As Finance Minister Nirmala Sitharaman prepares to present the upcoming interim budget on February 1, 2024, amid the backdrop of impending general elections in India, the financial landscape anticipates a pivotal moment. Departing from the norm of full-year fiscal statements, interim budgets play a crucial role in providing temporary financial plans, vital for sustaining government expenditures until a new government assumes office. This article delves into the fundamental distinctions between interim and full-year budgets, shedding light on their implications, key components, and the strategic considerations governing their formulation. Additionally, an analysis of the past 20 years of budget day market data is presented, offering insights into the expected dynamics for Budget 2024.

An interim budget serves as a temporary financial blueprint, enacted to sustain expenditures for a limited period, typically until a new government is elected. In the case of India, where the financial year concludes on March 31, an interim budget becomes essential to cover expenses and revenues until the incoming government presents a comprehensive budget in July.

In contrast, a regular full-year budget, mandated by Article 112 of the Indian Constitution, spans the entire fiscal year. It encompasses detailed documentation of both past and projected expenses and incomes, providing a comprehensive overview of the government’s financial plans.

The interim budget includes a critical component known as the “vote-on-account.” This refers to the estimated expenditure tabled for parliamentary approval ahead of general elections, covering expenses required before a new government assumes charge. Unlike a full budget, the vote-on-account is a conventionally passed grant-in-advance, facilitating government operations until the passage of subsequent financial bills.

Typically covering a period of three to four months, interim budgets are more concise than their full-year counterparts. They focus on estimated expenses and income generation for the brief transition period until a new government takes charge.

Finance Minister Nirmala Sitharaman, acknowledging the interim nature of the upcoming budget, has indicated a cautious approach. She stated, “No spectacular announcements will come at that time (in the vote on account),” emphasizing the transitional nature of the budget amidst impending elections.

A strategic move in 2017, shifting the budget date from the end of February to the start of February, enabled governments to avoid model code of conduct restrictions during Lok Sabha elections. This shift has allowed the presentation of meaningful budgets even in election years.

Given the constraints imposed by the impending elections, major policy changes and significant announcements are unlikely in the interim budget. However, potential adjustments for inflation and targeted enhancements, such as a possible increase in the Kisan Samman Nidhi, are plausible strategies. Expectations point towards substantial spending allocations for social schemes, including pension hikes and support for agriculture, forming a core proposition in the government’s electoral strategy.

| Budget Type | Budget Day | Minister | High | Low | Prev closing | Points Range | % Volatility |

| Interim | 01 February, 2023 | N. Sitharaman | 17,972.20 | 17,353.40 | 17,662.15 | 618.80 | 3.50% |

| Full | 01 February, 2022 | N. Sitharaman | 17,622.40 | 17,244.55 | 17,339.85 | 377.85 | 2.18% |

| Full | 01 February, 2021 | N. Sitharaman | 14,336.35 | 13,661.75 | 13,634.60 | 674.60 | 4.95% |

| Full | 01 February, 2020 | N. Sitharaman | 12,017.35 | 11,633.30 | 11,962.10 | 384.05 | 3.21% |

| Interim | 01 February, 2019 | Piyush Goyal | 10,983.45 | 10,813.45 | 10,830.95 | 170.00 | 1.57% |

| Full | 01 February, 2018 | Arun Jaitley | 11,117.35 | 11,016.90 | 11,027.70 | 100.45 | 0.91% |

| Full | 01 February, 2017 | Arun Jaitley | 8,722.40 | 8,537.50 | 8,561.30 | 184.90 | 2.16% |

| Full | 29 February, 2016 | Arun Jaitley | 7,094.60 | 6,825.80 | 7,029.75 | 268.80 | 3.82% |

| Full | 28 February, 2015 | Arun Jaitley | 8,941.10 | 8,751.35 | 8,844.60 | 189.75 | 2.15% |

| Full | 10 July, 2014 | Arun Jaitley | 7,731.05 | 7,479.05 | 7,567.75 | 252.00 | 3.33% |

| Interim | 17 February, 2014 | P Chidambaram | 6,080.65 | 6,038.30 | 6,048.35 | 42.35 | 0.70% |

| Full | 28 February, 2013 | P Chidambaram | 5,849.90 | 5,671.90 | 5,796.90 | 178.00 | 3.07% |

| Full | 16 March, 2012 | Pranab Mukherjee | 5,445.65 | 5,305.00 | 5,380.50 | 140.65 | 2.61% |

| Full | 28 February, 2011 | Pranab Mukherjee | 5,477.00 | 5,333.25 | 5,303.55 | 143.75 | 2.71% |

| Full | 26 February, 2010 | Pranab Mukherjee | 4,992.00 | 4,858.45 | 4,859.75 | 133.55 | 2.75% |

| Full | 06 July, 2009 | Pranab Mukherjee | 4,479.80 | 4,133.70 | 4,424.25 | 346.10 | 7.82% |

| Interim | 16 February, 2009 | Pranab Mukherjee | 2,953.20 | 2,839.10 | 2,948.35 | 114.10 | 3.87% |

| Full | 29 February, 2008 | P Chidambaram | 5,290.80 | 5,098.35 | 5,285.10 | 192.45 | 3.64% |

| Full | 28 February, 2007 | P Chidambaram | 3,893.40 | 3,674.85 | 3,893.80 | 218.55 | 5.61% |

| Full | 28 February, 2006 | P Chidambaram | 3,090.30 | 3,031.80 | 3,067.45 | 58.50 | 1.91% |

| Full | 28 February, 2005 | P Chidambaram | 2,106.20 | 2,047.70 | 2,060.90 | 58.50 | 2.84% |

| Full | 08 July, 2004 | P Chidambaram | 1,586.55 | 1,504.50 | 1,566.80 | 82.05 | 5.24% |

| Interim | 04 February, 2004 | Jaswant Singh | 1,829.65 | 1,761.75 | 1,769.00 | 67.90 | 3.84% |

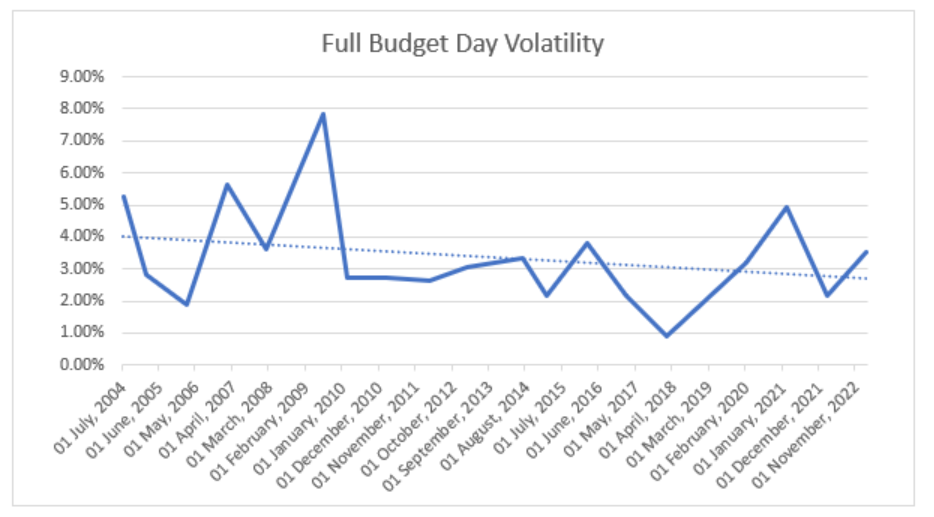

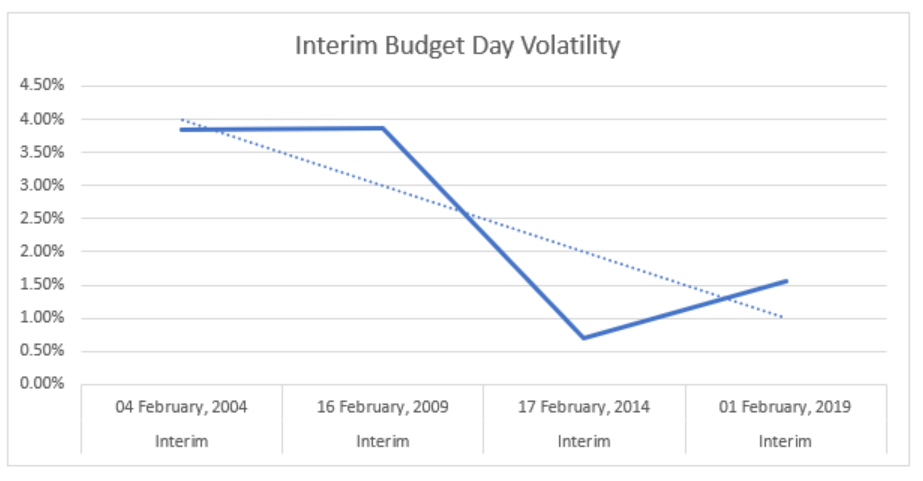

Based on the analysis of the past 20 years of Nifty50 performance on budget days, the average volatility on full budget days is approximately 3.38%, while interim budget days show an average volatility of around 2.7%. Notably, the budget day in July 2009 witnessed the highest market volatility, whereas the February 2014 budget day recorded the lowest volatility in the past two decades.

The analysis of the past 20 years reveals that while both full and interim budget days exhibit higher market volatility, interim budgets tend to result in a comparatively less volatile market. The data underscores the impact of budgetary announcements on market dynamics, offering insights for investors navigating India’s budget seasons.

Disclaimer: This blog has been written exclusively for educational purposes. The securities mentioned are only examples and not recommendations. It is based on several secondary sources on the internet and is subject to changes. Please consult an expert before making related decisions.

Published on: Jan 15, 2024, 6:49 PM IST

We're Live on WhatsApp! Join our channel for market insights & updates