Bell Helicopters, Dassault Aviation, Hindustan Aeronautics Limited, and Spirit AeroSystems.

The company has facilities located in India, specifically in both Bengaluru and Coimbatore. Its international locations include Swindon and Bristol in the UK, as well as Schwarzenberg in Germany.

In the June quarter of FY24, the company’s revenue from operations experienced a significant increase of 16.6% YoY, rising from Rs 311 crore to Rs 363 crore. The company reported an operating profit of Rs 37 crore, compared to an operating profit of Rs 42 crore in the corresponding quarter last year, resulting in an operating profit margin of 10%.

Meanwhile, the net profit of the company amounted to Rs 41 crore, marking a 400% increase compared to the corresponding quarter’s profit of Rs 8 crore last year. Even on a sequential basis, net profit doubled in Q1 FY24, rising from Rs 18 crore in Q4 FY23 to Rs 41 crore. This is also reflected in the company’s EPS growth, which increased from Rs 12.88 per share to Rs 65.22 per share.

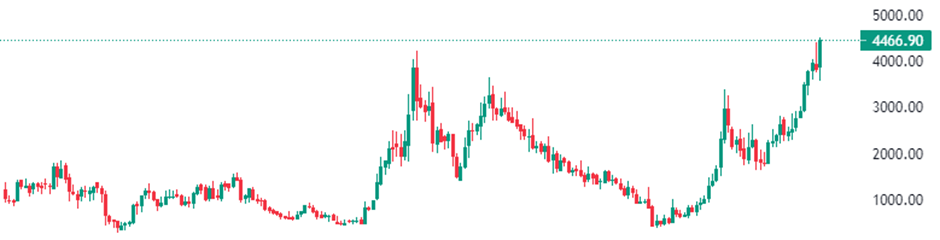

Here is the chart presentation of the company’s shares on the monthly time frame:

After examining the monthly candle, it appears to indicate a promising future performance. Additionally, the stock is currently trading at all-time high levels, thanks to the net profit and EPS growth reported by the company in the recent quarter. It closed with significant gains, even as major indices closed in the red.

Investors should consider keeping a close watch on this stock.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Sep 20, 2023, 4:53 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates